Today, April 28, 2017, Chaparral Energy (“Chaparral”) released their 2017 strategy. Chaparral also posted an updated Investor Presentation, which contains great details for those interested. In this week’s Oklahoma Operator News we take a brief look at Chaparral’s 2017 strategy.

On March 21, 2017, Chaparral emerged from Chapter 11 bankruptcy protection. They were able to eliminate approximately $100 million of annual interest expense. Chaparral plans to divest their Enhanced Oil Recovery Assets, and have hired CIBC Griffis & Small as an advisor. Chaparral plans to use the proceeds from their divestments to help fund their 2017 strategy.

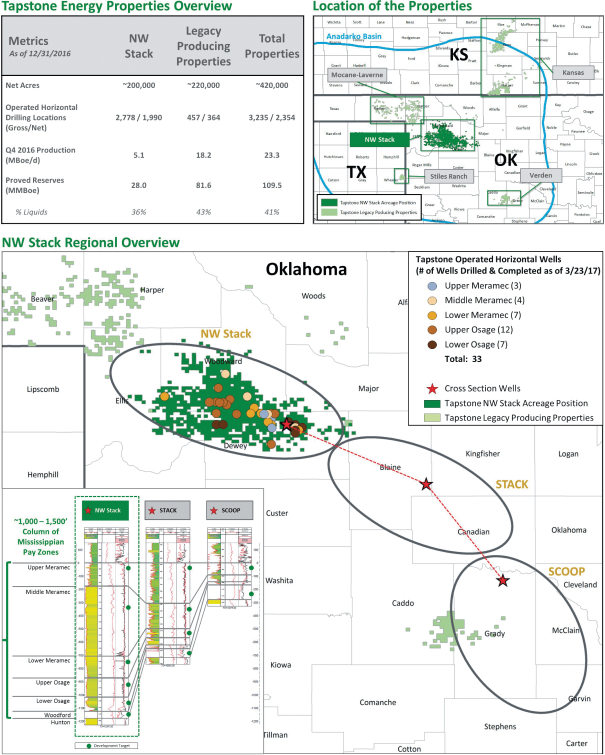

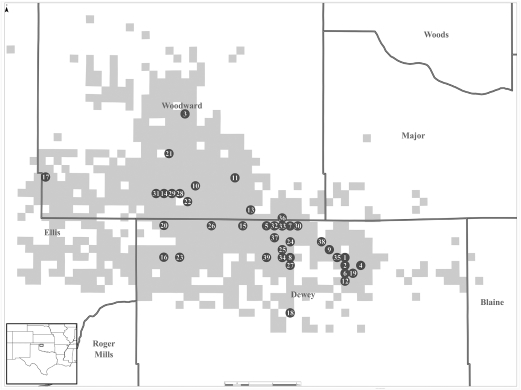

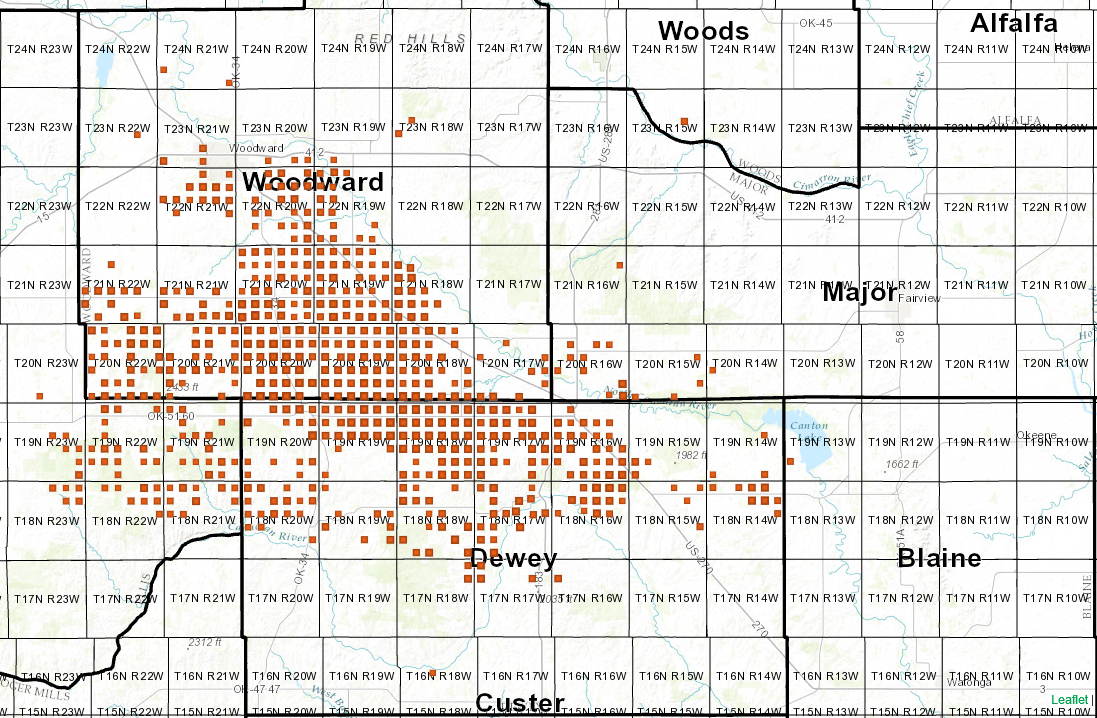

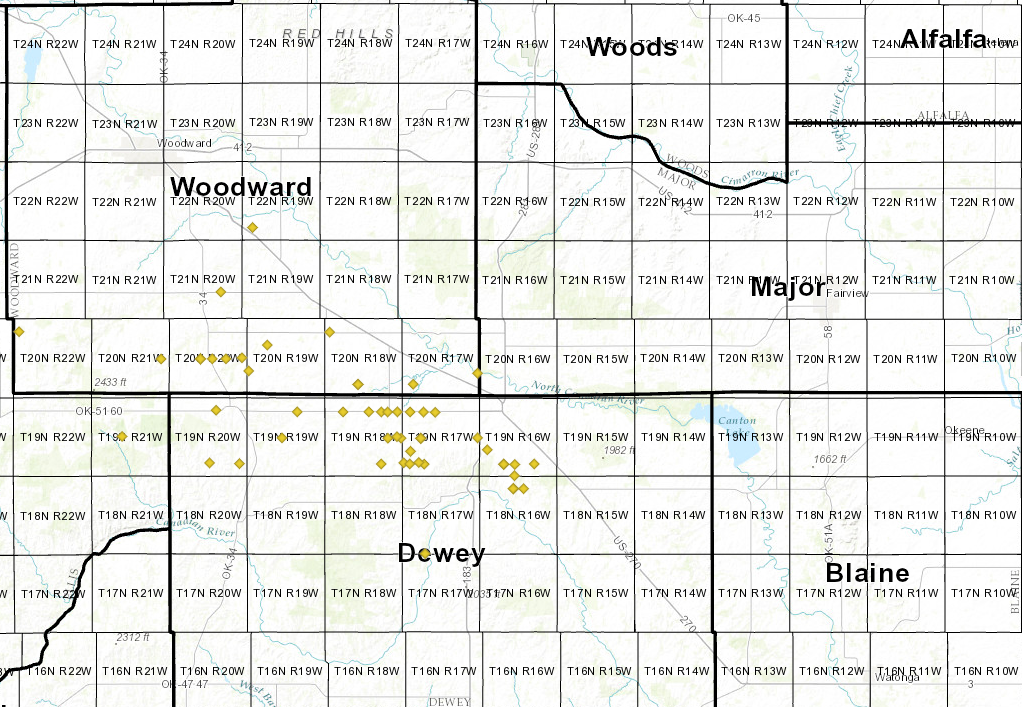

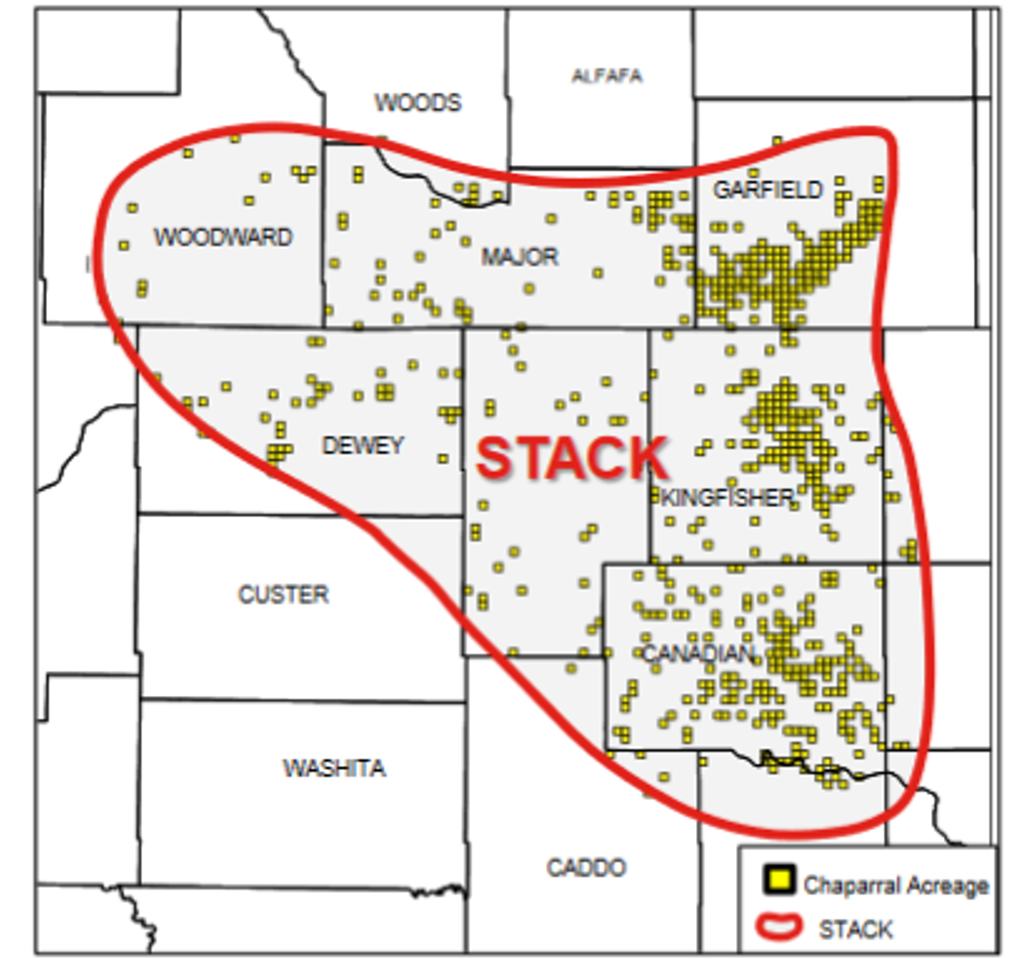

Chaparral’s primary strategy in 2017 is to transition to a “Premium Pure-Play STACK Company.” Currently, Chaparral has 110,000 acres of STACK assets. This acreage covers the original STACK counties, Canadian and Kingfisher, as well as Blaine, Dewey, Woodward, Major, and Garfield.

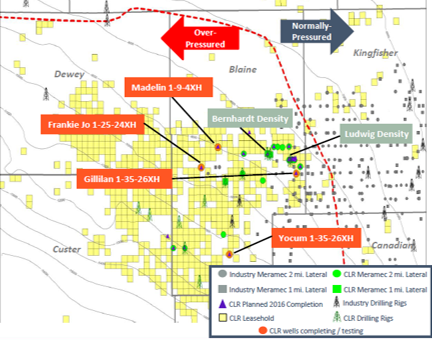

Chaparral’s acreage is primarily located in the normal pressured region. Continental’s record well, the Angus Trust 1-4-33XH, is located in the over pressured region of Blaine county. However, Newfield’s record well, the Burgess 1H-18, is located in the normal pressured region, specifically in 15N-07W, Kingfisher County, OK.

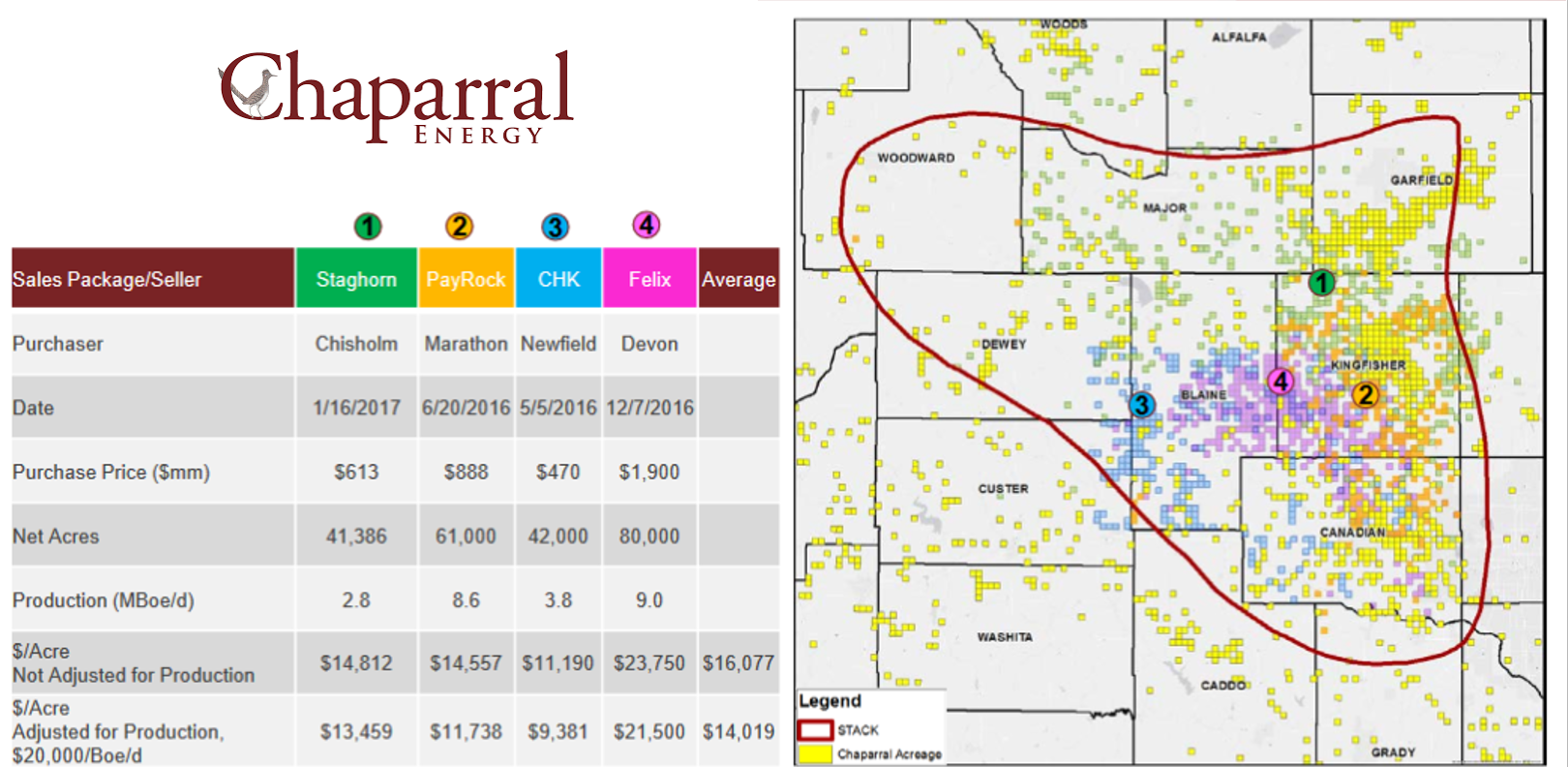

The STACK play has been the source for recent Acquisition & Divestment activity. Chaparral’s presentation included a great overview of this activity. As you can see, there have been some significant transactions take place in 2016/2017. Due to the surrounding transactions, Chaparral can easily assign value to their acreage, and provide their investors with concrete evidence.

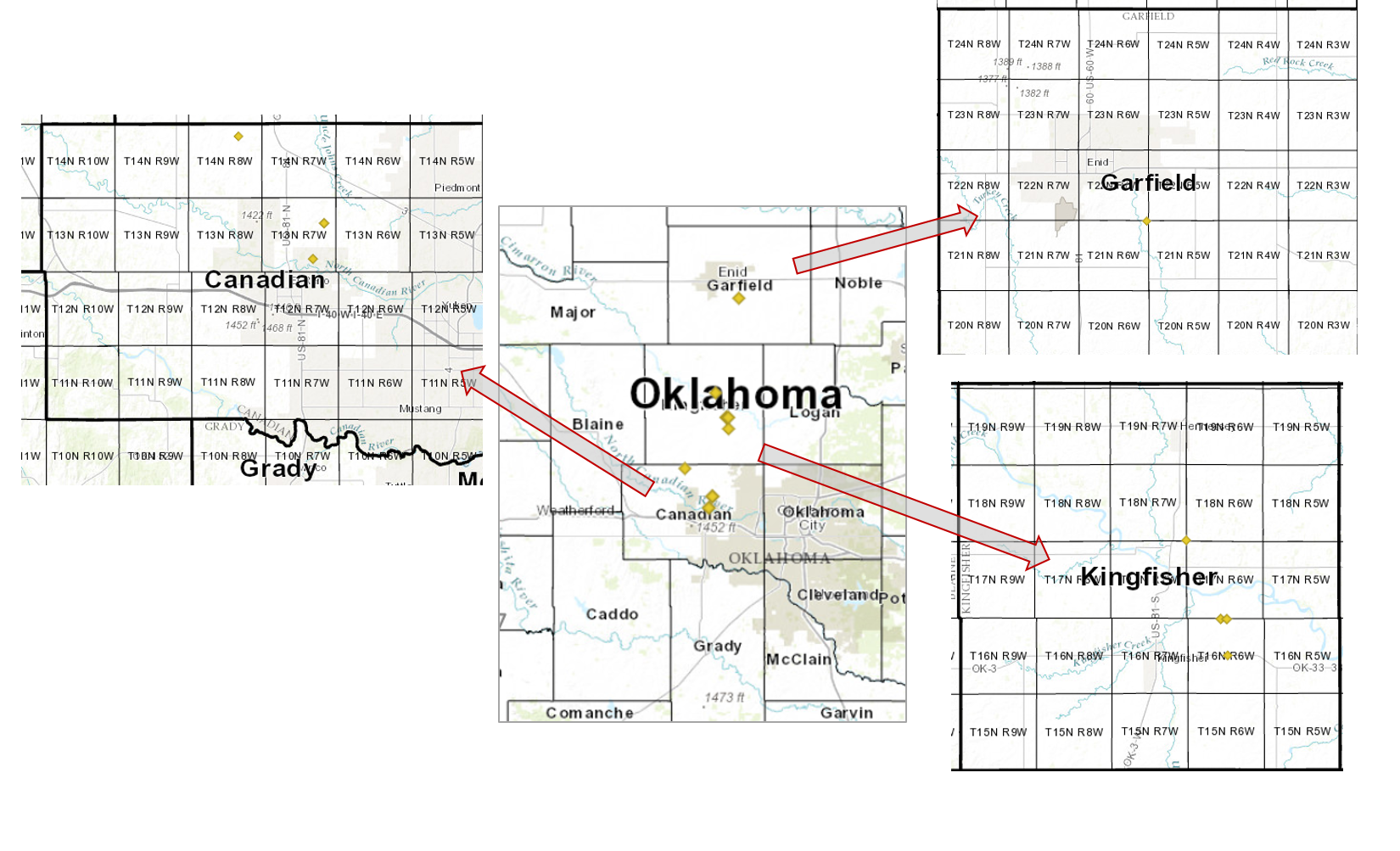

To date, Chaparral has filed 11 Permits to Drill, covering the counties of Canadian, Garfield, and Kingfisher. Chaparral claims to be the “lowest-cost Meramec Operator” (on a like-for-like basis, one mile laterals).

Chaparral’s CEO, Earl Reynold’s stated that “we are committed to maintaining a strong balance sheet and safely delivering solid repeatable results as we develop and expand our premier STACK position.” Based on the recent well results of other operators in the area, and the $/acre prices obtained by recent sellers, Chaparral appears to be positioning themselves for a strong future. This is great news for the state of Oklahoma whose budget and economy has suffered with the decline of oil and gas activity and layoffs.