Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Category: Uncategorized

Minerals of Oklahoma 2018

Back in September of 2017 Convey Energy examined mineral activity in Oklahoma. We had some recent requests to do a similar report for the 2018 activity.

The data presented herein this report is based on land records that Convey Energy internally gathered from county courthouse records using our soon to be launched platform; Convey640.

WHERE

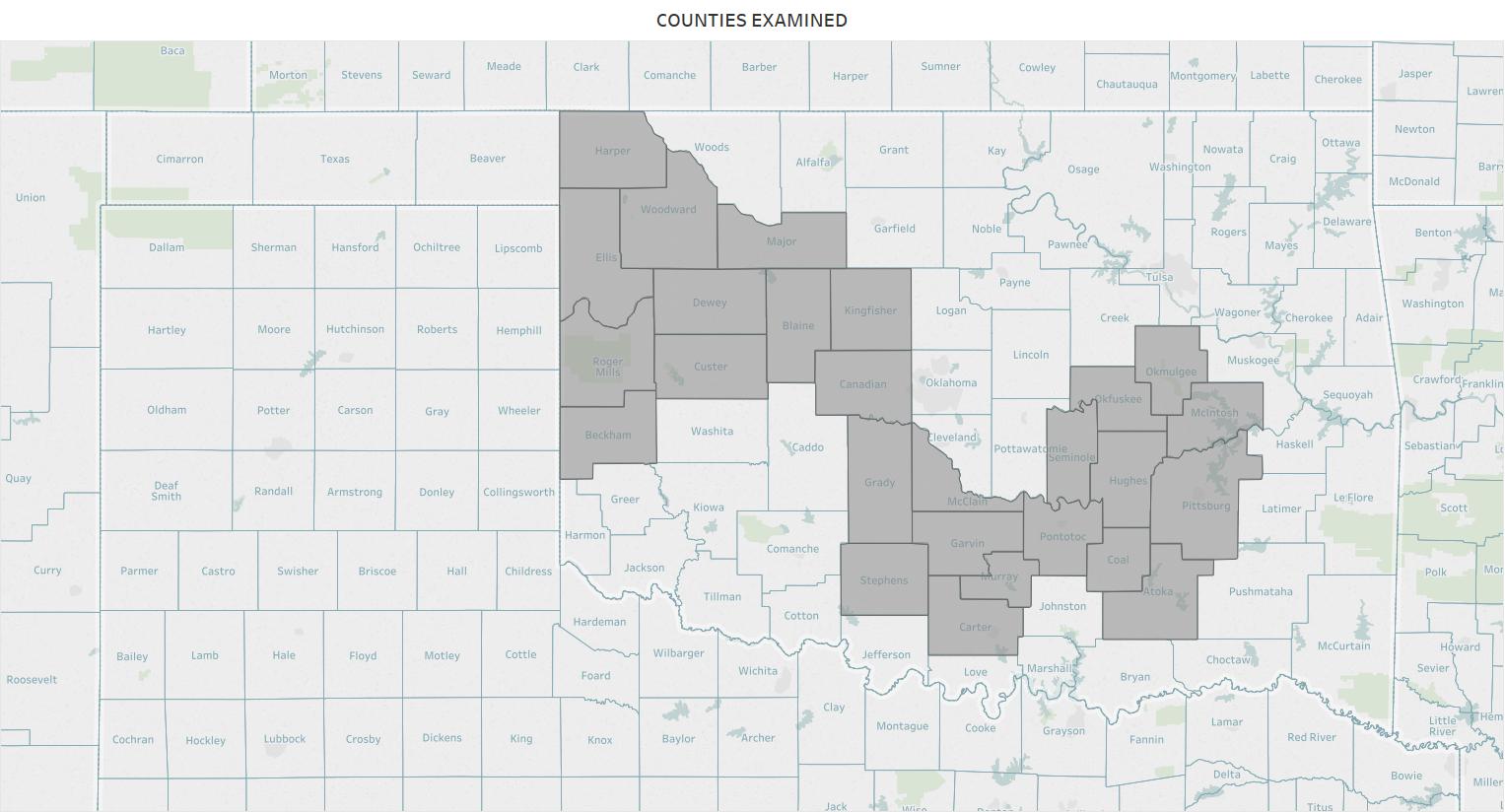

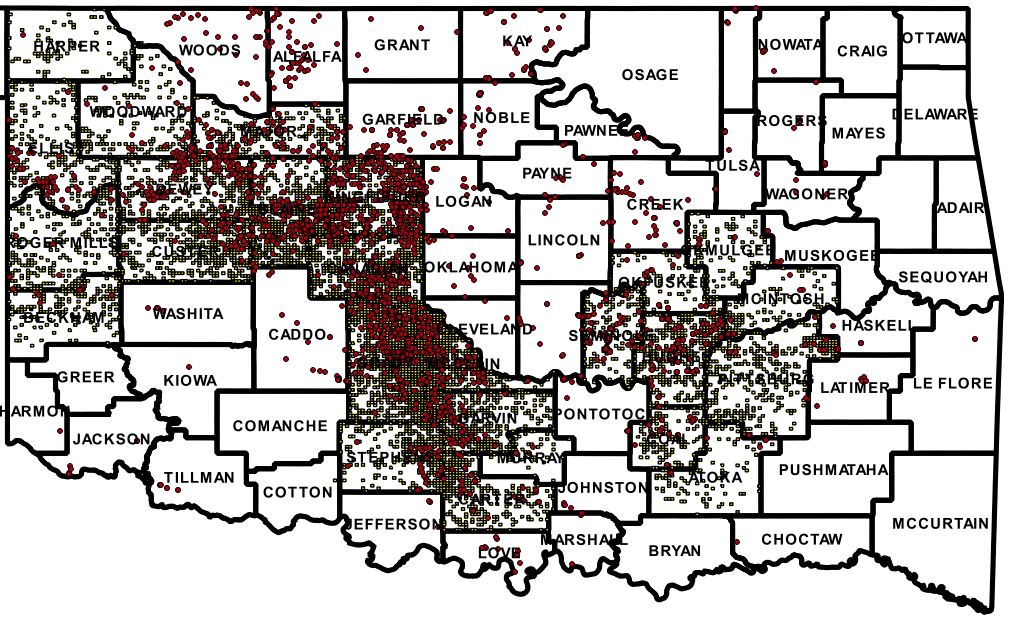

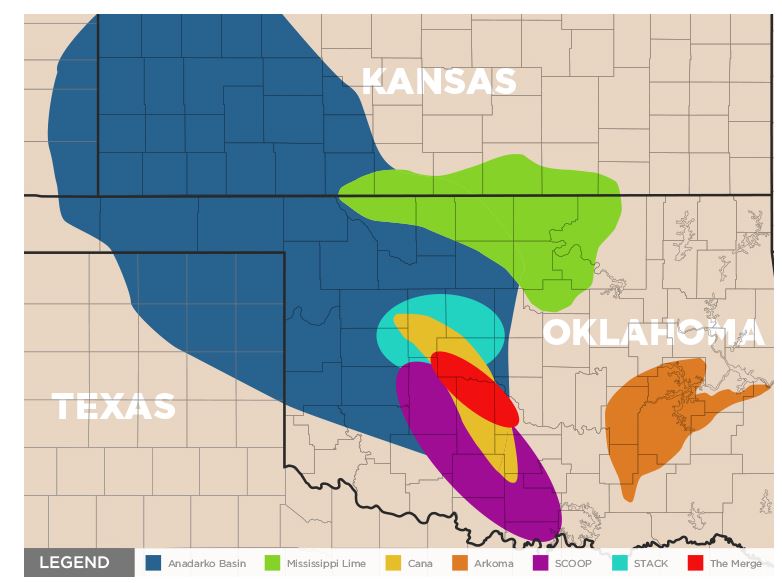

The below map illustrates the counties we examined; we primarily looked at the ARKOMA, SCOOP, STACK, NW STACK, and WESTERN OKLAHOMA regions.

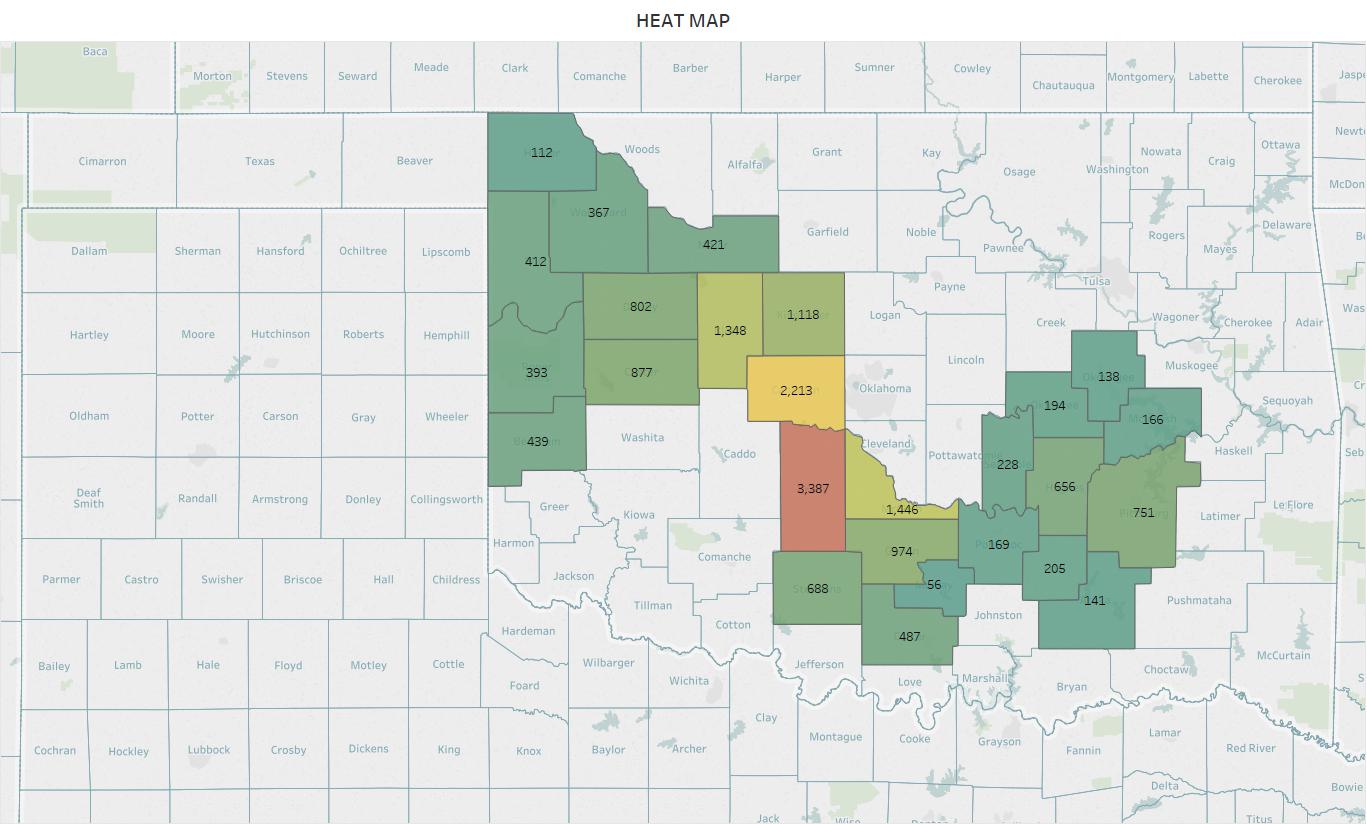

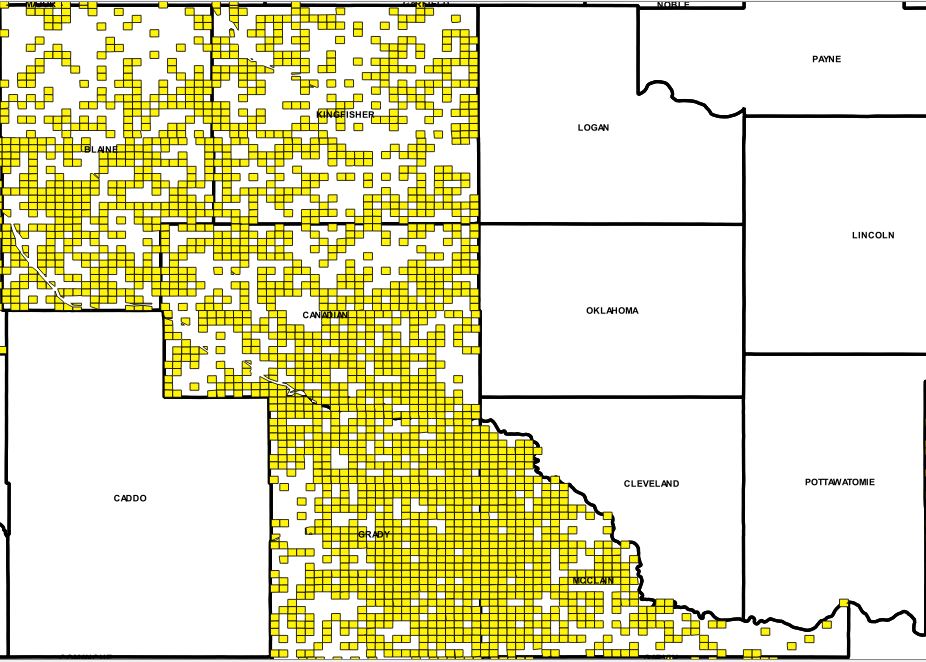

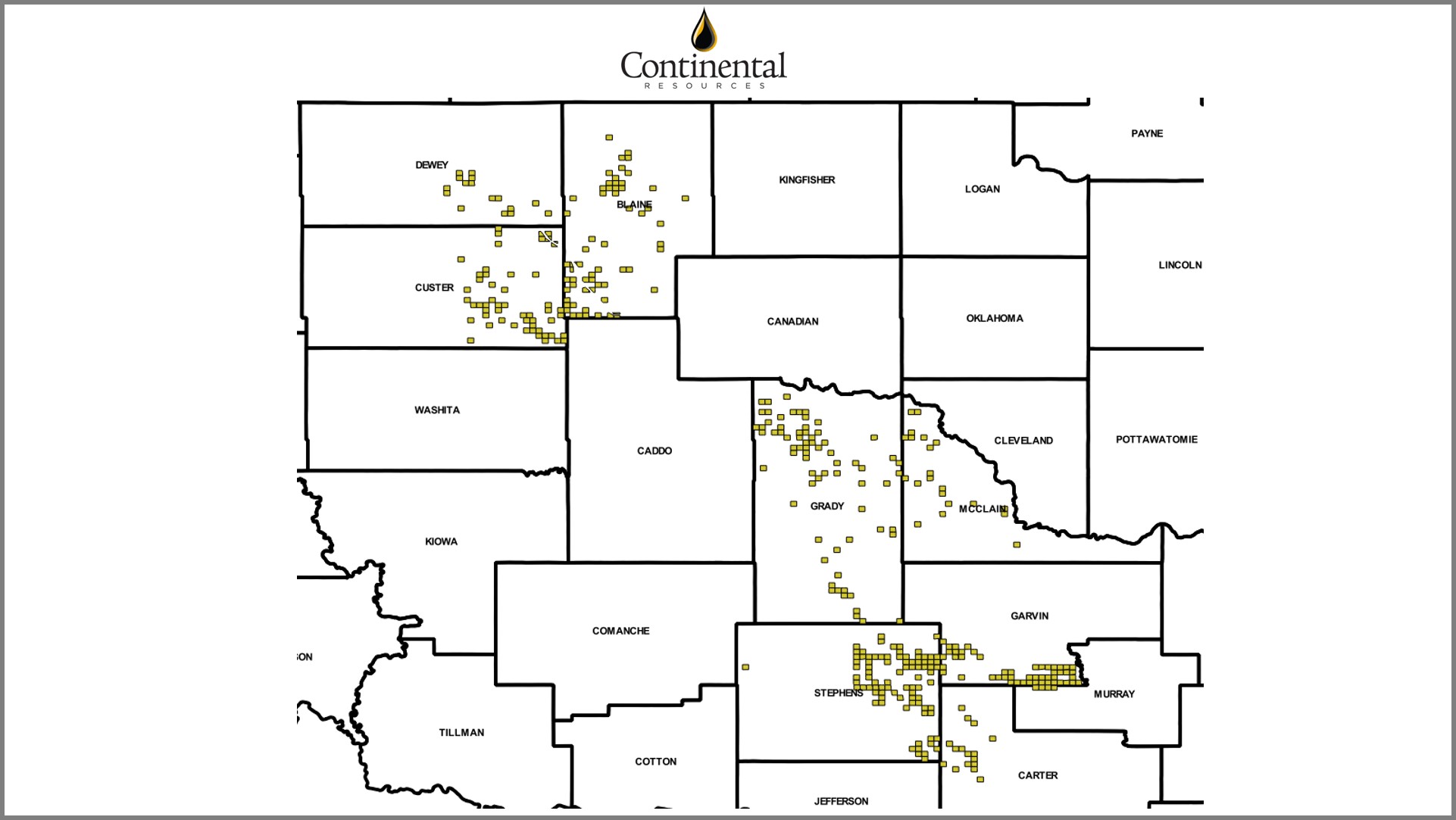

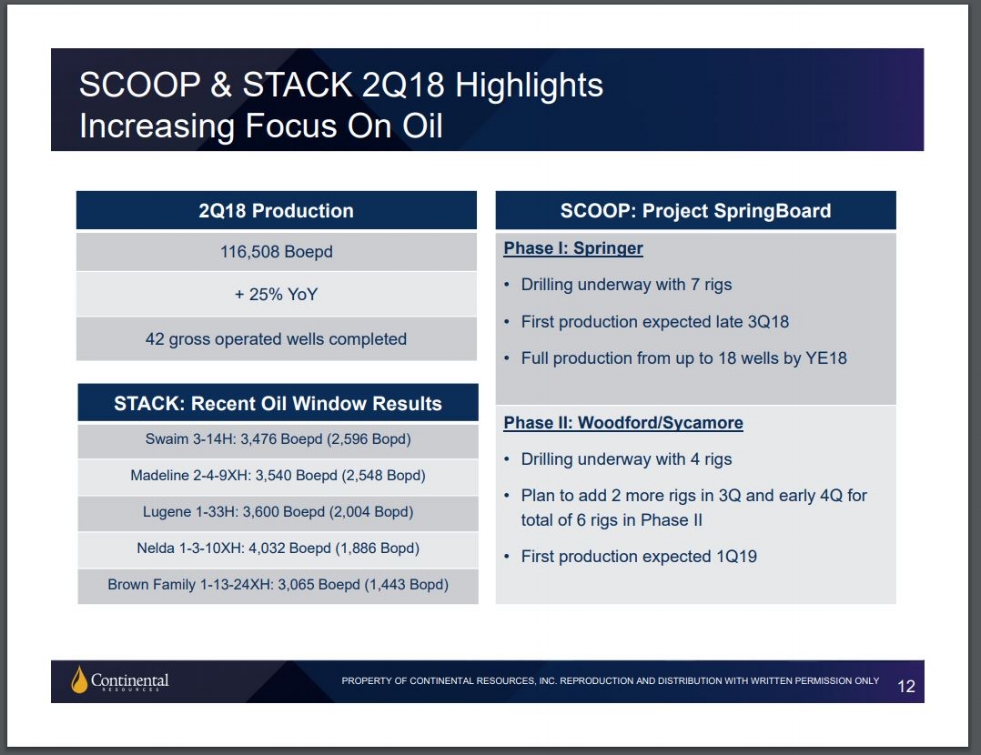

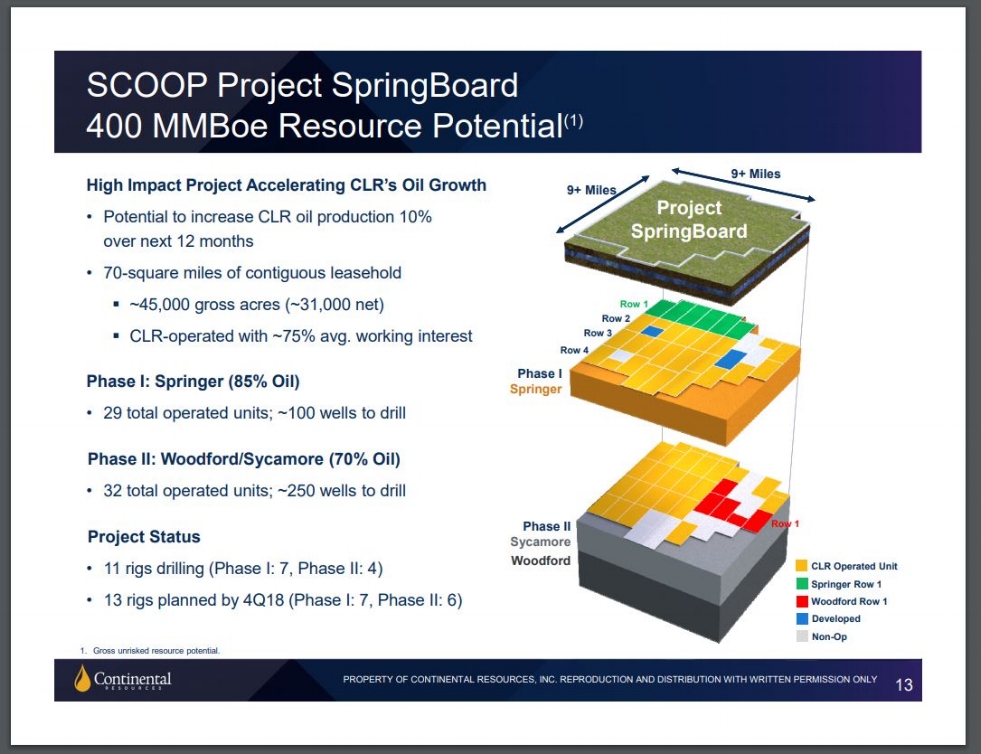

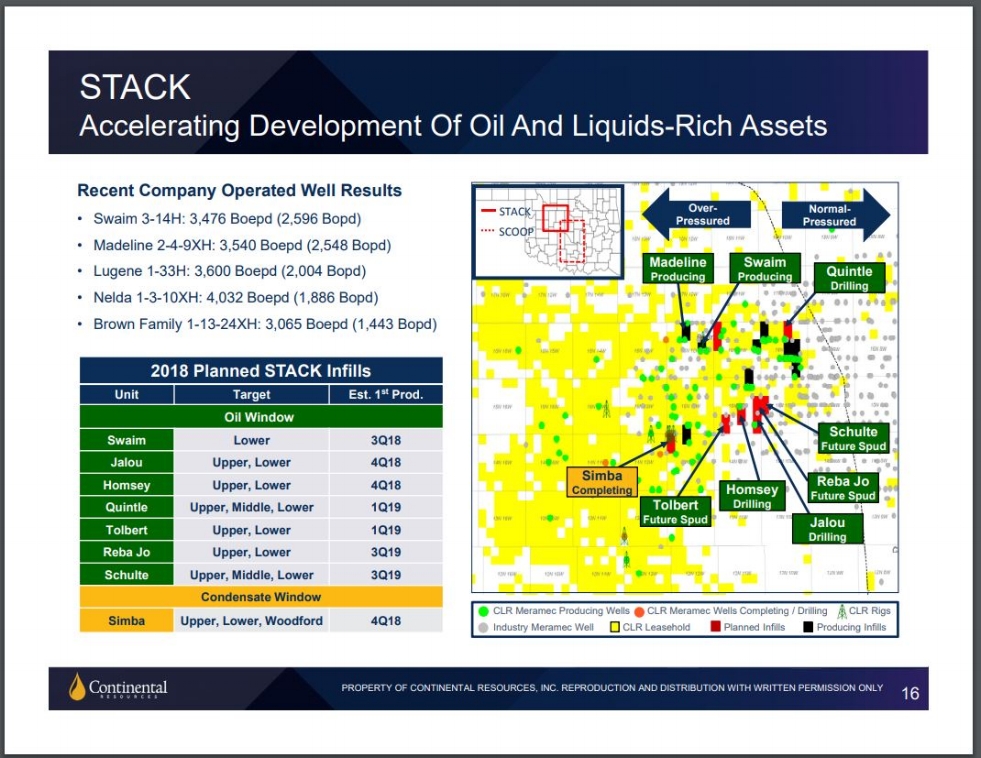

When applying a heat map to the counties we examined, we find that Grady County is the most active. This is not too surprising as Grady has witnessed a lot of activity ever since Continental announced their Springboard Project. The below graph further illustrates that mineral companies are targeting the Springboard area in Grady, The Merge area (located around the Canadian River), Western Blaine County, Northern McClain County (where EOG and Native are active) and southern and central Kingfisher (closer to the core of the STACK).

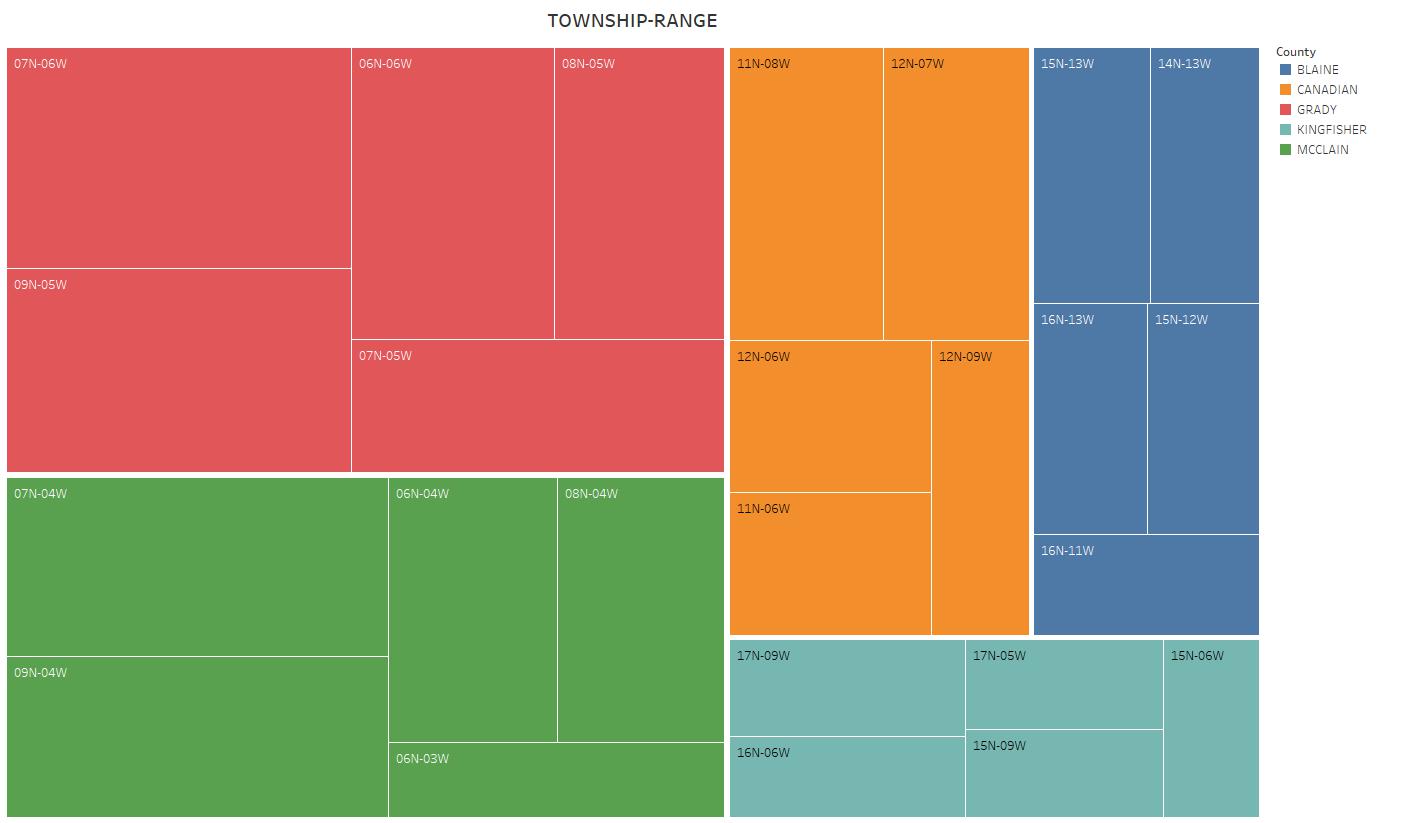

There were not too many sections in the counties of Blaine, Kingfisher, Canadian, Grady, and McClain left untouched. The yellow represents sections where Mineral Deeds were filed.

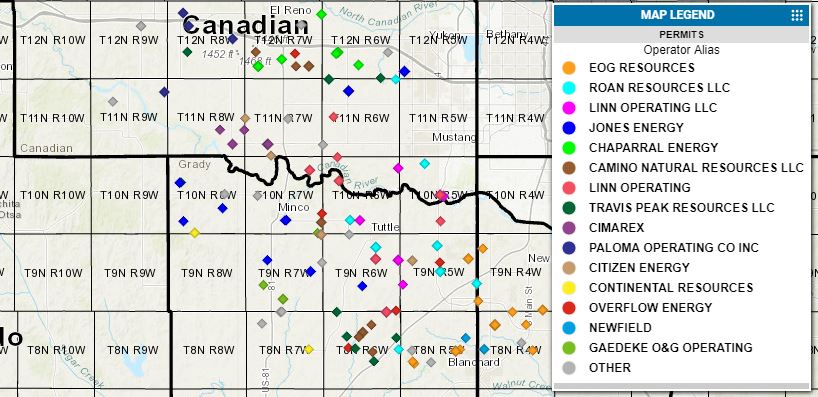

Borrowing Drillinginfo’s well permit shapefiles (permits approved in 2018), and overlaying onto our data you can see that a majority of the mineral buying occurred in those areas where a permit was present.

WHO

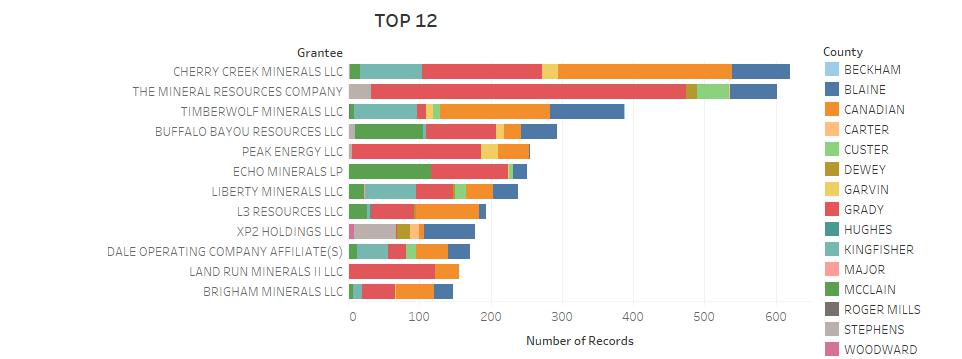

This graph represents the TOP 12 Grantees (buyers) in Oklahoma in the counties we examined. They are colored by the counties of their activity. The graph reflects the number of times a Grantee appears in title. However, it does not represent the number of tracts they acquired (i.e. a Grantee who acquired 20 tracts in 1 Mineral Deed would only be tabulated as 1 in the graph.)

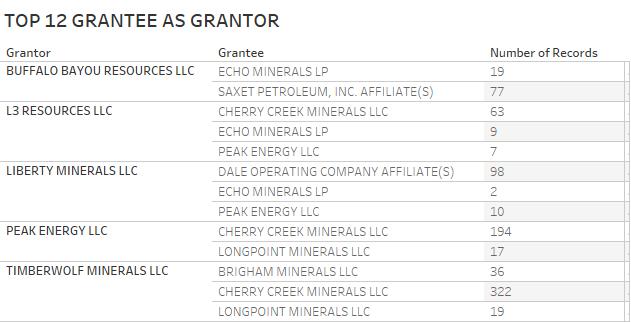

We then took the top 12 Grantees and examined if they also showed up as Grantors. We highlighted the main Grantees targeted by the noted Grantors. In other words, we looked to see if any of the top 12 buyers were primarily brokering for another company.

As you can see by the chart above, Echo Minerals, Saxet Petroleum, Inc., Cherry Creek Minerals, Dale Operating Company, and Brigham Minerals were popular end buyers. The TOP 12 Grantee chart can actually be re-written to be the TOP 8 Grantee Chart, comprised of the following companies:

CHERRY CREEK MINERALS/LONGPOINT MINERALS

-

A division of FourPoint Energy

-

Website: LongPoint Minerals

-

Headquarters: 100 St. Paul Street, Ste. 400, Denver, CO 80206

-

Recently announced a capital raise of over $846 Million to acquire high-growth, long-long mineral interests in top U.S. resource plays (press release)

THE MINERAL RESOURCES COMPANY

-

A division of Continental Resources

-

Headquarters: 20 N. Broadway, Oklahoma City, OK 73102

-

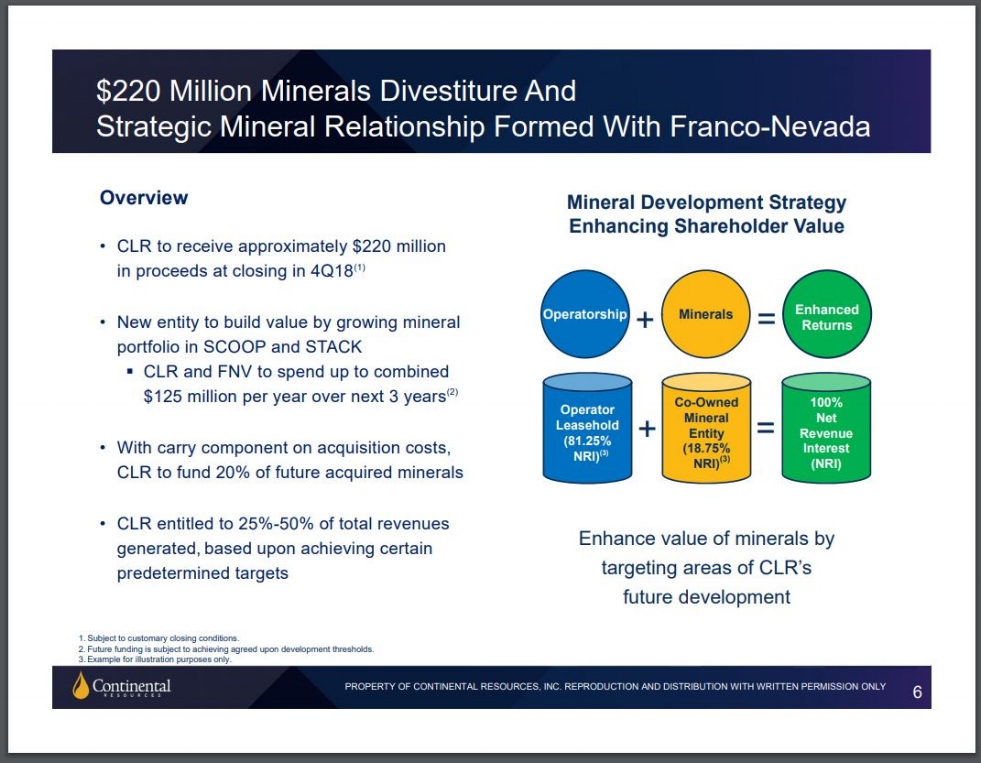

Announced in August 2018 that Continental Resources and Franco-Nevada (a Toronto-based royalty company) to spend up to a combined $125 million per year for the next three years to buy mineral rights in Oklahoma’s SCOOP and STACK Plays (per newsok)

ECHO MINERALS LP

-

A division of Echo Energy

-

Headquarters: 3818 Northwest Expressway, Suite 840, Oklahoma City, OK 73112

-

Future Headquarters: 120 Robert S. Kerr, Oklahoma City, OK at the Ziggurat Building

-

-

Echo currently manages assets in the SCOOP, STACK, Midland, and Delaware basins in Oklahoma and Texas.

XP2 HOLDINGS

-

A division of Expro Minerals

-

Headquarters: 307 W 7th St., Suite 810, Fort Worth, TX 76102

-

Actively purchasing mineral rights in the Anadarko Basin of Oklahoma.

ALLDALE MINERALS III, LP — through its subsidiaries Orchid AD3, LLC, Tundra AD3, LLC, Arbala AD3, LLC, and North Fork AD3, LLC

-

A division of Dale Operating Company

-

Headquarters: 2100 Ross Avenue, Suite 1870, Dallas, TX 75201

-

Alliance Resource Partners LP (NASDAQ: ARLP) entered into definitive agreements to acquire the general partner interests in AllDale Minerals LP and AllDale Minerals II LP and all of the limited partner interests in AllDale not currently owned by ARLP’s affiliate, Cavalier Minerals JV, LLC, the company said December 17, 2018 (per Oil & Gas Investor)

LAND RUN MINERALS II, LLC

-

A division of 89 Energy

-

Headquarters: 105 North Hudson Ave., Suite 650, Oklahoma City, OK 73102

-

An aggressive, growth-oriented oil and gas exploration and production company with a proven track record as an early-mover in Mid-Continent resource plays

BRIGHAM MINERALS, LLC

-

Website: Brigham Minerals

-

Headquarters: 5914 W. Courtyard Dr., Suite 100, Austin, TX 78730

-

Privately-owned company focused on acquiring oil and gas mineral rights in unconventional, shale plays throughout the United States – including the SCOOP and STACK plays in Oklahoma.

SAXET PETROLEUM, INC. — investment vehicles Saxet III Minerals, LLC, RIP3, LP

-

Website: Saxet

-

Headquarters: 510 Bering Dr., Suite 600, Houston, TX 77057

-

Raised $100 Million from Post Oak Energy Capital in August 2018 to acquire mineral and royalty interests in prolific U.S. basins (press release)

CONCLUSION

Like in 2017, the mineral game is dominated at the top by a few well funded groups. These groups are paying premium prices ranging from $10,000/nma – $25,000/nma. A majority of the activity takes place in areas where an oil and gas well permit is present, which makes sense because the mineral companies reflected are trying to capture the early months of production where the wells experience the highest production rates. If we were to examine more traditional mineral companies (for instance family backed companies whose purchase prices per nma are significantly lower), we would likely see them acquiring less risky acreage that has had a steady flow of production and acreage that can be more accurately modeled with engineering software.

It is still a bit worrisome to see so many companies relying on the same few end buyers. It raises the risks for companies to be caught holding acreage and/or not closing on deals they have under agreement, should the end buyers close their funds. Additionally, it can be tough for those not paying the premium prices to enter the core regions; which premium prices are a good thing if you are sitting on the landowner side of the fence.

The lower oil prices we have been experiencing will likely slow down drilling activity and lower acreage prices. Mineral owners and other sellers may be a bit shocked when they find out that their offers have been pulled or drastically lowered. The mineral game is risky and there is a lot of money being thrown around. We at Convey Energy cannot accurately predict what is going to happen in 2019, but we will be here watching, analyzing, and reporting the trends, story lines, and opportunities for the upcoming year.

Convey Energy Consultants

Finding The Right Title Fit

Title is one of the most important parts of the oil and gas upstream sector but not the most glamorous. You will not find any headlines about ABC Title Company raising $50 million from a PE Fund and you will not read in Oil and Gas Investor about ABC Title Company acquiring XYZ Title Company for 10X. A majority of the work does not take place in fancy offices that reach high into the sky, rather the work is done in old courthouses, and a title career is not something they push in Energy Management at the Universities (at least not when I was in school). Yet, title is the foundation that supports the glamorous sides of the upstream sector. The slightest oversight in title can be the difference in hundreds or millions of dollars and the difference in you having the right to drill a well or be left standing on the sidelines holding bad oil and gas leases.

So Many Choices

How do you choose the right title company? If you look at the sponsors for Oklahoma City Association of Petroleum Landman (OCAPL) there are over 15 title related companies listed. If you Google “Oklahoma oil and gas title companies” you get over 18 pages of results. If you tell someone you work in oil and gas they’ll likely ask you if you know their friend who is a landman; in short there is a lot of competition in the title market. But not all companies who provide title as a service are the same. Your needs will determine who you need to hire; are you a well operator, a mineral company, an individual, or midstream operator? Below are a few examples of the types of title companies serving the industry.

Full Service Land Company

I would assume a majority of Oklahoma title companies fall under this category. They have services and teams in place that can research entire townships, file the necessary regulatory paperwork, lease mineral owners, and handle surface issues. A lot of the bigger operators tend to use these companies since they can have one shop handle all their needs. Probably the most common issue facing these companies, who often times have large number of contract landmen on payroll, is the up and down nature of the business which makes constantly hiring and firing landmen “just part of the business.” This constant rotation of workers leads to the more experienced and seasoned members managing title teams, and the fresher faces in the courthouses pulling books and running title.

Surface Title and Right of Way Company

These companies are focused primarily on surface and usually do not get into mineral ownership too much. The title and land team are responsible for researching surface rights, easement burdens, and negotiating with landowners on numerous issues like well site locations, pipeline routes, water usage, and more. The client base for surface companies tends to be the well operators.

Individual Landman

Often times these individuals have been in the industry for many years and once worked for a land company. Most courthouses have business cards posted for a local landman and they are great resources for individuals who need to know what they or their family own in the county. Having a connection to an individual landman who lives near your Area of Operations can be a positive should you ever need a document quickly and the courthouse is located hours away from your office. Depending on where the individual is in his or her career they might not travel too far outside their county or they might not have access to some of the modern and expensive software programs found at other land companies.

Title Attorney

The most popular title report(s) prepared by a title attorney is the Drilling Title Opinion (DTO). These reports cover who owns in a section that is about to be drilled by a well, how much they own, and any curative requirements that affect marketability. DTOs are prepared for the operators to ensure they have the right to drill a well. Sometimes mineral and non-op companies get their hands on the DTOs (we can talk about ethics in a future blog) and can bypass the title portion of their acquisitions since they know who is in pay from the operator. Larger mineral companies usually have title attorneys on speed dial or on staff because their acquisitions regularly have mineral owner curative requirements affecting the mineral company’s pay status. In areas that have a history of oil and gas activity it is rare to find a tract that does not have “clouds” on the title.

Boutique Land Company

Convey Energy falls under the Boutique Land Company category. We are not considered a full service land company or surface title company, and do not write title opinions. We specialize in title and due diligence for mineral and non-op groups who are actively acquiring in Oklahoma. A majority of our work is seller specific (i.e. we track the seller’s interests and burdens and do not focus too much on outside owners). Our title team consists of 3-5 landmen which allows us to control quality and landman qualifications.

When I first started Convey Energy Consultants, formerly known as Oklahoma Mineral Fund, I honestly tried to avoid the title aspect of the business. I was focusing on the mineral owners and trying to match them with respective buyers. But mineral owners and companies kept requesting title and Convey Energy was born. Today Convey Energy focuses on Acquisition & Divestiture, Title Research, and Data Analysis.

Conclusion

So next time you have a title project take a moment to reflect on your specific needs. Are you drilling a well, buying minerals, purchasing leases, installing pipeline, or just need to know what your family owns? Regardless of your needs it is important that the title is accurate (and I’ll be the first to admit everyone makes mistakes but you have to learn from those mistakes or it’ll be costly as noted above). By choosing a title company that fits your needs you are ensuring that mistakes are limited and that the title report accurately addresses the questions you need answered. And next time you encounter a title landman I encourage you to shake his/her hand, because although not glamorous at times, their job is vital the upstream sector.

Cody Tucker | ctucker@conveyenergyok.com

Convey Energy Consultants

Top 10 Oklahoma Lessees

They say “A picture is worth a thousand words”….

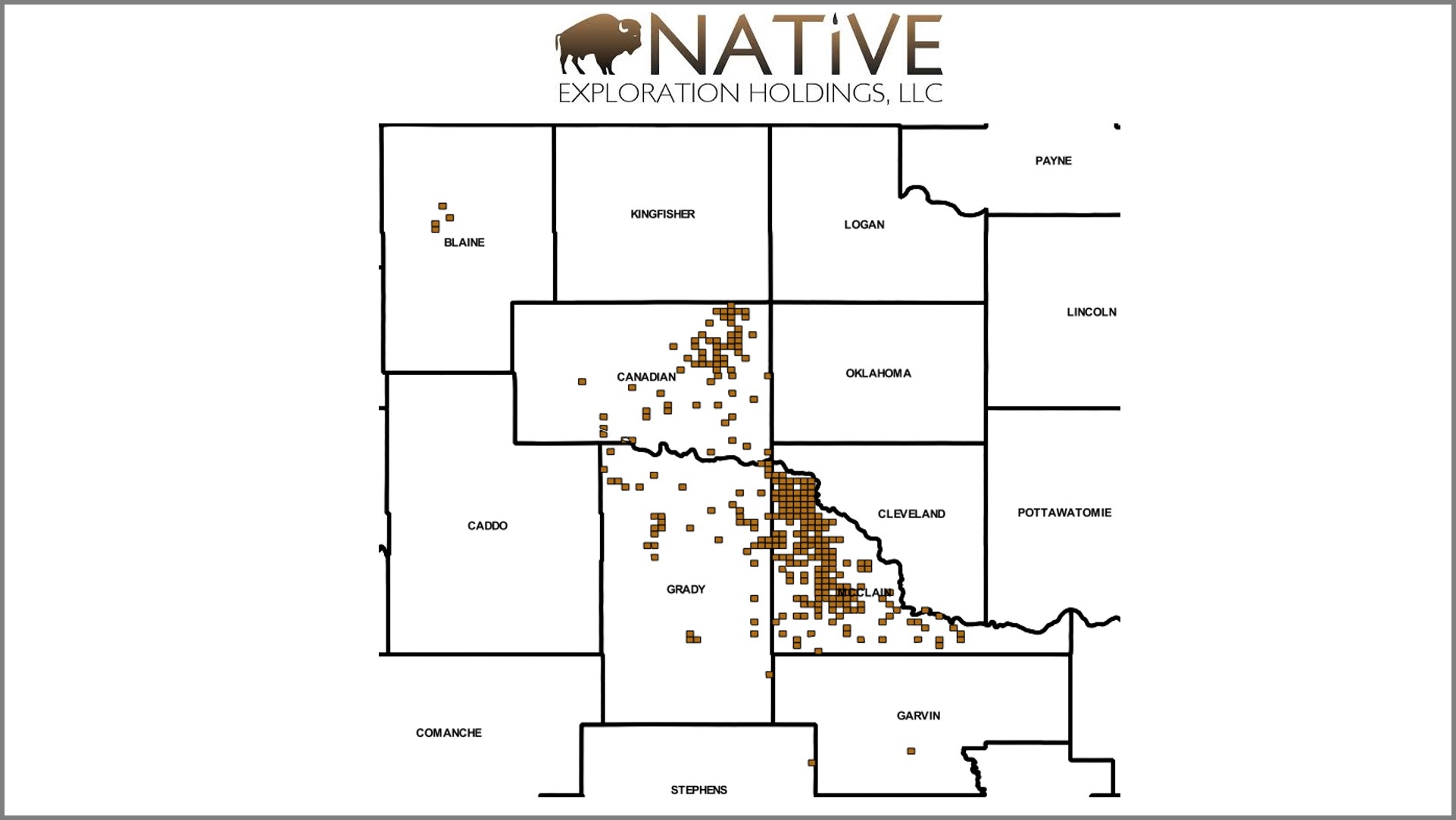

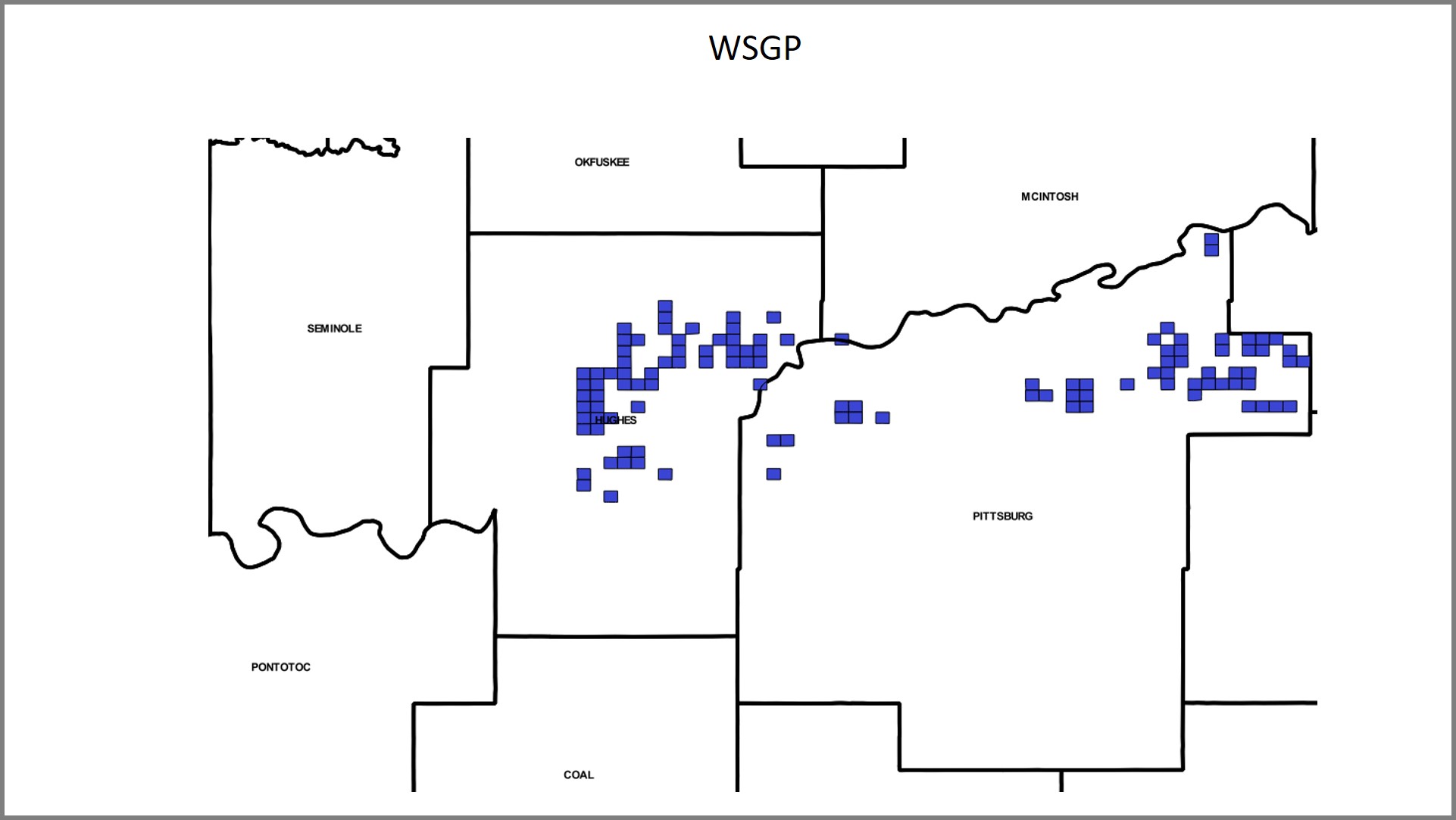

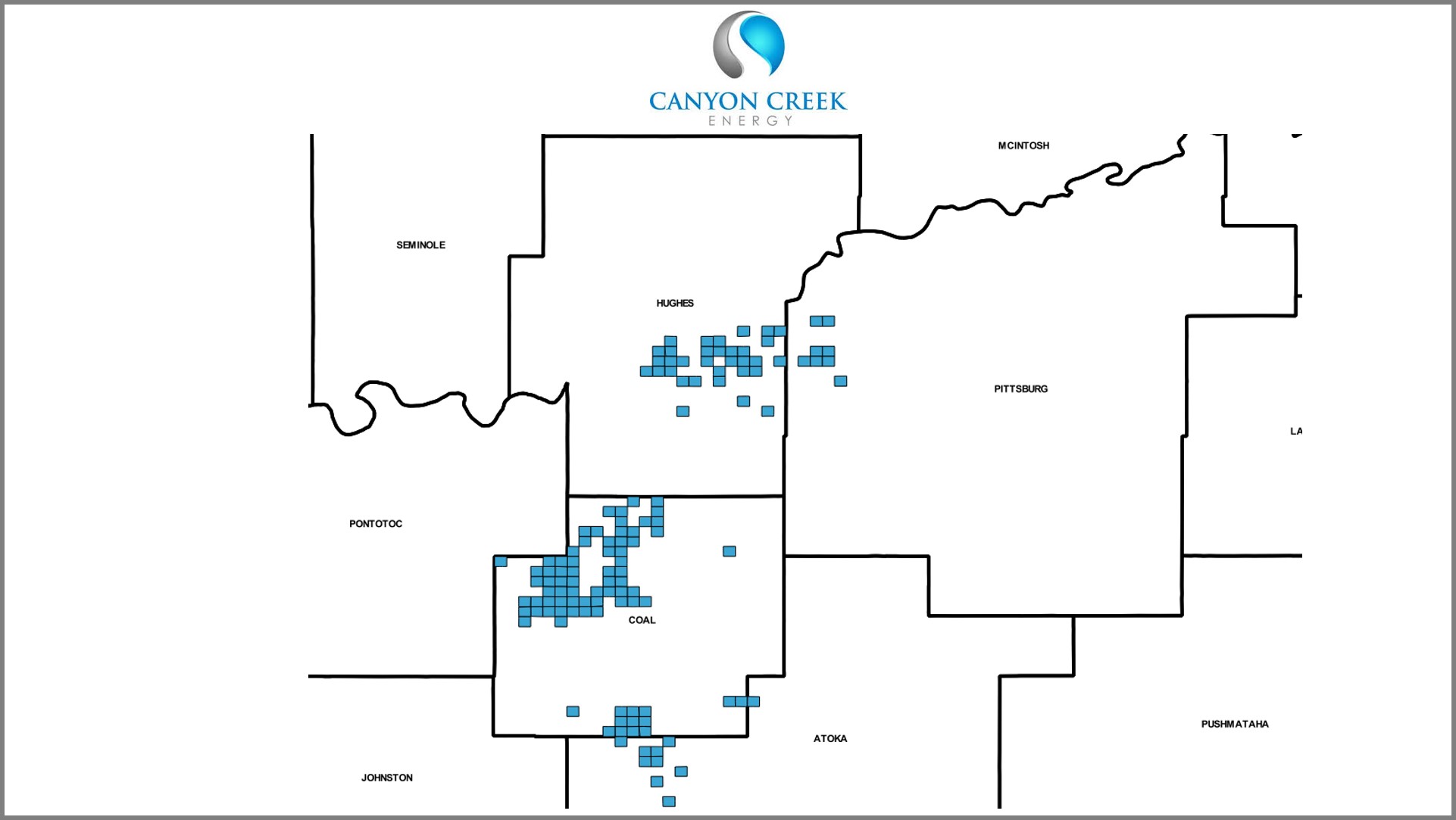

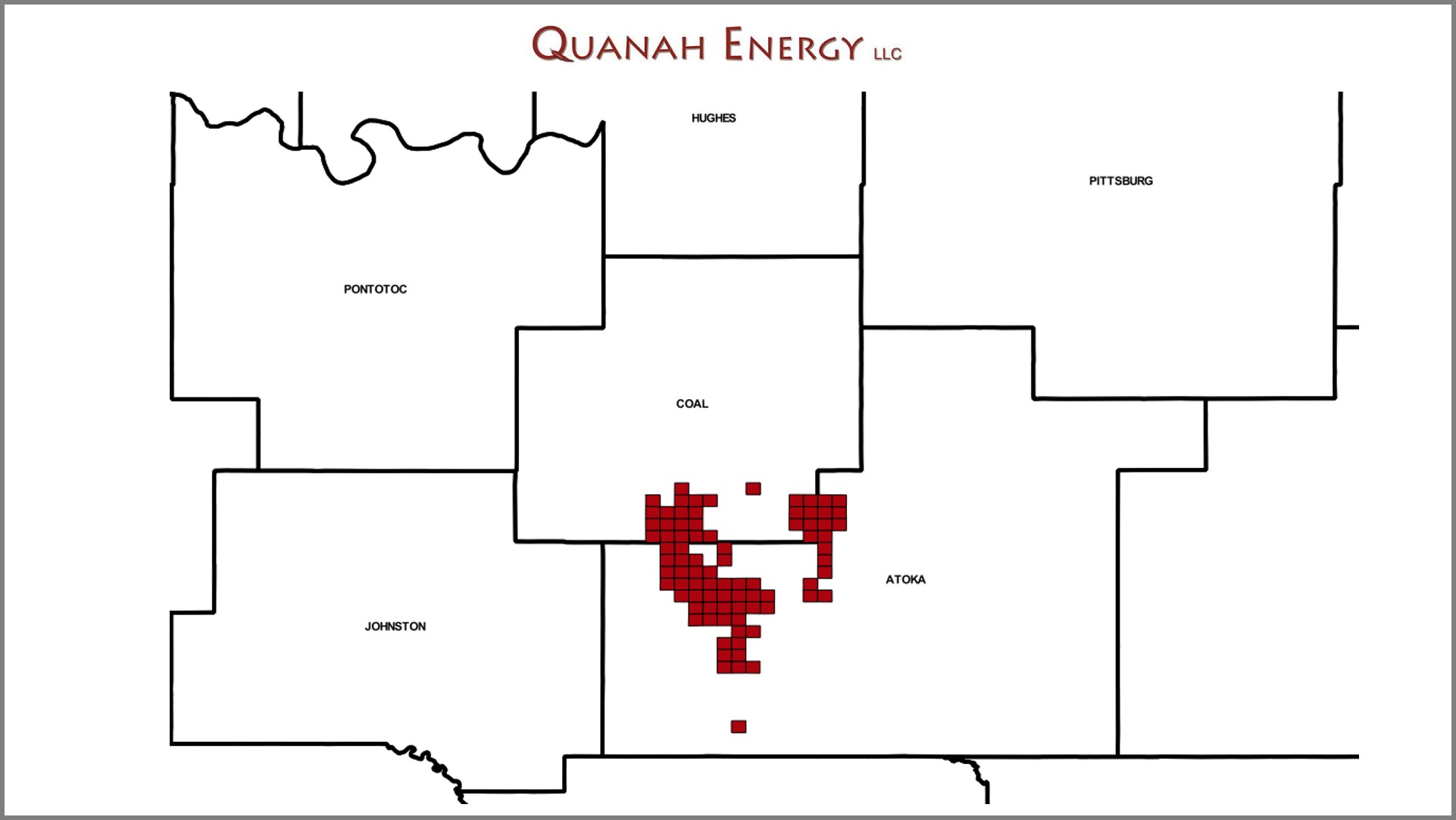

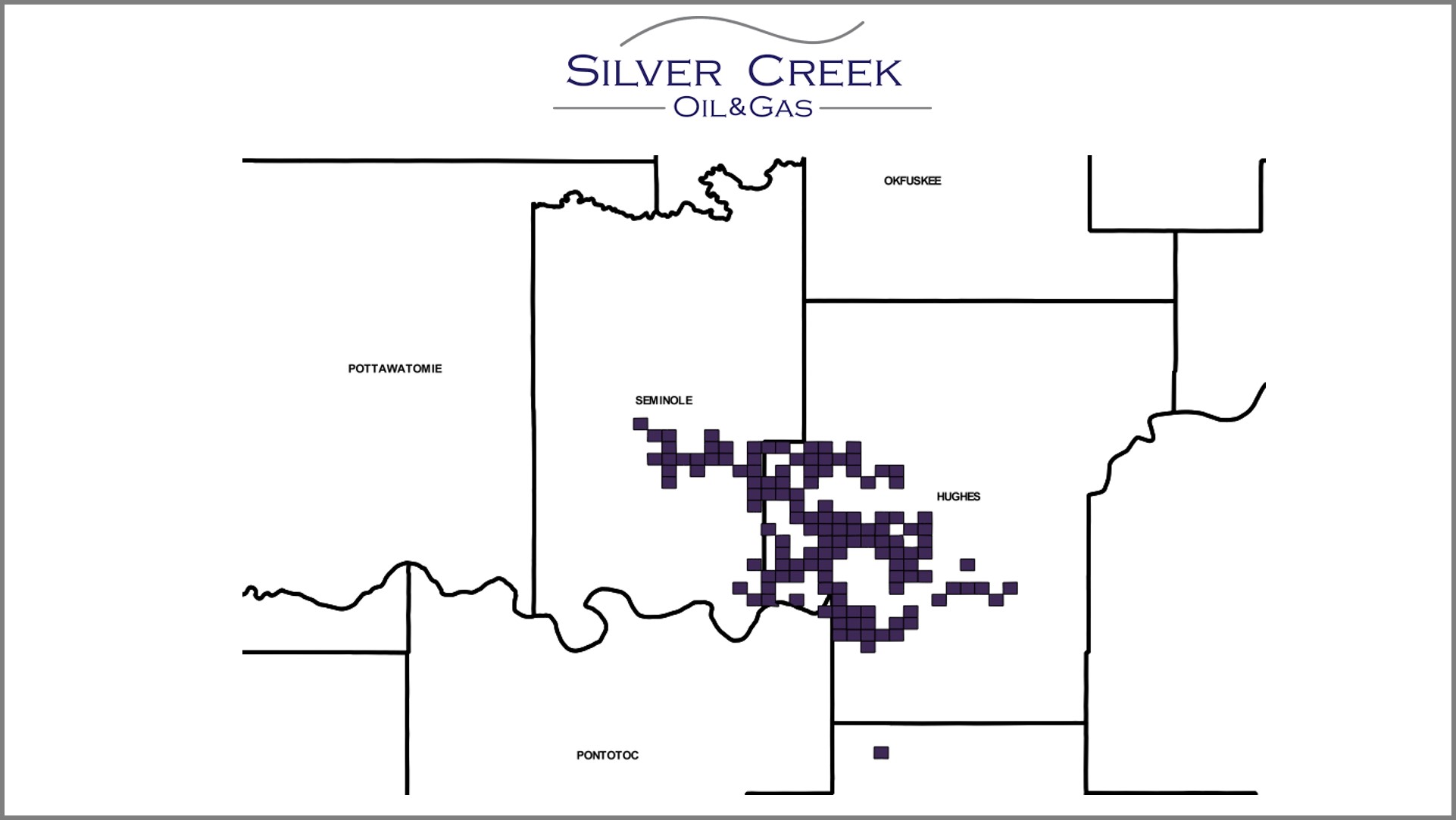

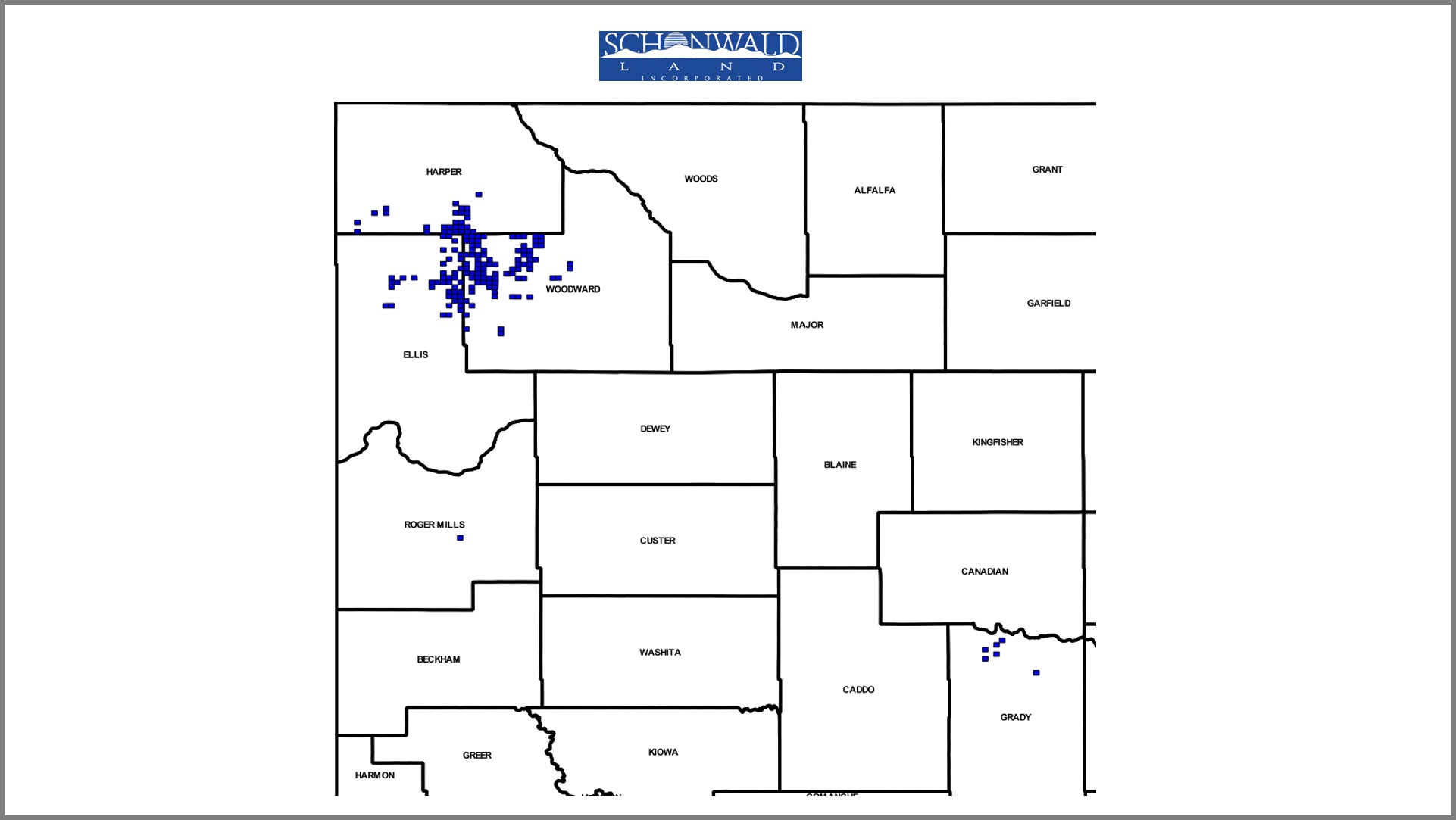

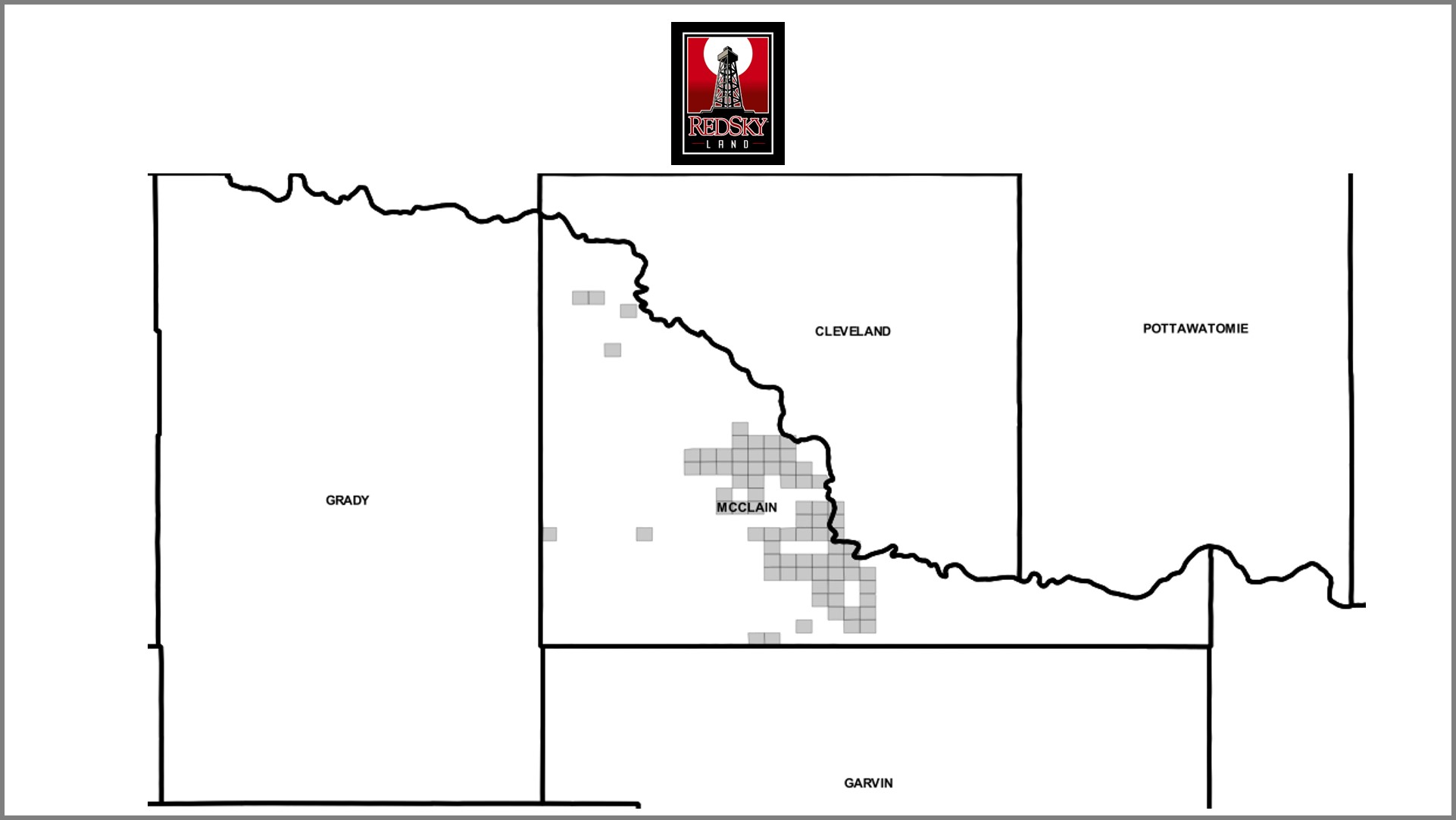

Below are the top 10 Lessees in Oklahoma for 2018 (to date) and a map of their acreage (prior to any assignments or divestitures).

Notes:

Schonwald Land, Inc. appears to be leasing for BMR II, LLC

Redsky Land appears to be leasing for BP AMERICA PRODUCTION COMPANY

Quanah Energy LLC was acquired by Canyon Creek Energy in January 2018

Oklahoma Pooling Report

Please visit the following link to access the premium content.

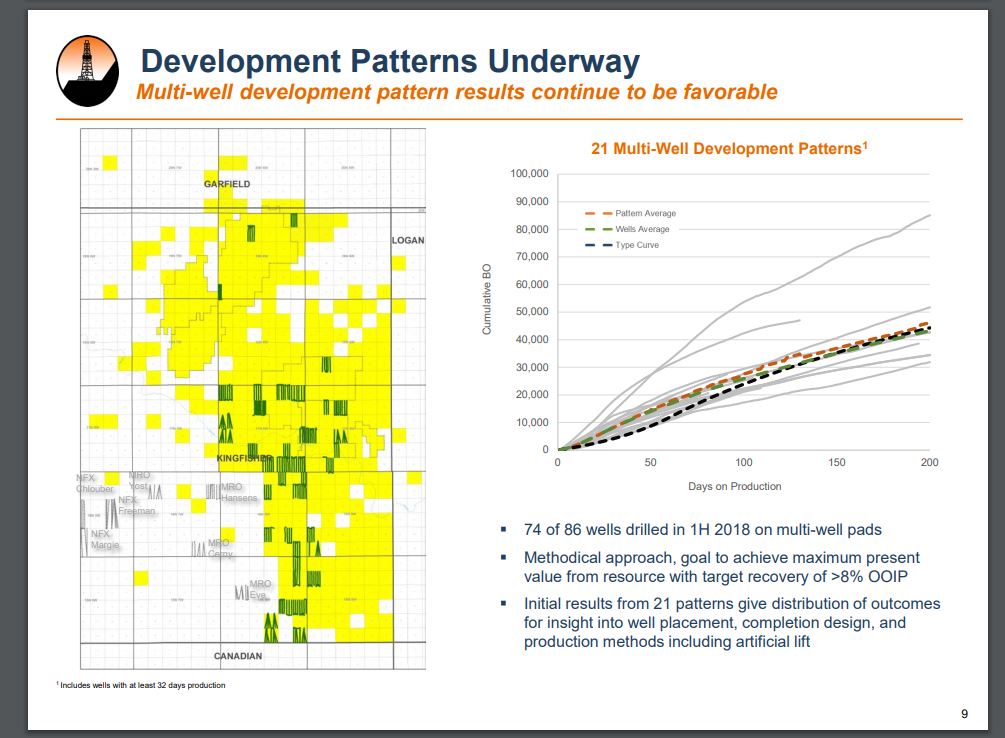

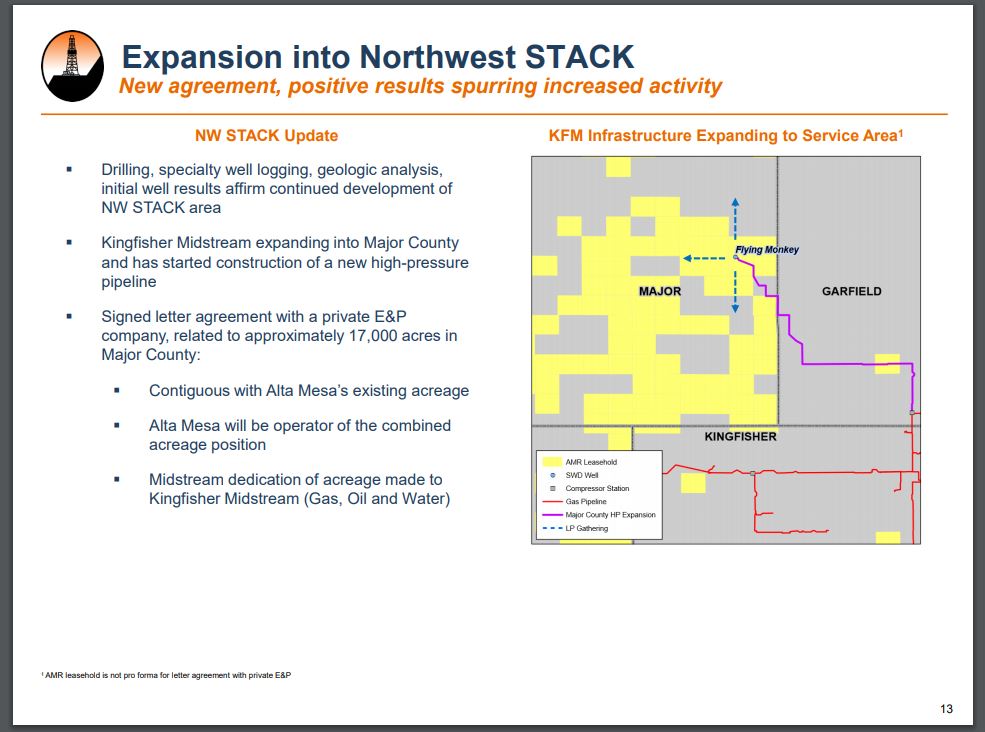

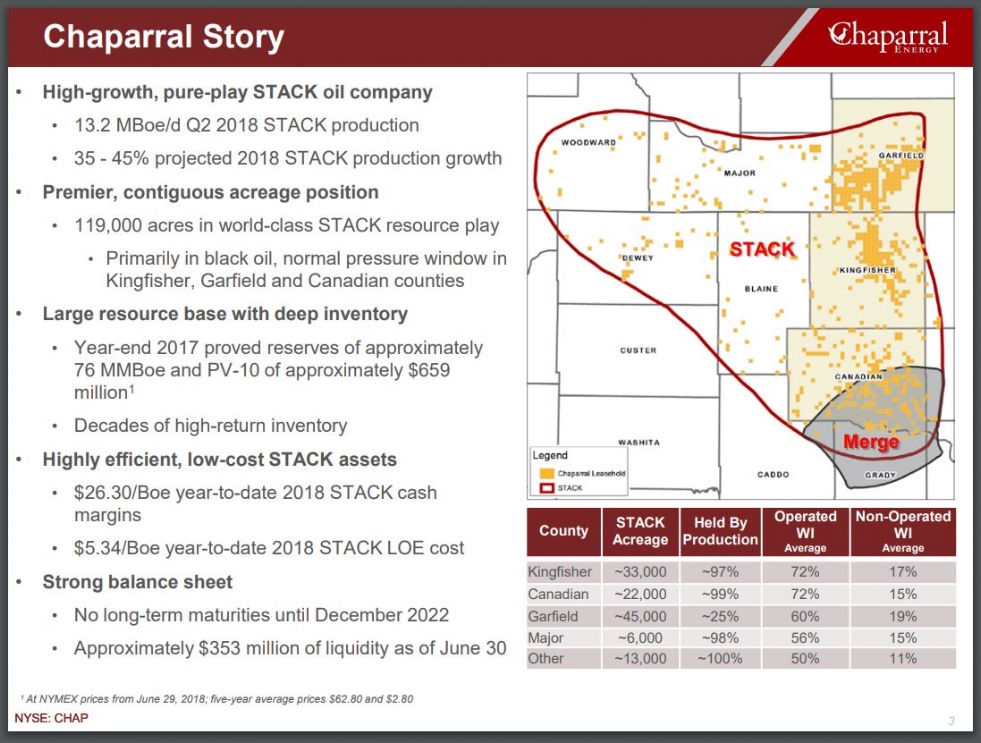

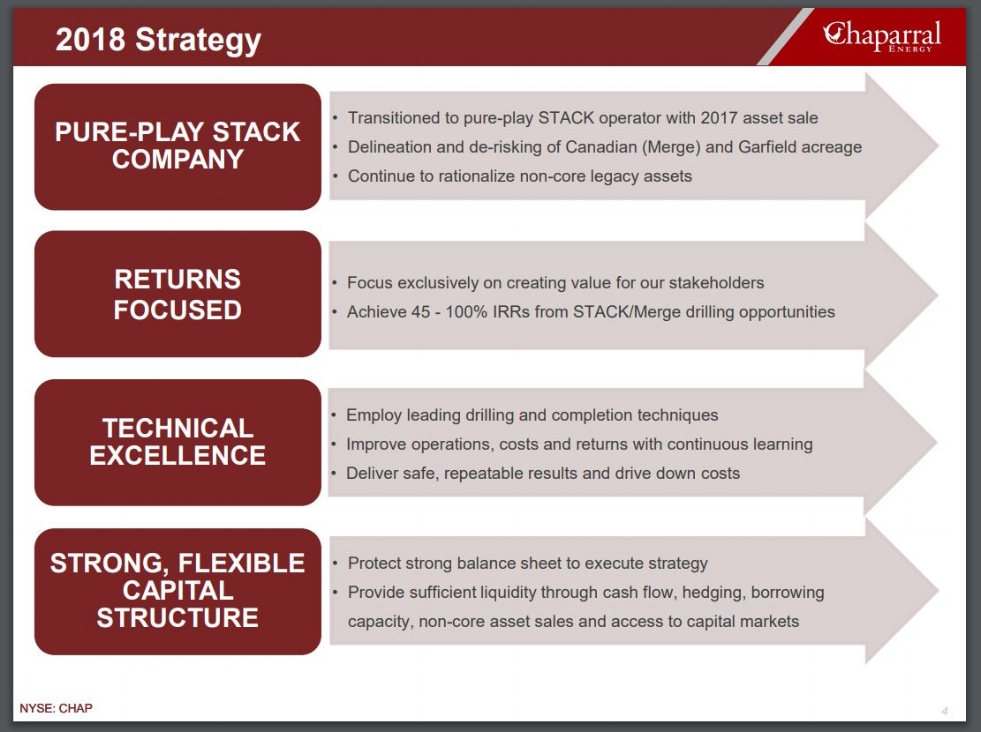

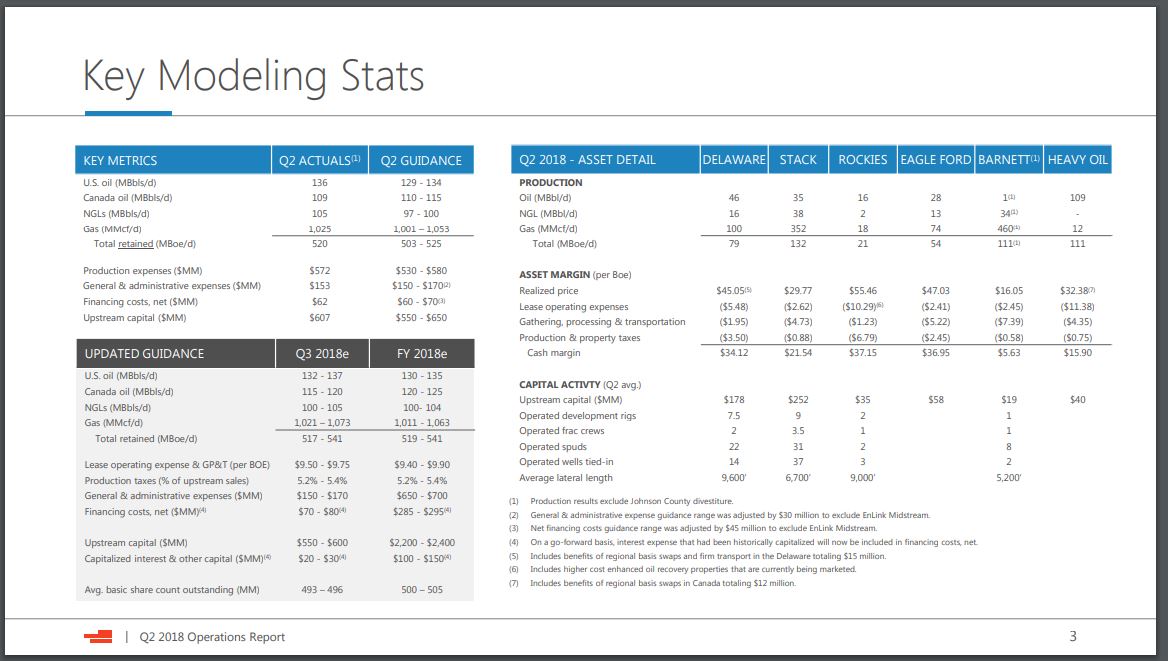

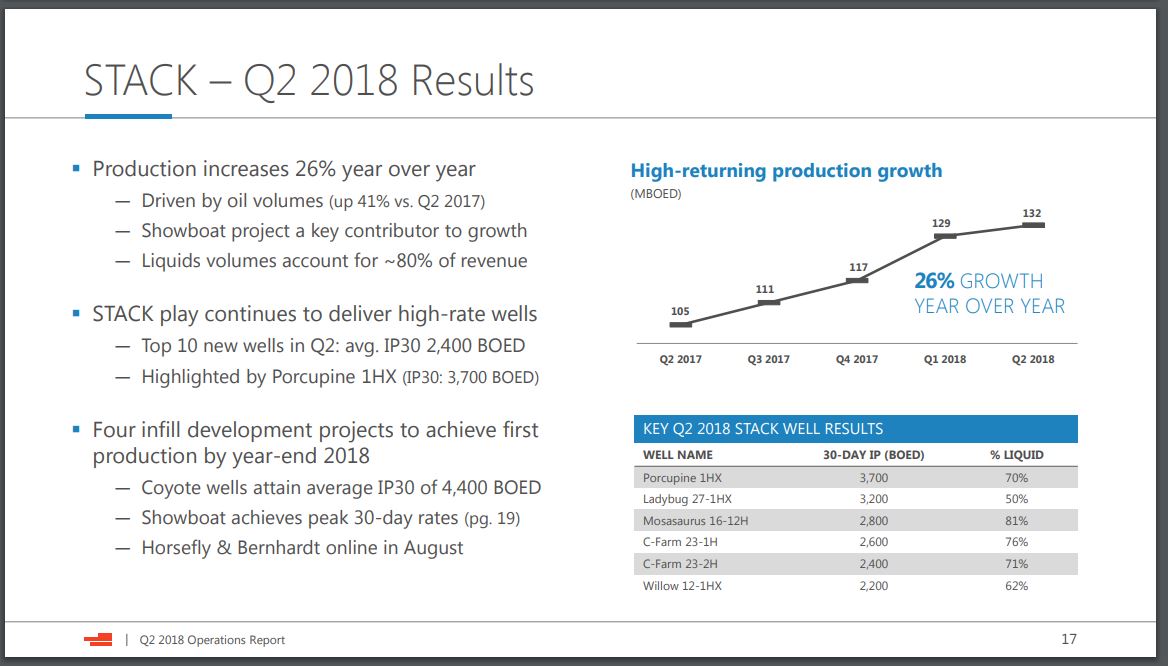

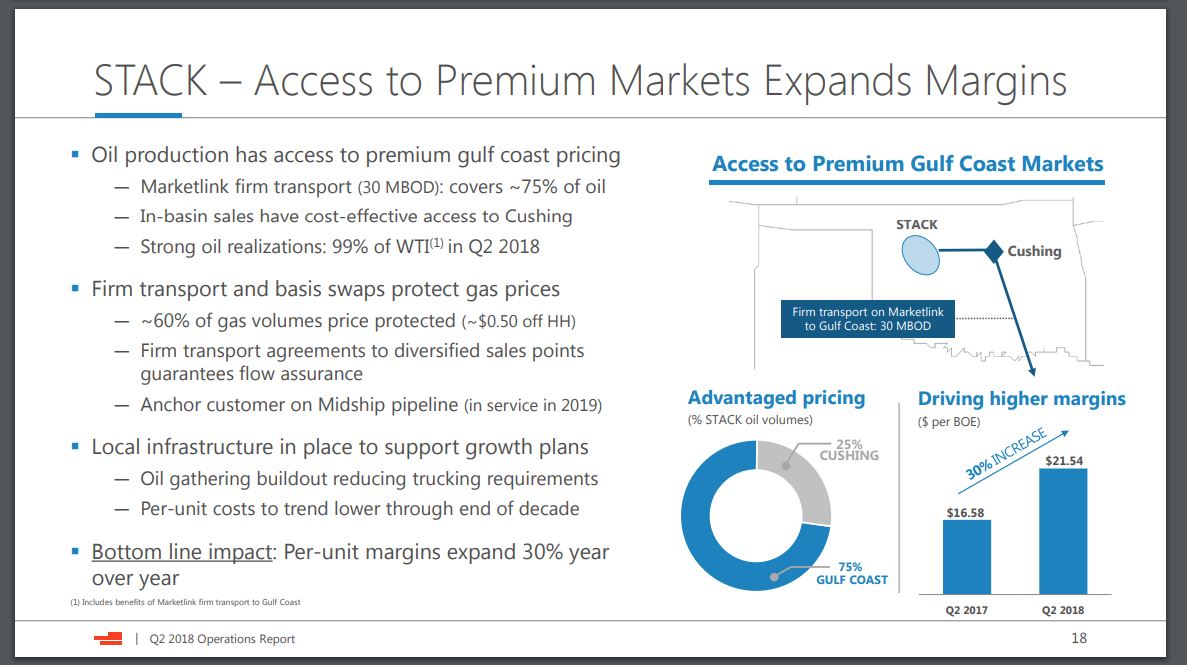

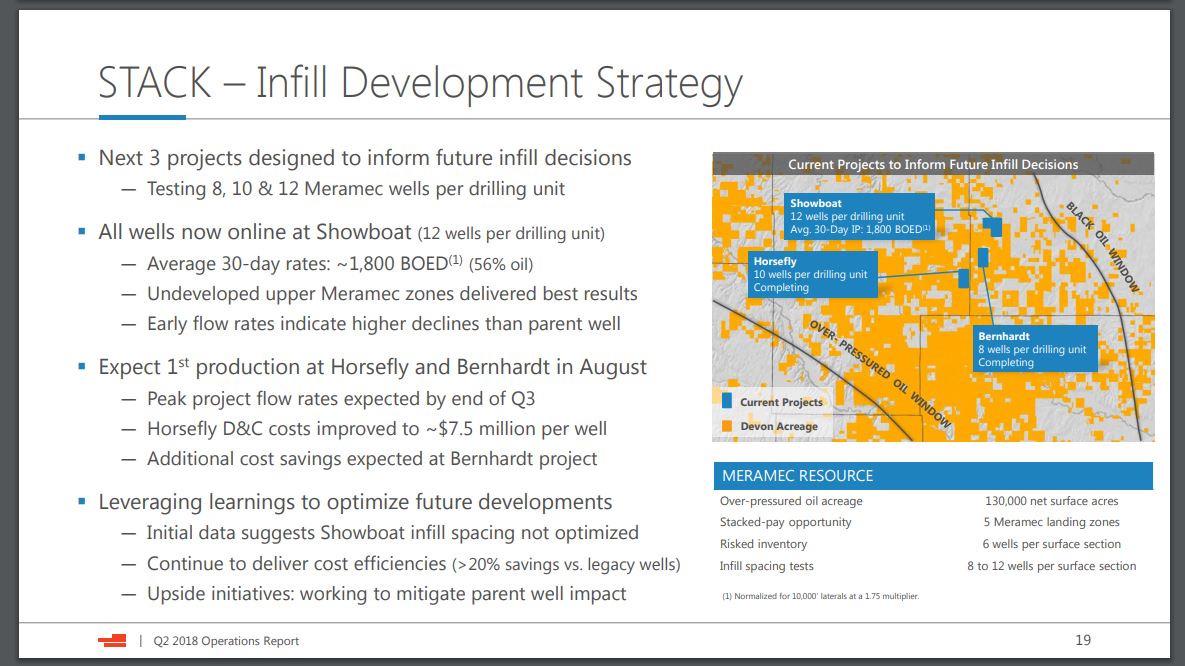

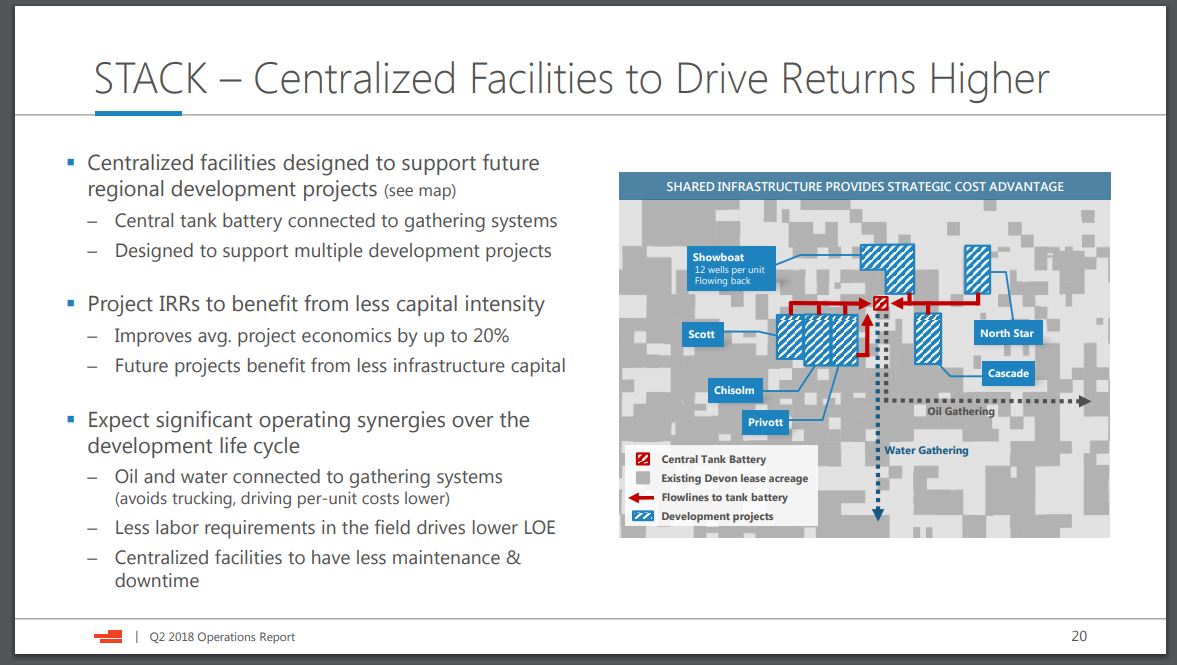

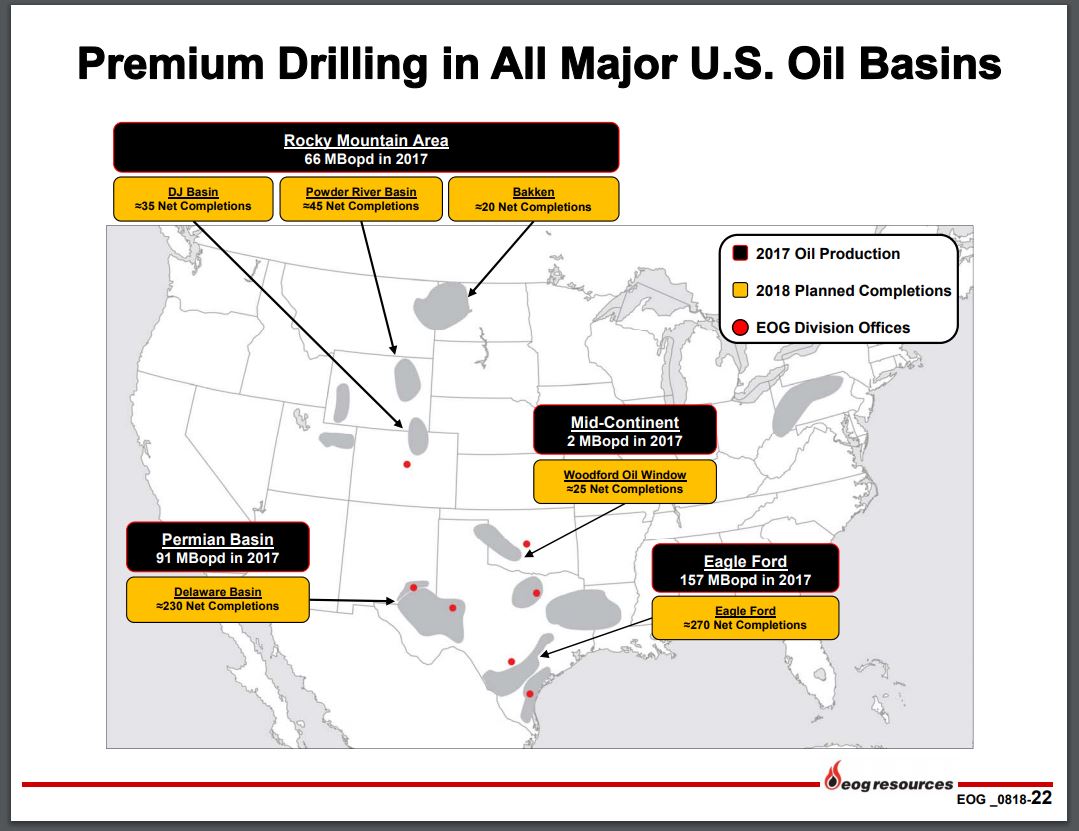

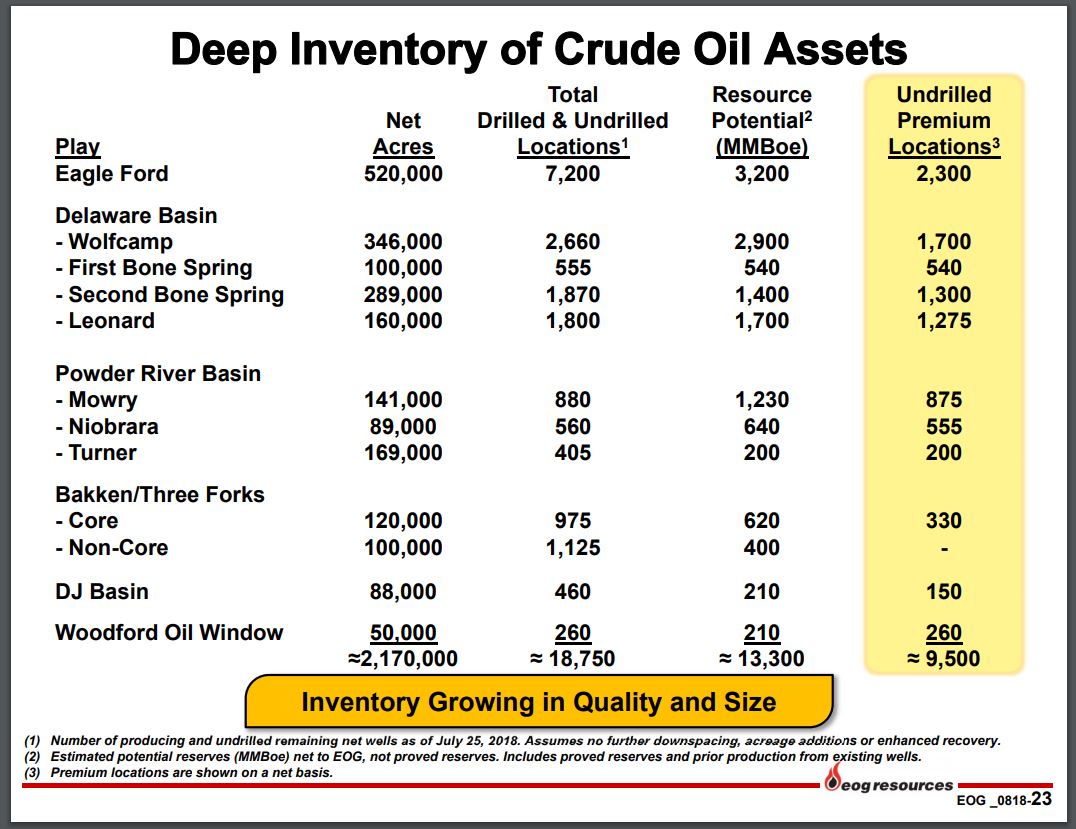

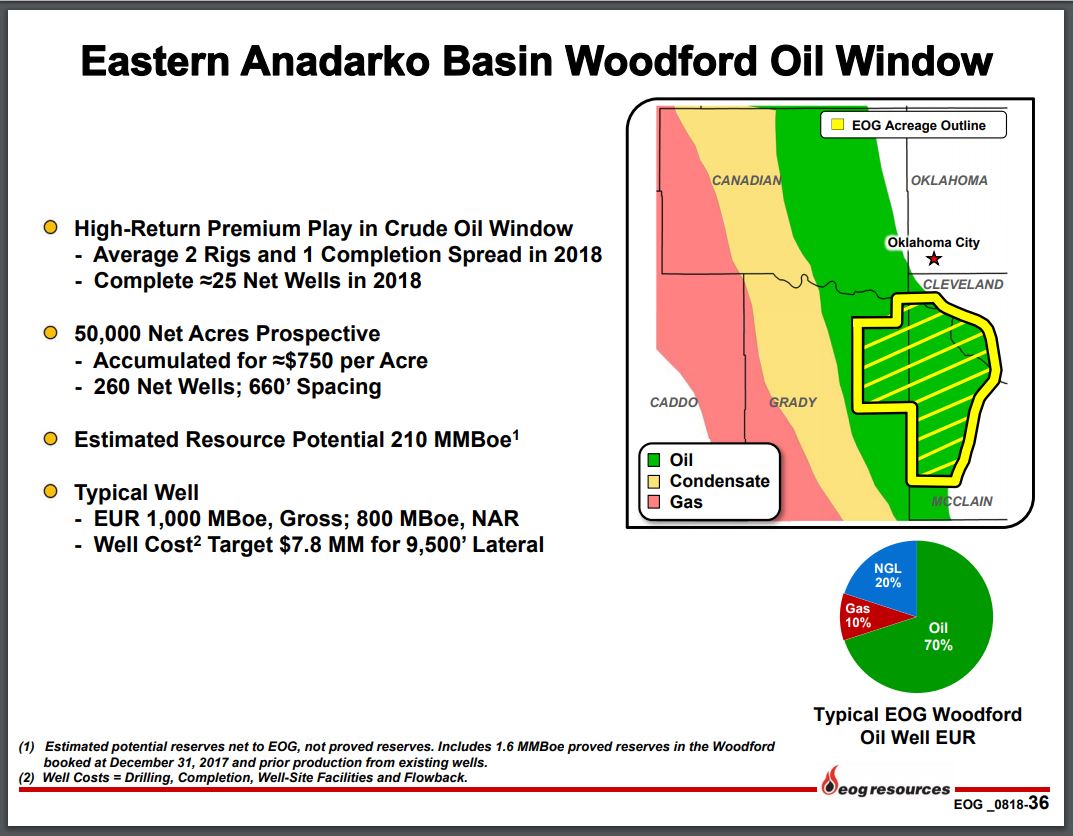

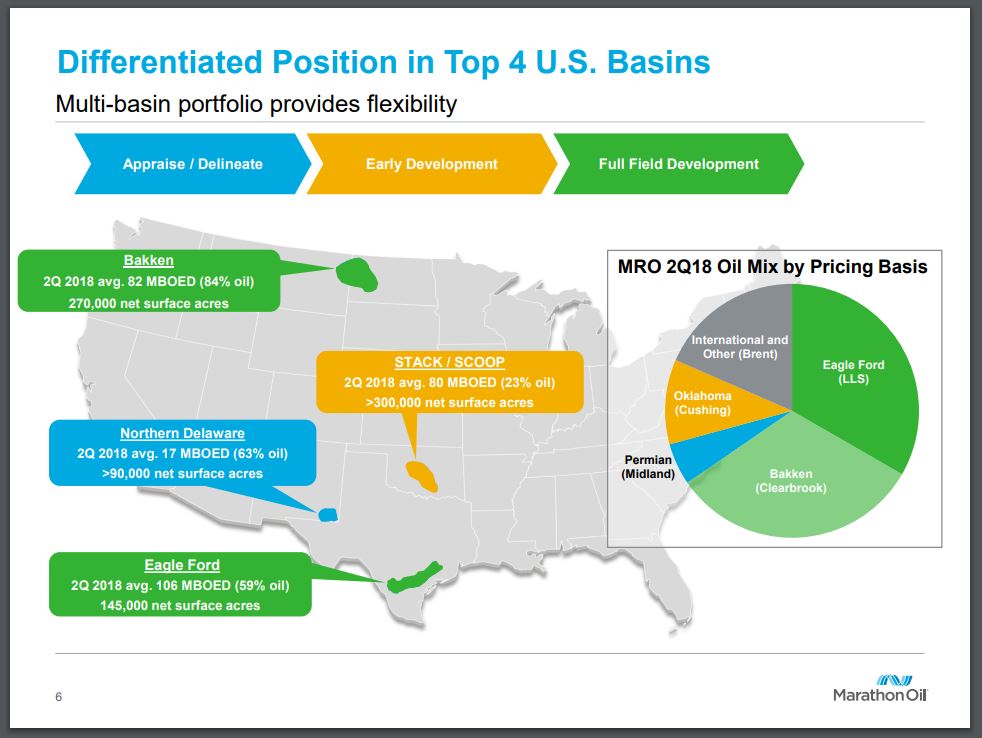

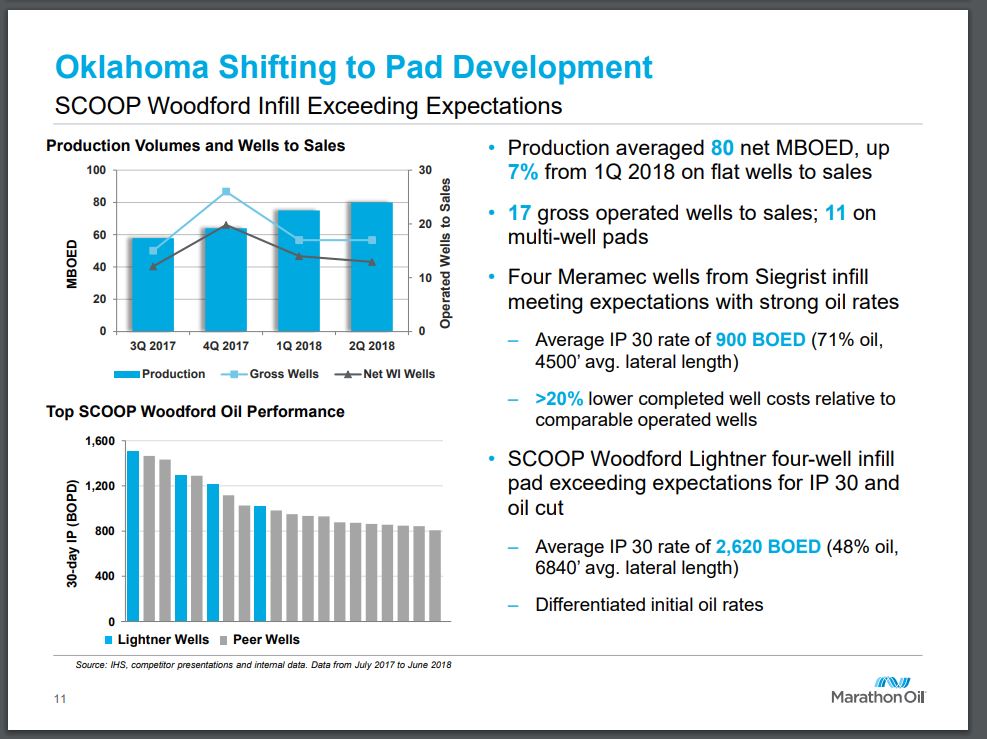

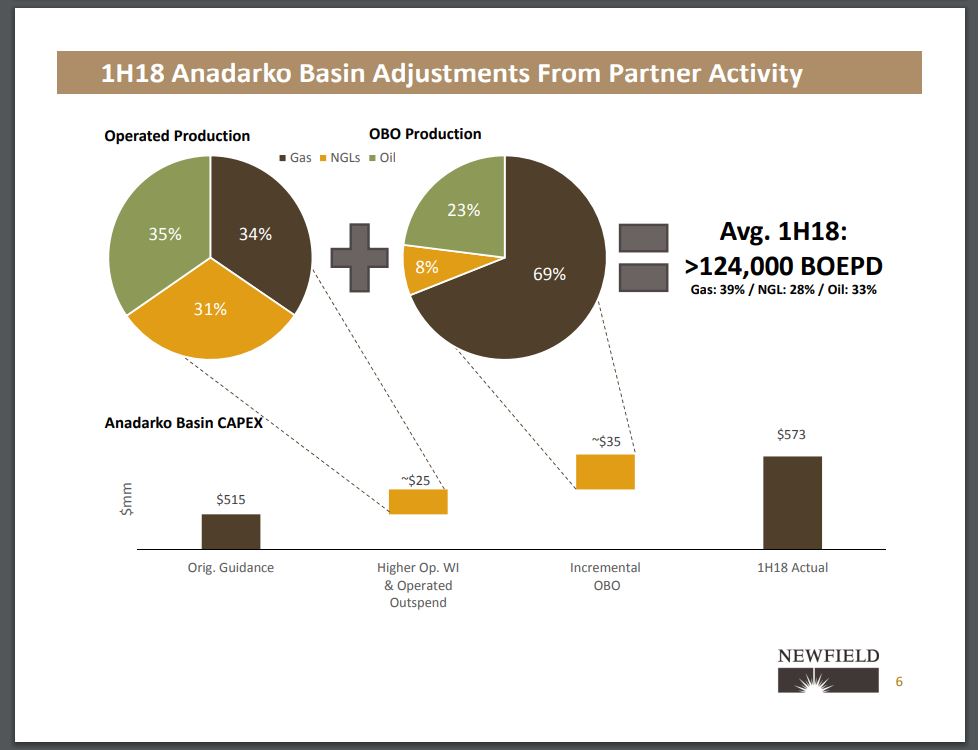

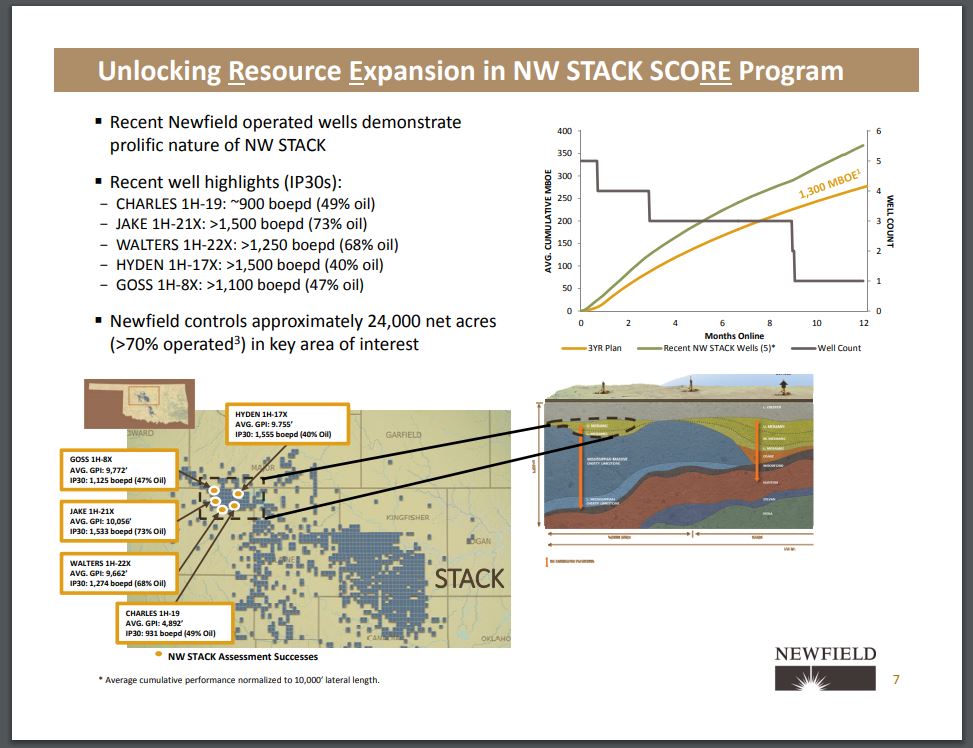

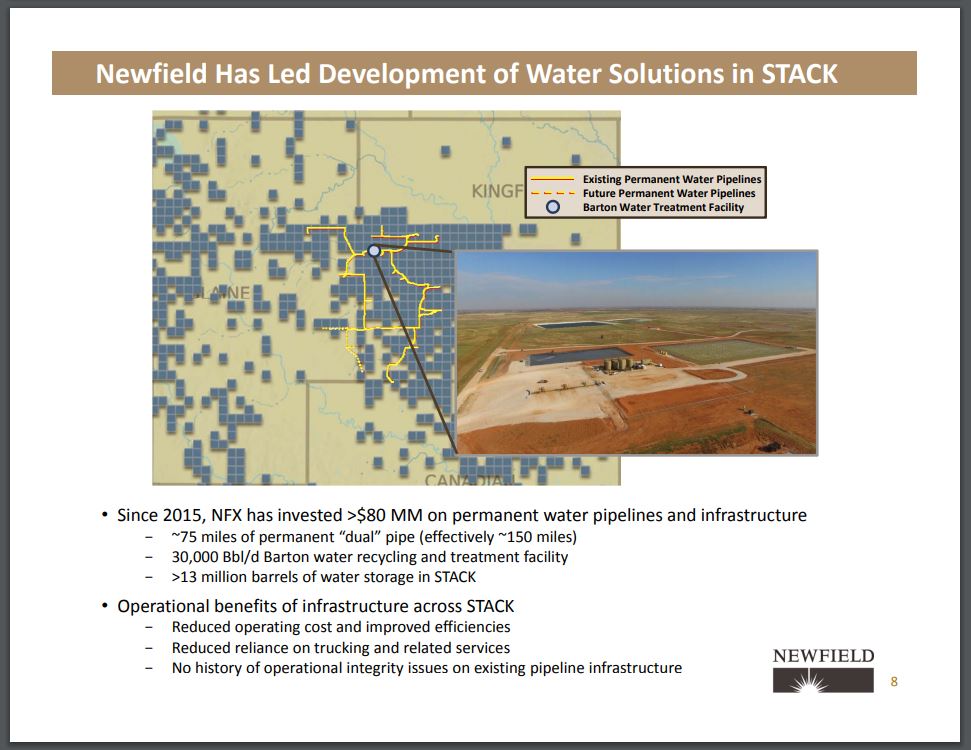

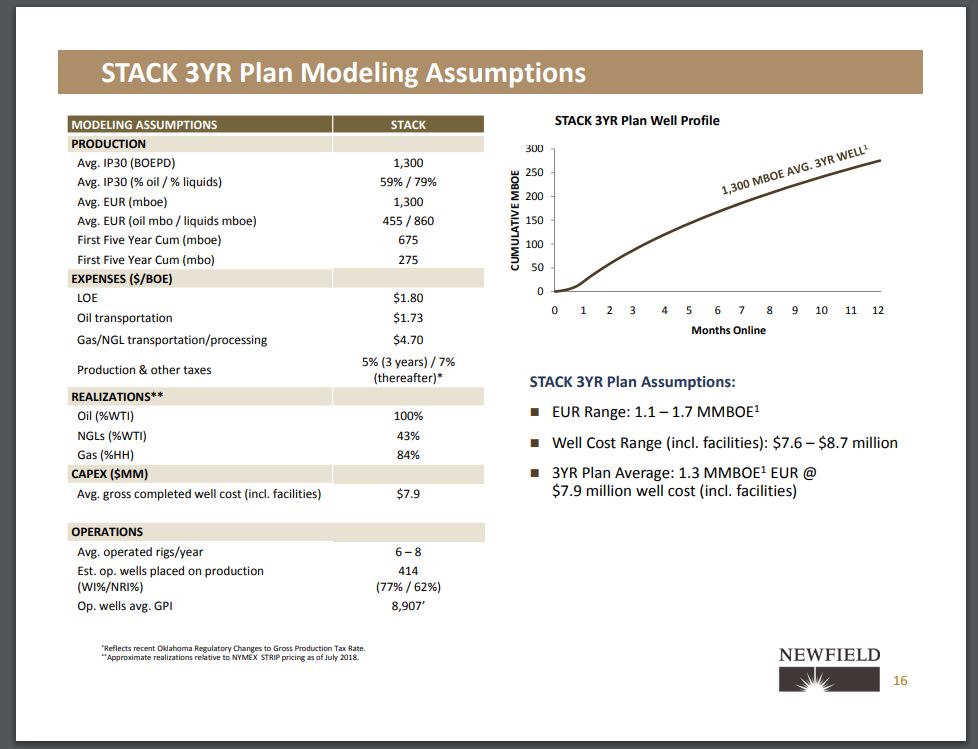

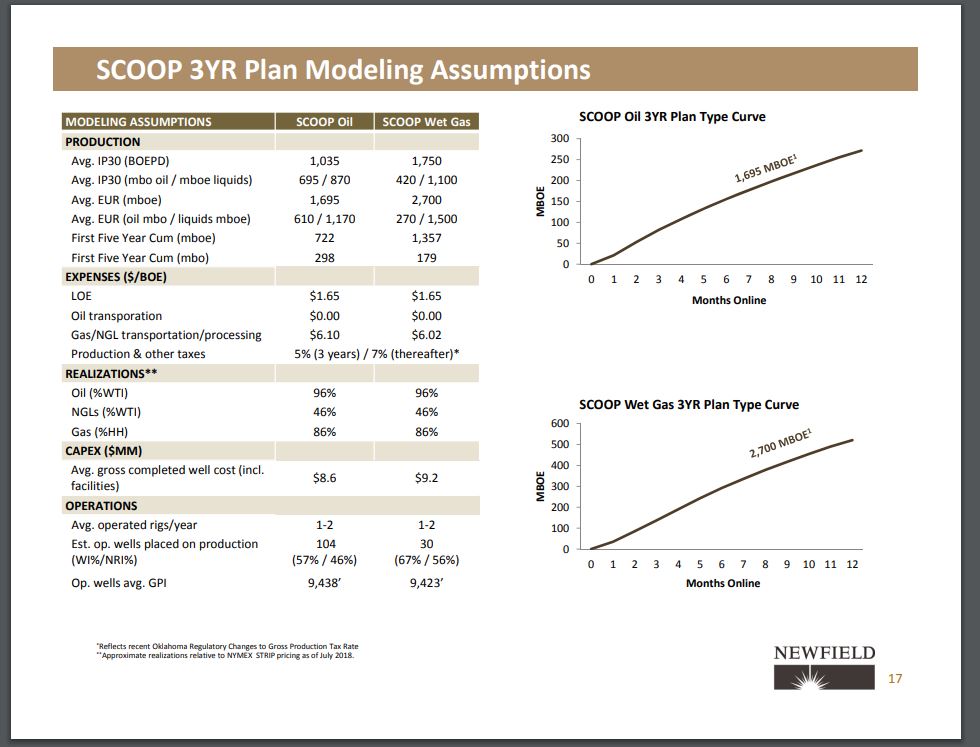

Below is a quick summary of the 2018 2nd Quarter Earnings Presentations for companies who are active in Oklahoma. We are only highlighting the individual pages related to Oklahoma production; for the full report please visit the links provided.

We will update this page as the reports are made public.

Last Update: 08/02/2018

- Alta Mesa Resources

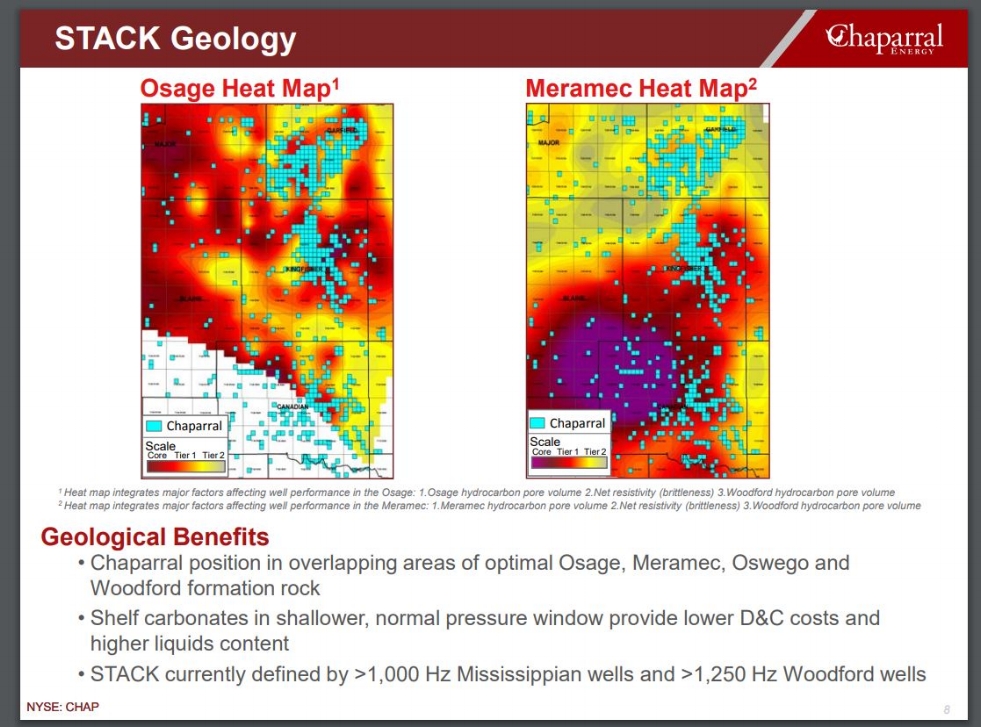

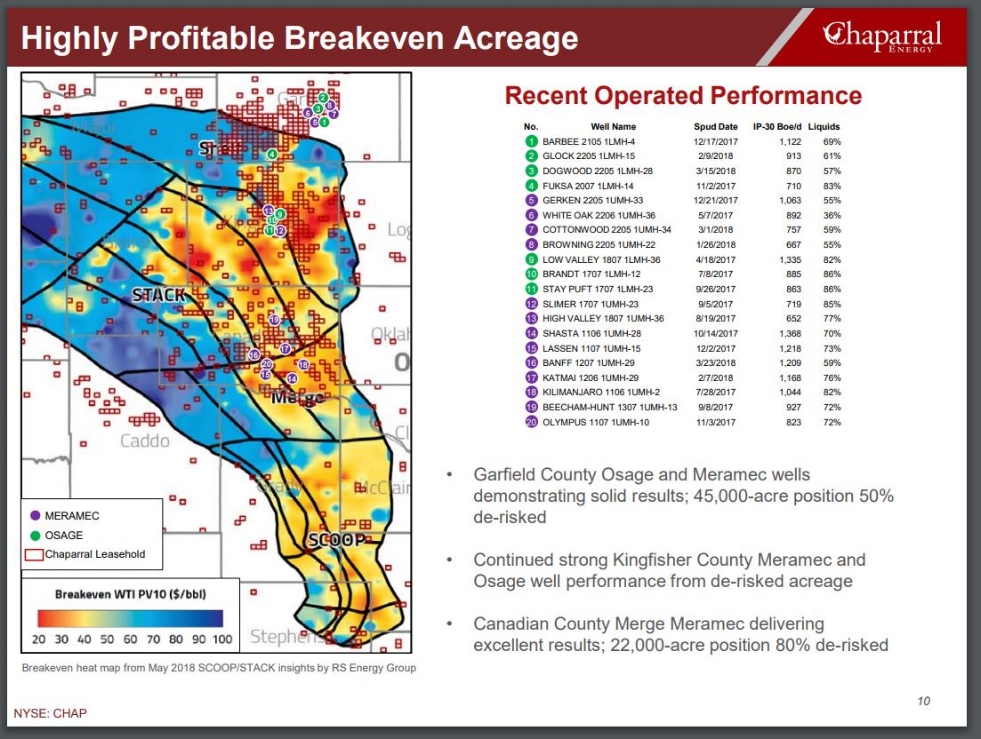

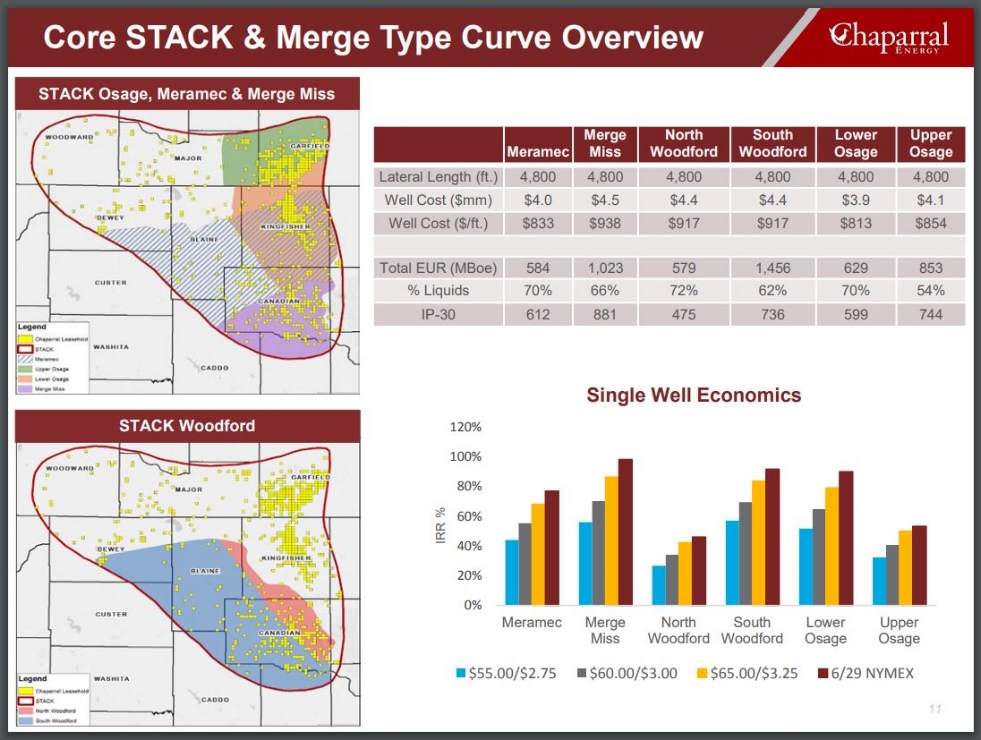

- Chaparral Energy

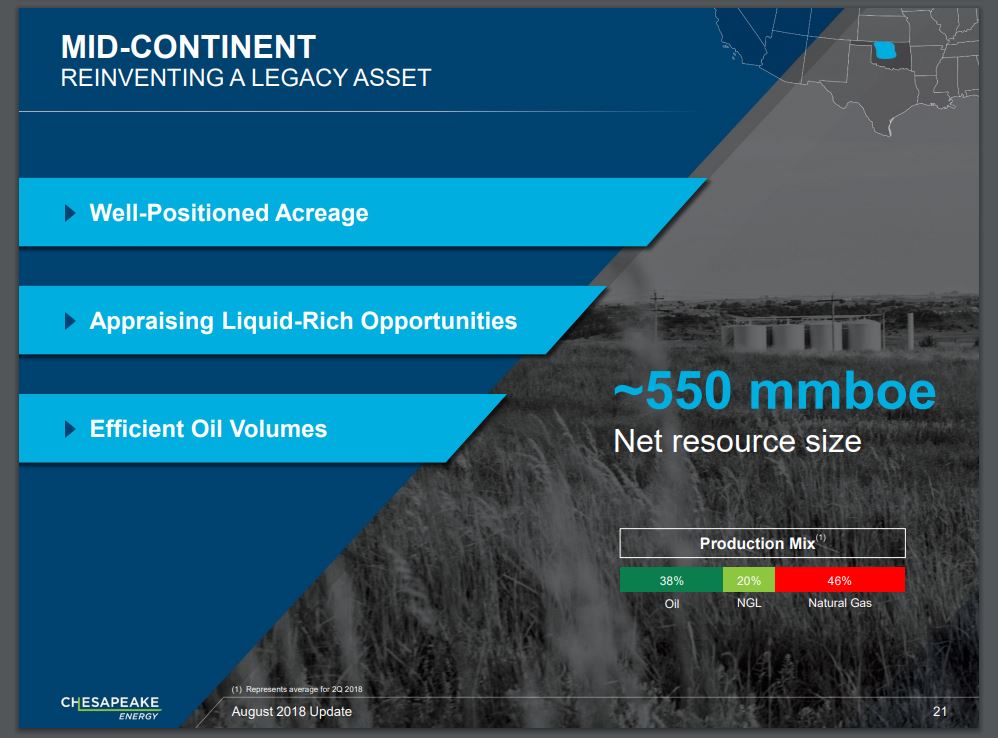

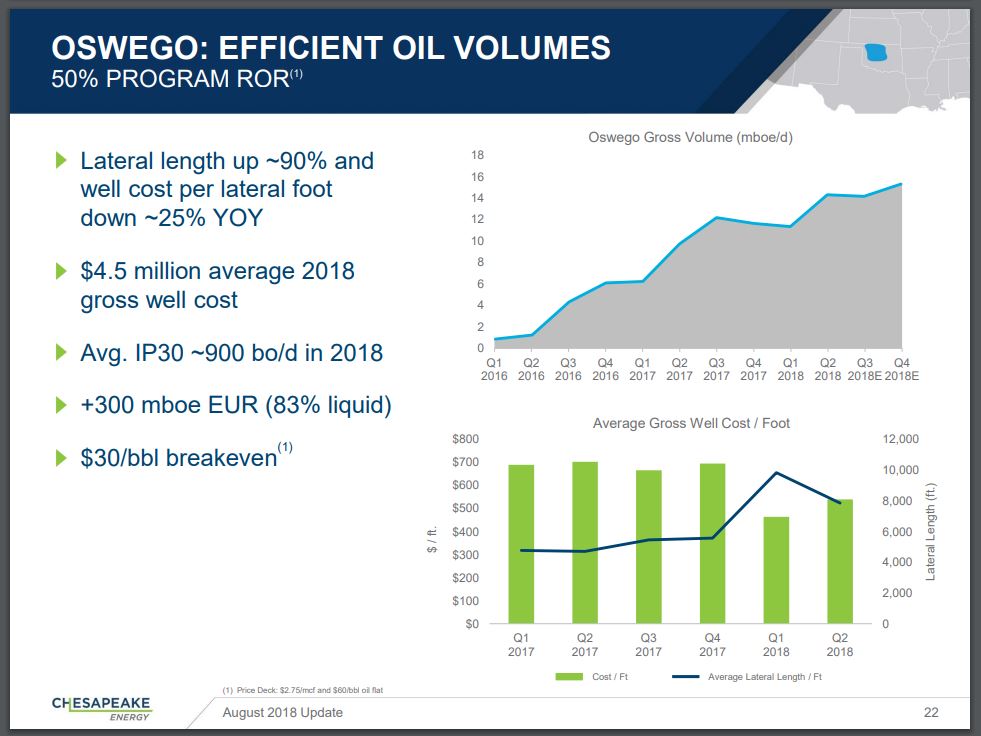

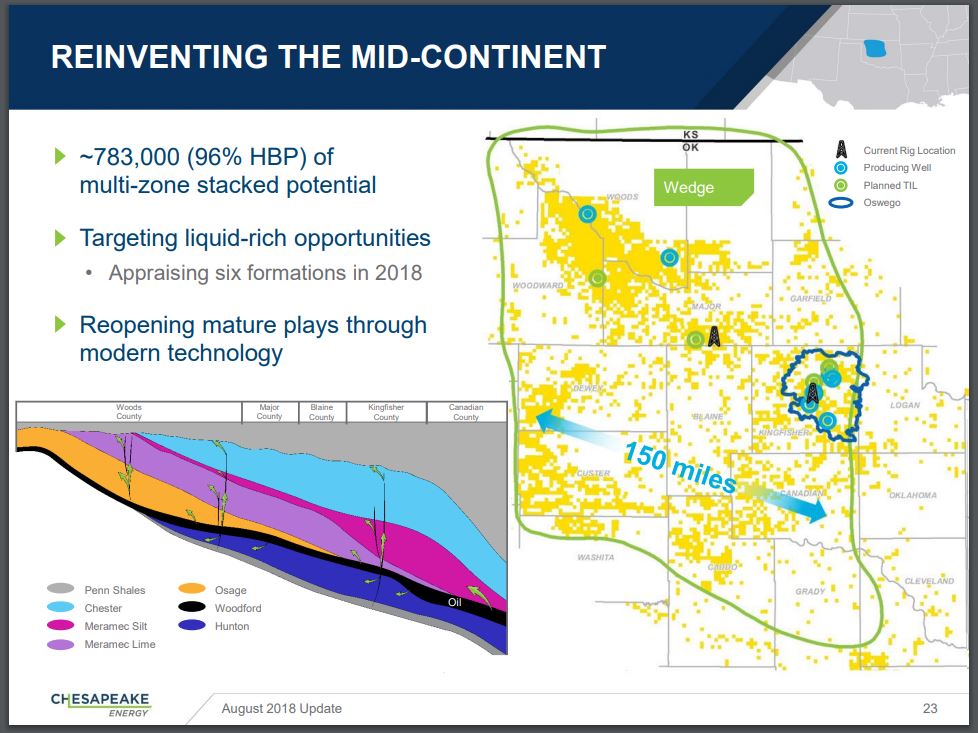

- Chesapeake Energy

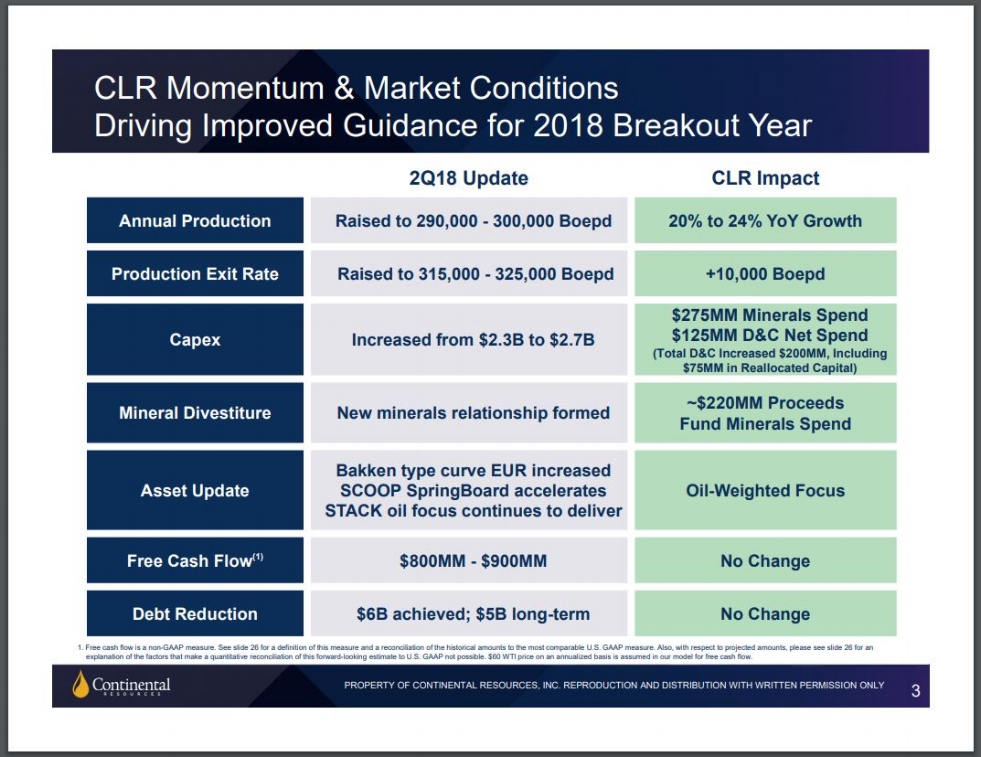

- Continental Resources

- Devon Energy

- EOG Resources

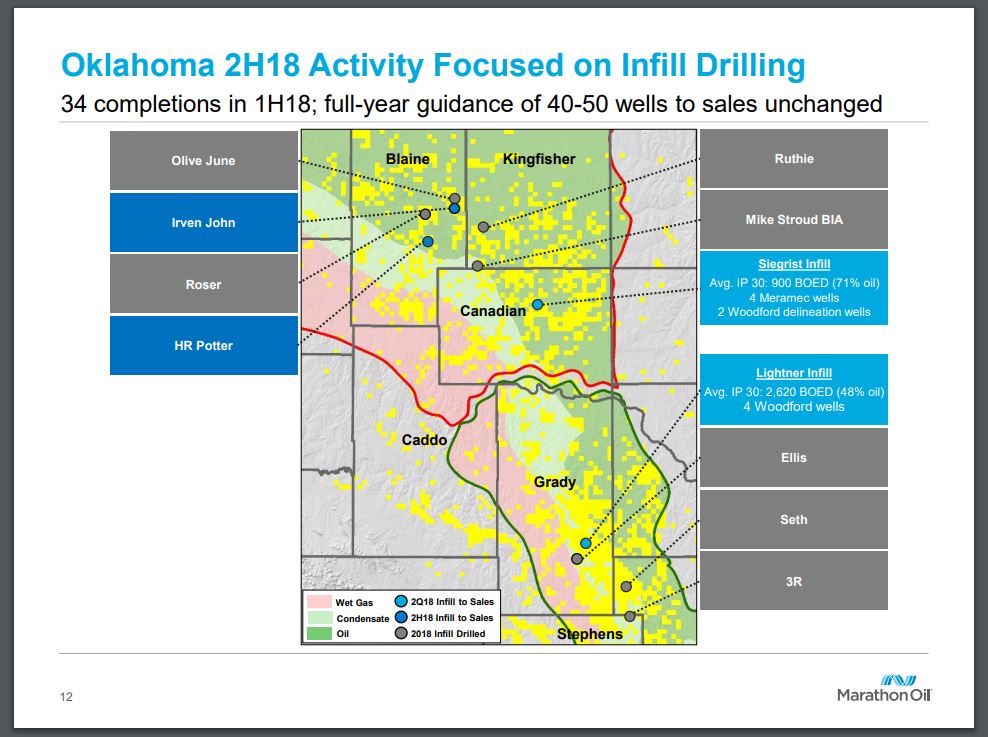

- Marathon Oil

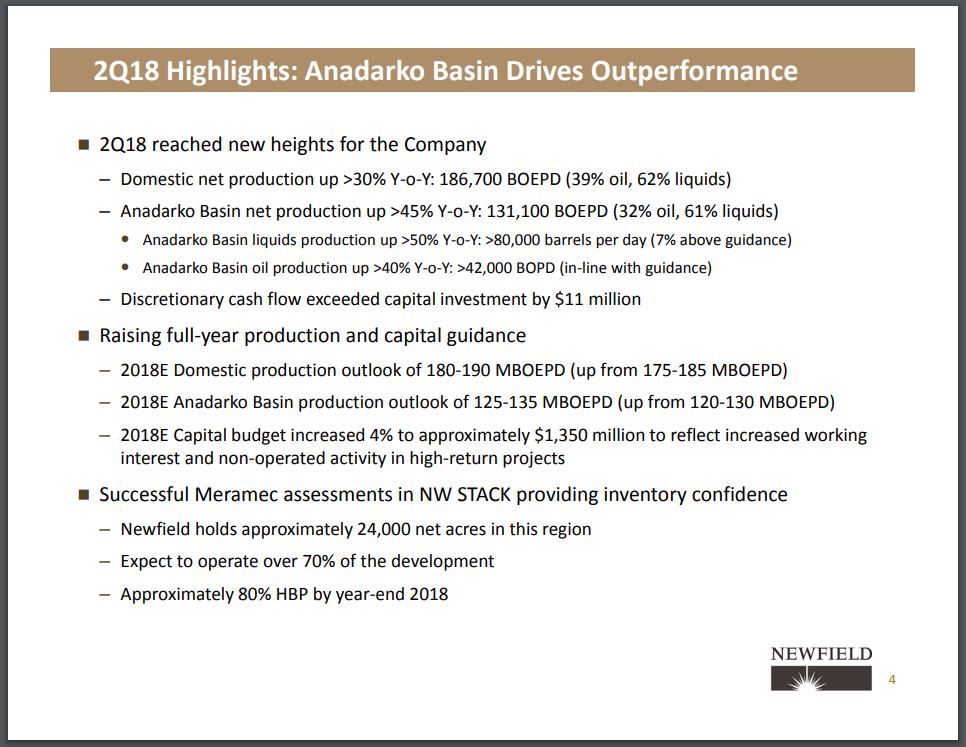

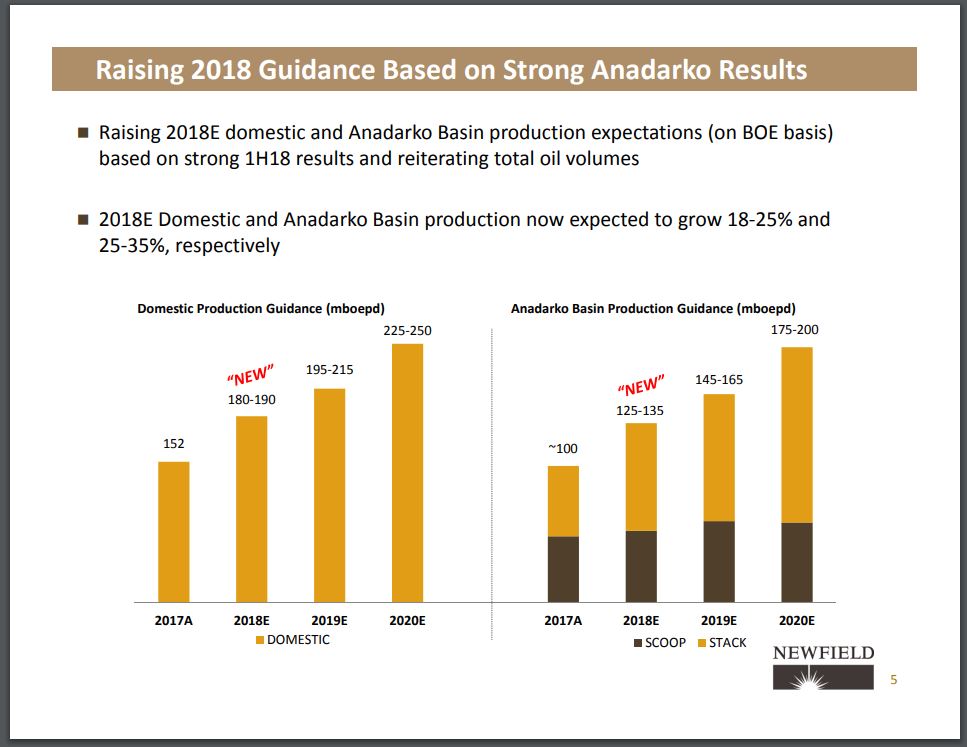

- Newfield Exploration

CONVEY ENERGY CONSULTANTS

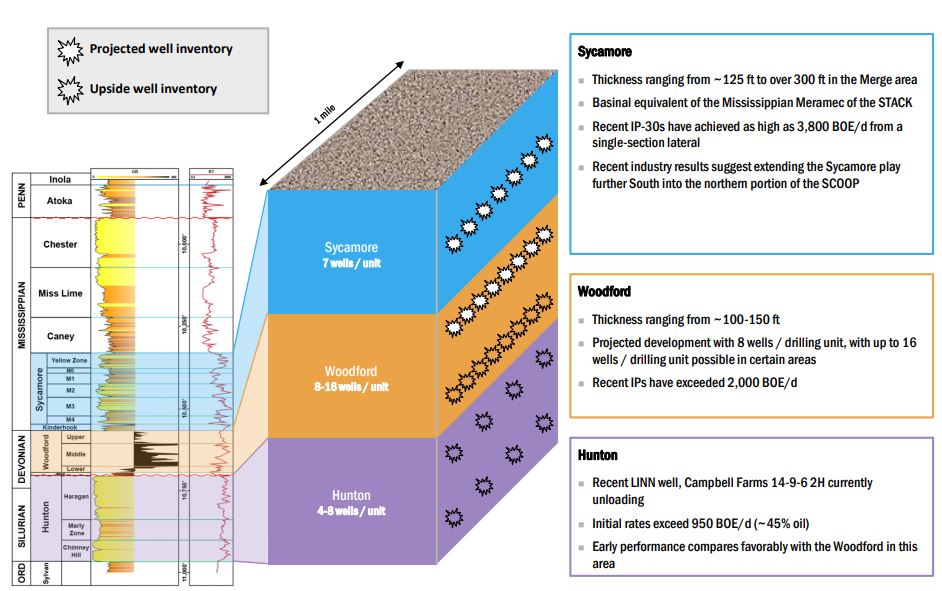

Oklahoma MERGE Play

This week our team attended a luncheon where the MERGE was the focus of discussion. Most are familiar with the SCOOP and STACK due to their media/investor presentation popularity, but the MERGE is still relatively new. In this article we take a brief look at the MERGE using public data to get a better understanding of the new play.

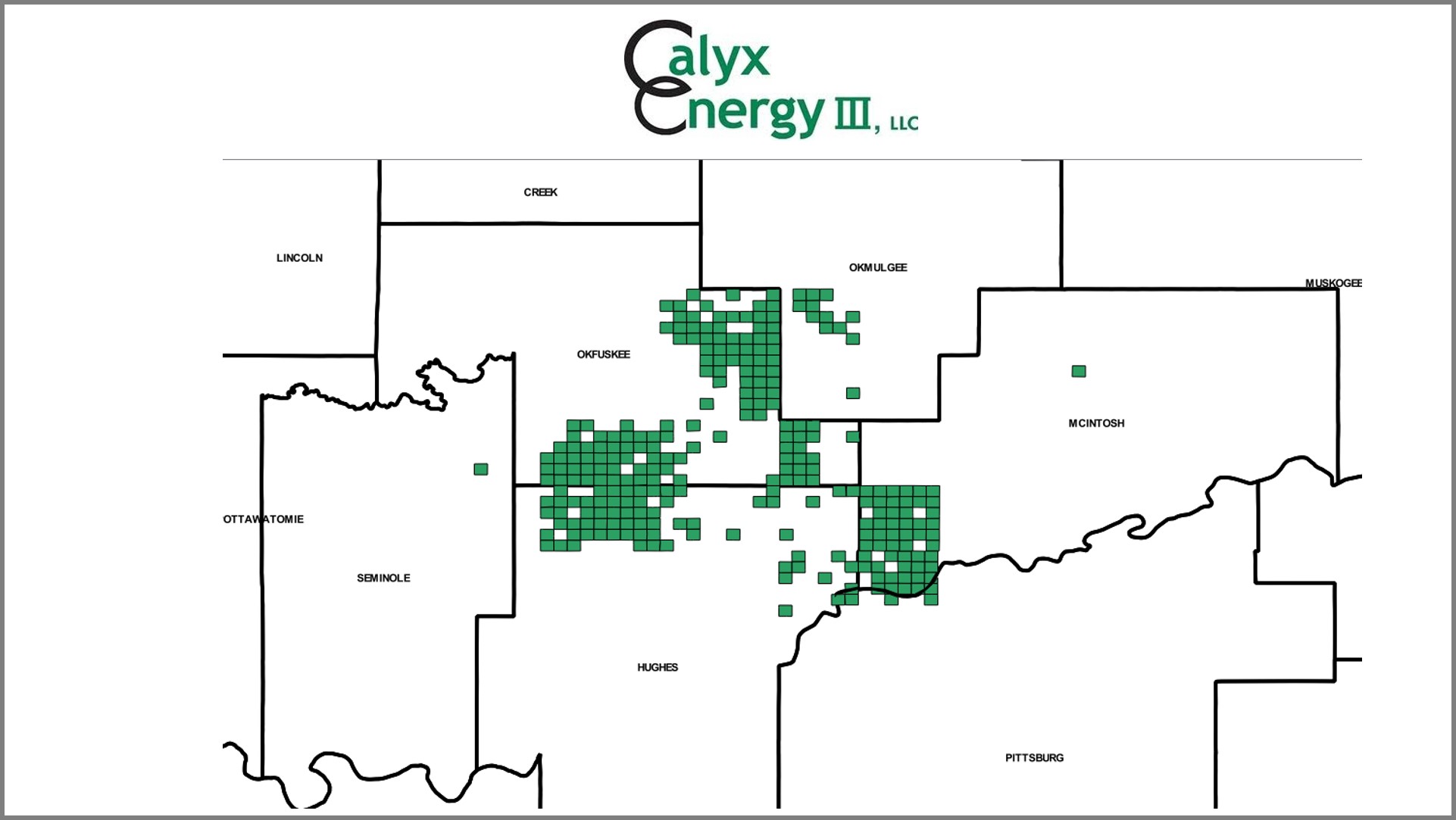

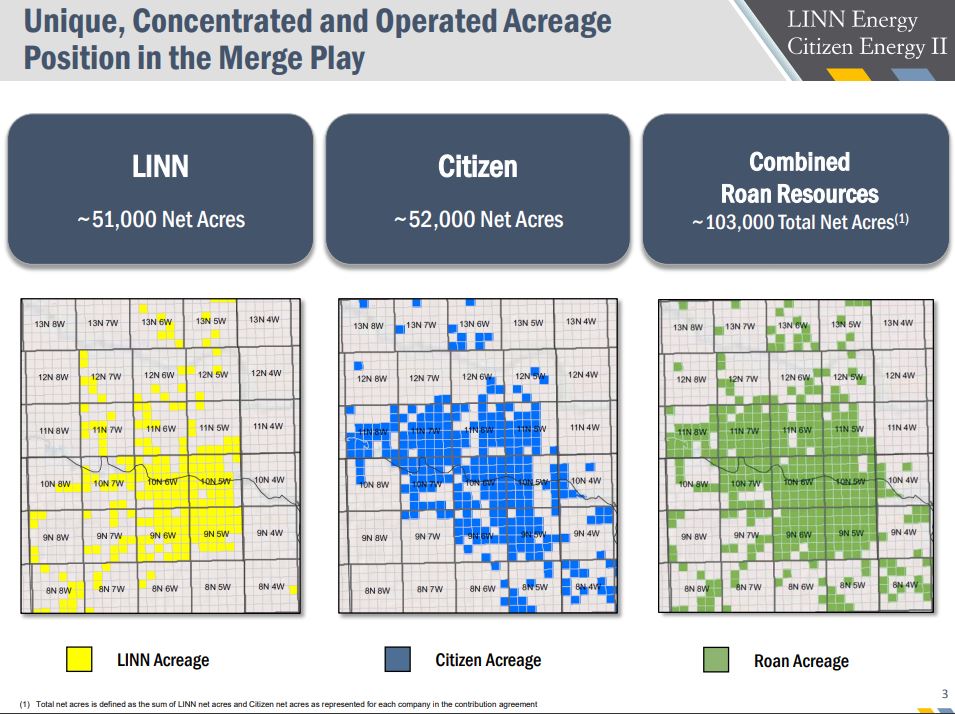

LOCATION

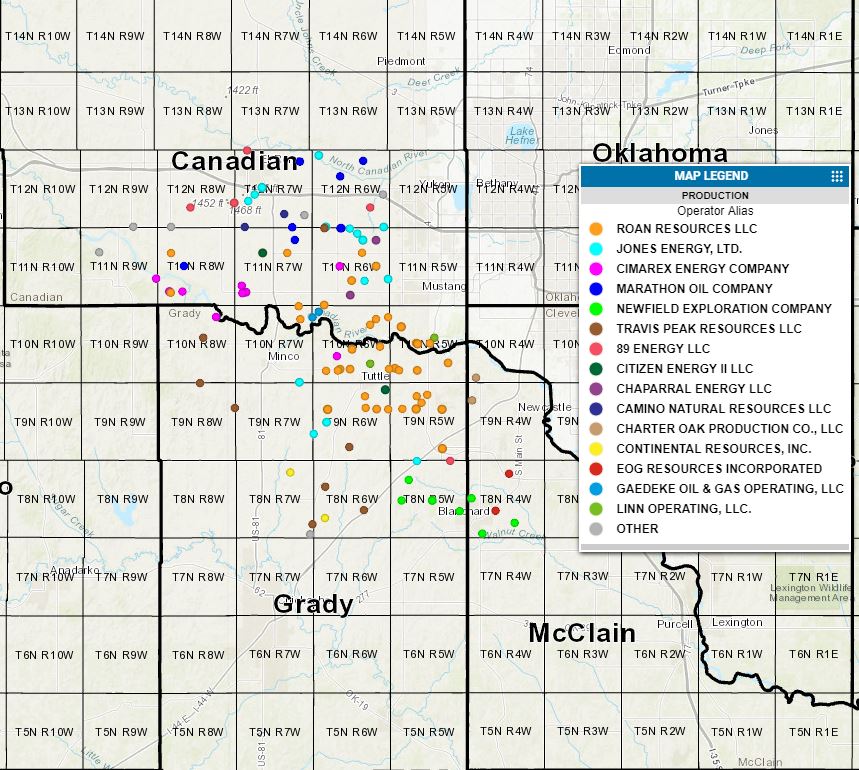

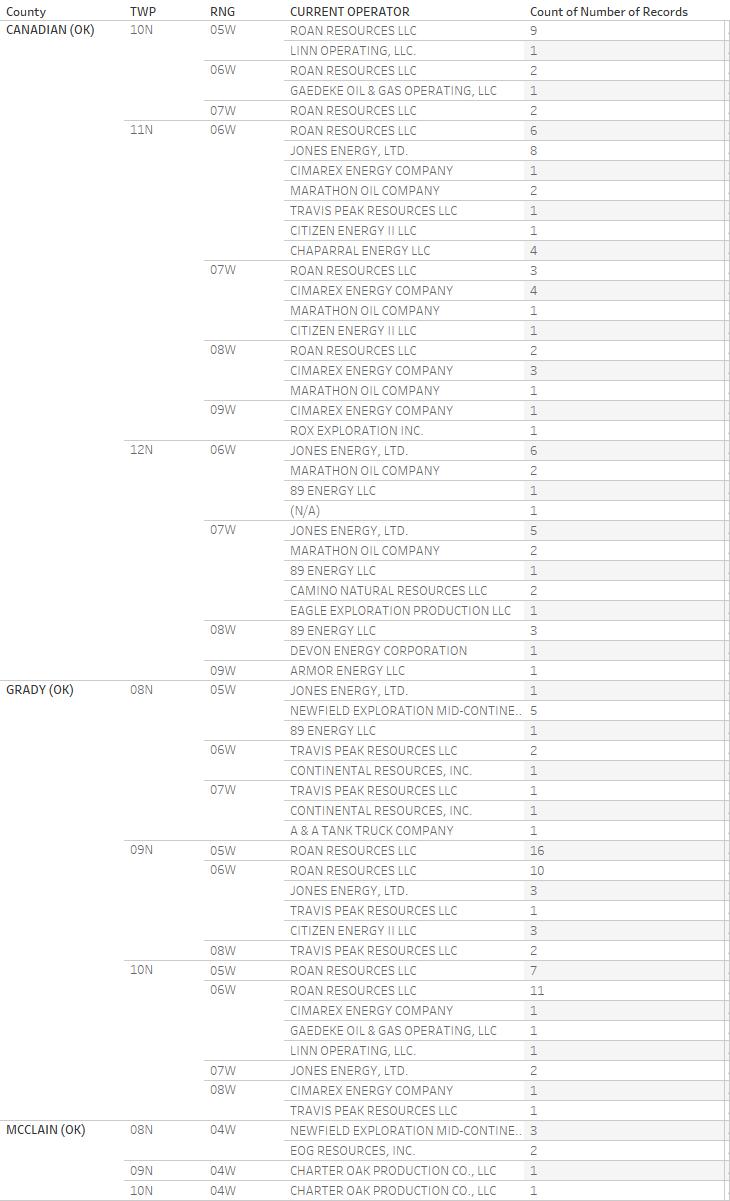

As illustrated above, the MERGE is located between the SCOOP and STACK. For this article we limited our data to Canadian County, Grady County, and McClain County, and filtered to only include the townships between 08N and 12N.

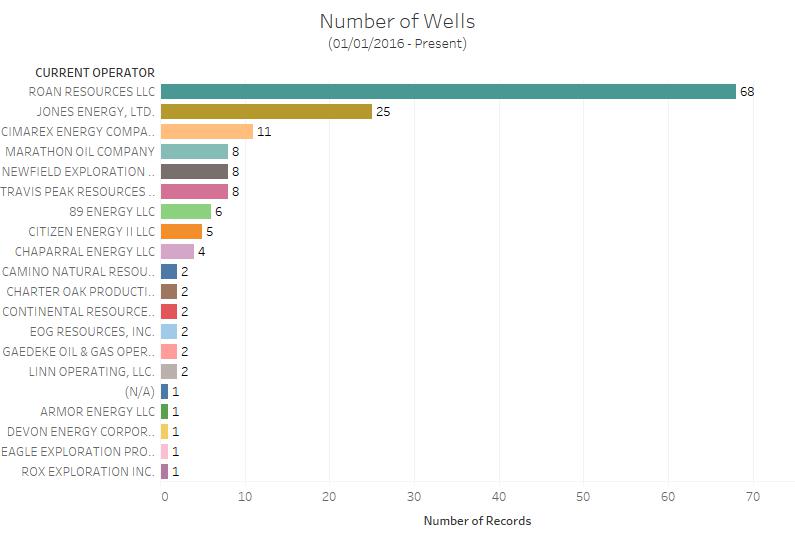

NUMBER OF WELLS

With the recent merger of Linn Energy and Citizen Energy, newly formed Roan Resources has the most number of wells currently, followed by Jones, Cimarex, Marathon, Newfield, and Travis Peak.

WELL RESULTS

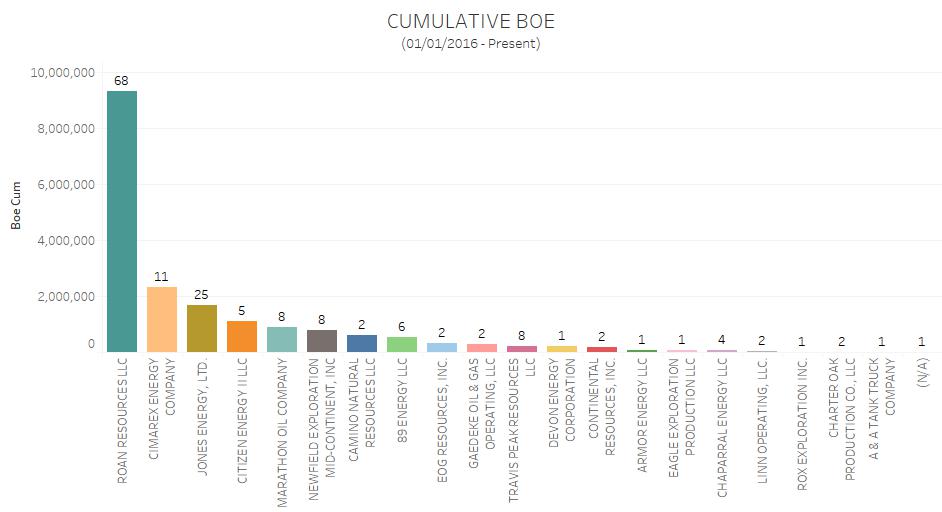

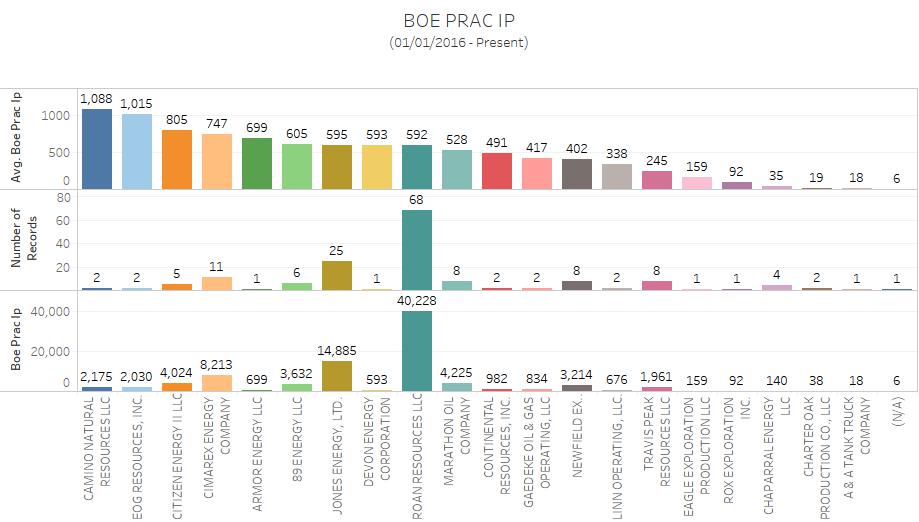

Since our business is focused more on the land side we don’t analyze production numbers in great detail on a regular basis. However, based on what we have experienced first hand and word of mouth, Oklahoma production data is somewhat lacking at times. Therefore, the below charts are based on available data.

Camino Natural Resources has the best Average BOE Prac IP, however those numbers could be skewed a bit since the average is based on 2 wells versus Roan’s average which is based on 68 wells. Roan is leading the way with the total BOE Prac IP with over 40,000; next closest being Jones Energy with 14,000.

FORMATIONS

The majority of the wells are targeting the Woodford, Mississippian, and Hunton Formations.

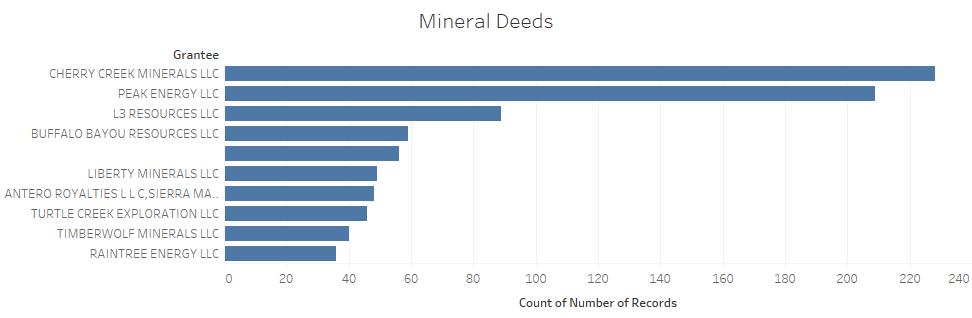

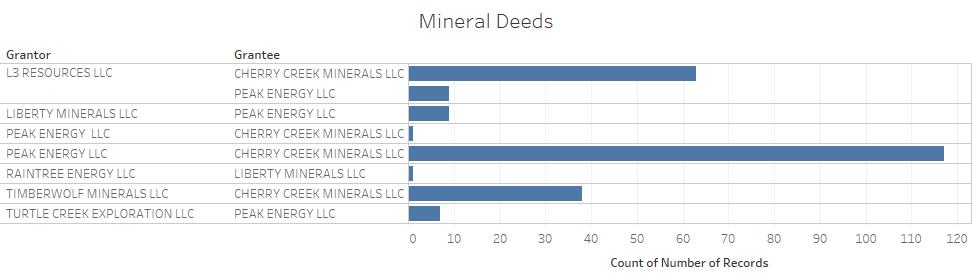

MINERALS and OIL & GAS LEASES

The 1st chart below illustrates the top mineral buyers in the MERGE for 2018. The number of buyers is actually less if you look at the 2nd chart. The 2nd chart takes the top Grantees of the 1st chart and applies them as Grantors. You can see that the majority of mineral buying is by Cherry Creek Minerals, which is related to LongPoint Minerals out of Denver, Colorado.

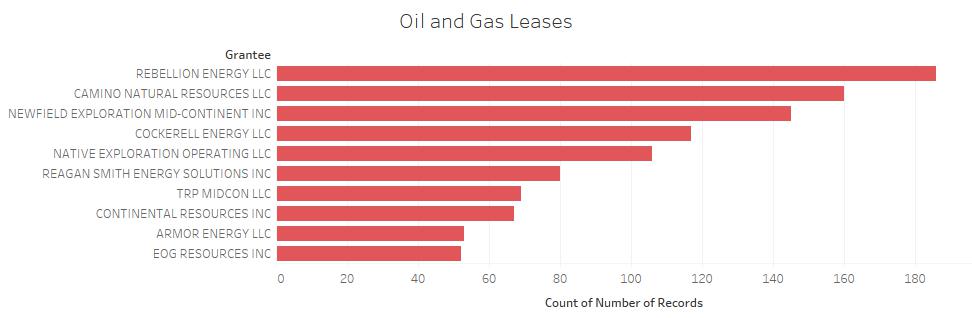

2018 OGL activity is illustrated in the below chart. Rebellion Energy, Camino Natural Resources, Newfield Exploration, Cockerell Energy, and Native Exploration lead the Lessee (Grantee) field.

FUTURE ACTIVITY

For 2018, over 180 permits have been approved in the MERGE. According to the discussion referenced at the beginning, the MERGE has a lot of promising characteristics that favor positive well results. The STACK and SCOOP have been great additions to Oklahoma’s historic oil and gas activity, and it is exciting that another play (and don’t forget the ARKOMA) has the potential to continue Oklahoma’s energy success!

- Sources:

- Production Data: Drillinginfo

- Land Data: County Clerk Records

CONVEY ENERGY CONSULTANTS

Updated: March 14, 2018

Private Equity firms have been pouring money into Oklahoma over the past few years, especially with the emergence of the SCOOP, STACK, and ARKOMA. Listed below are some of the companies and their capital partners, who are active or looking to acquire in Oklahoma/Mid-Continent Region.

EnCap Investments L.P.: Since 1988, EnCap Investments has been the leading provider of venture capital to the independent sector of the U.S. oil and gas industry.

Riverstone LLC: Riverstone is an energy and power-focused private investment firm founded in 2000 by David M. Leuschen and Pierre F. Lapeyre, Jr. with $38 billion of capital raised.

Energy & Minerals Group: The Energy & Minerals Group (EMG) is a private investment firm with Regulatory Assets Under Management (“RAUM”) of $14.1 billion.

Kayne Anderson: Kayne Anderson Capital Advisors, L.P., is a leading alternative investment firm that manages investments across multiple asset classes including energy, real estate, credit and specialty growth capital.

Natural Gas Partners: Founded in 1988, NGP has a family of private equity investment funds with approximately $17 billion of cumulative equity commitments organized to make direct equity investments in the energy sector.

Post Oak Energy Capital: Post Oak Energy Capital is a private investment firm based in Houston, Texas. Post Oak’s principals have significant operating experience managing businesses engaged in various segments of the energy industry.

Quantum Energy Partners: Founded in 1998, Quantum Energy Partners is a leading provider of private equity capital to the global energy industry.

TPH Partners: TPH Partners is a Houston-based energy private equity group that makes middle-market equity investments in the upstream, midstream and oilfield services sectors of the energy industry, seeking attractive entry points into businesses that provide long-term growth potential.

Apollo Global Management LLC: Apollo and its subsidiaries (“Apollo”) is a leading global alternative investment manager. We are contrarian, value-oriented investors in private equity, credit and real estate, with significant distressed expertise.

White Deer Energy: White Deer Energy is a private equity firm that targets investments in oil and gas exploration and production, oilfield service and equipment manufacturing and the midstream sectors of the energy business.

Vortus Investments: Vortus is a Fort Worth-based private equity firm focused on generating long-term capital gains through investments in the lower/middle market upstream energy industry in North America.

Bayou City Energy: Bayou City Energy (“BCE”) is an upstream-focused energy private equity firm based in Houston, Texas. BCE focuses on lower middle-market investments between $5 and $50 million in the North American upstream.

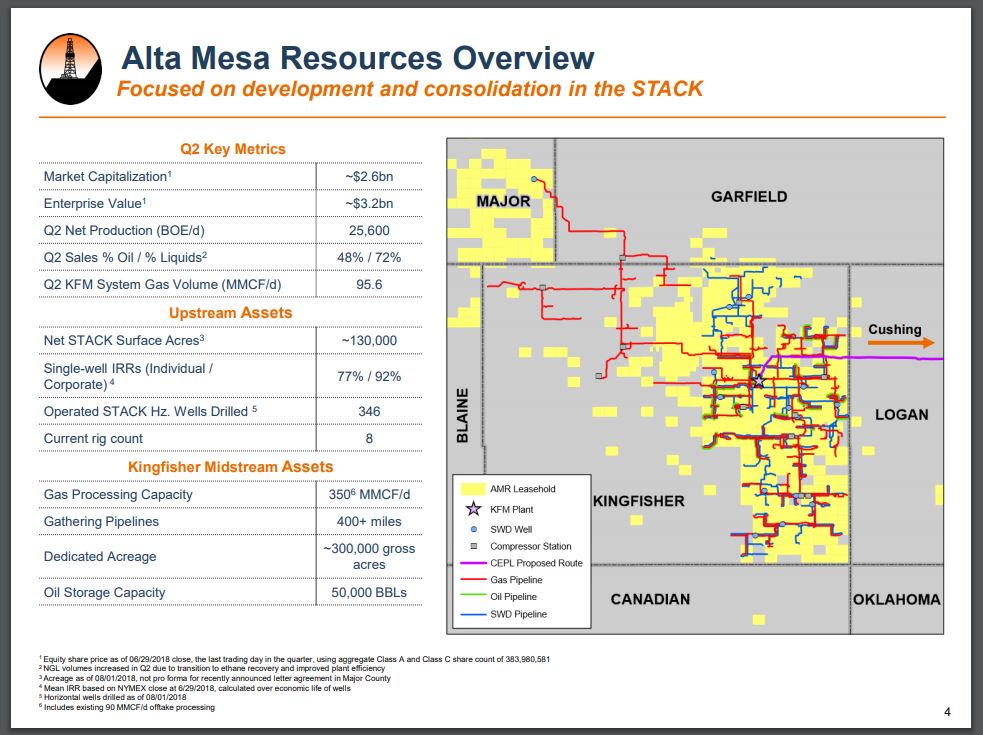

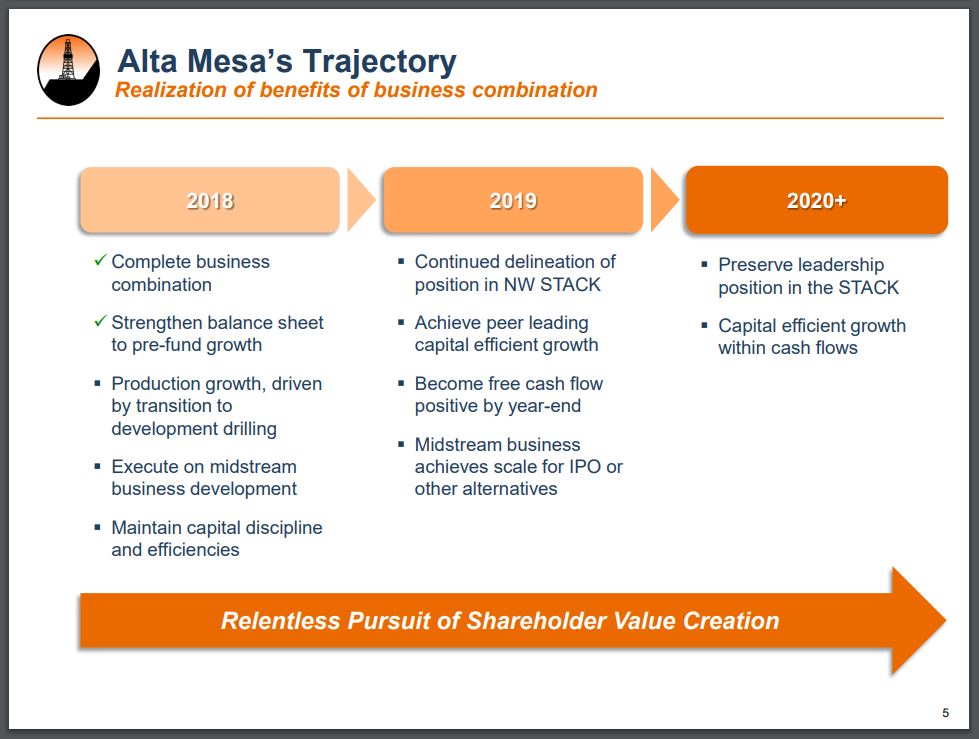

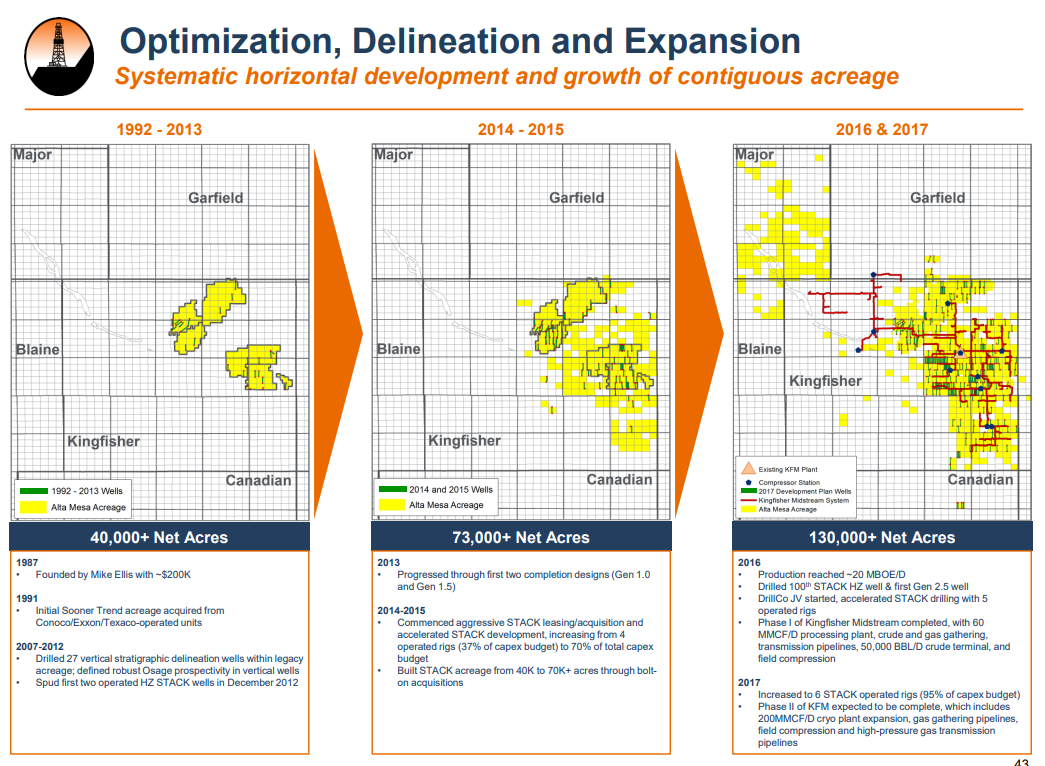

Silver Run II recently merged with Alta Mesa and Kingfisher Midstream to form a pure-play STACK company, Alta Mesa Resources, Inc. Darren Barbee, a senior Editor with Hart Energy published a great overview at Oil & Gas Investor (Click link for full article.)

Let’s take a quick look at the land side of the merger and Alta Mesa’s assets.

Alta Mesa (operating under Oklahoma Energy Acquitions) primarily focuses on the eastern side of Kingfisher County, OK. This map shows where the company has acquired leases over the past few years (not including assignments). Source: Drillinginfo

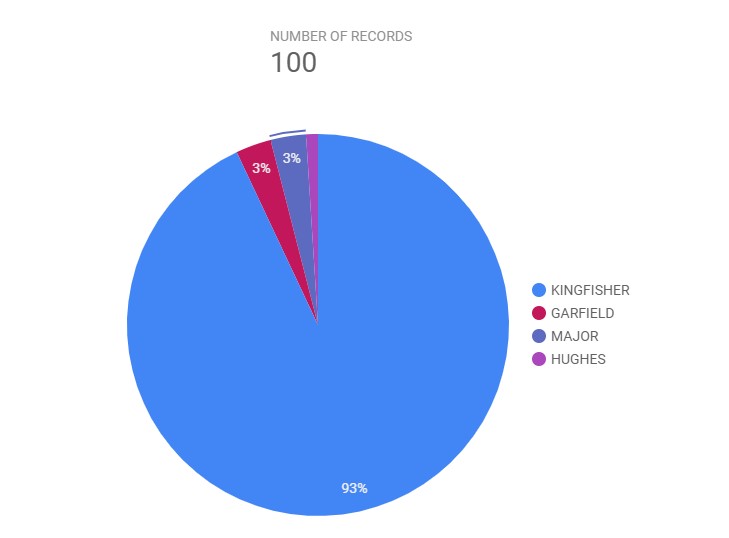

From January 1, 2017 to February 10, 2018, Oklahoma Energy Acquisitions has had 100 permits approved. As with their leasing, the permits are almost entirely located in Kingfisher County, OK.

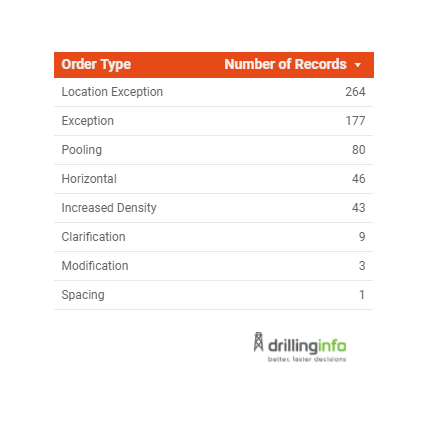

The below chart illustrates Oklahoma Corporation Commission applications for the same time period.

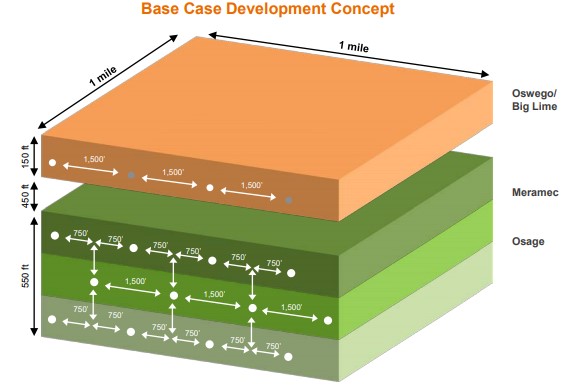

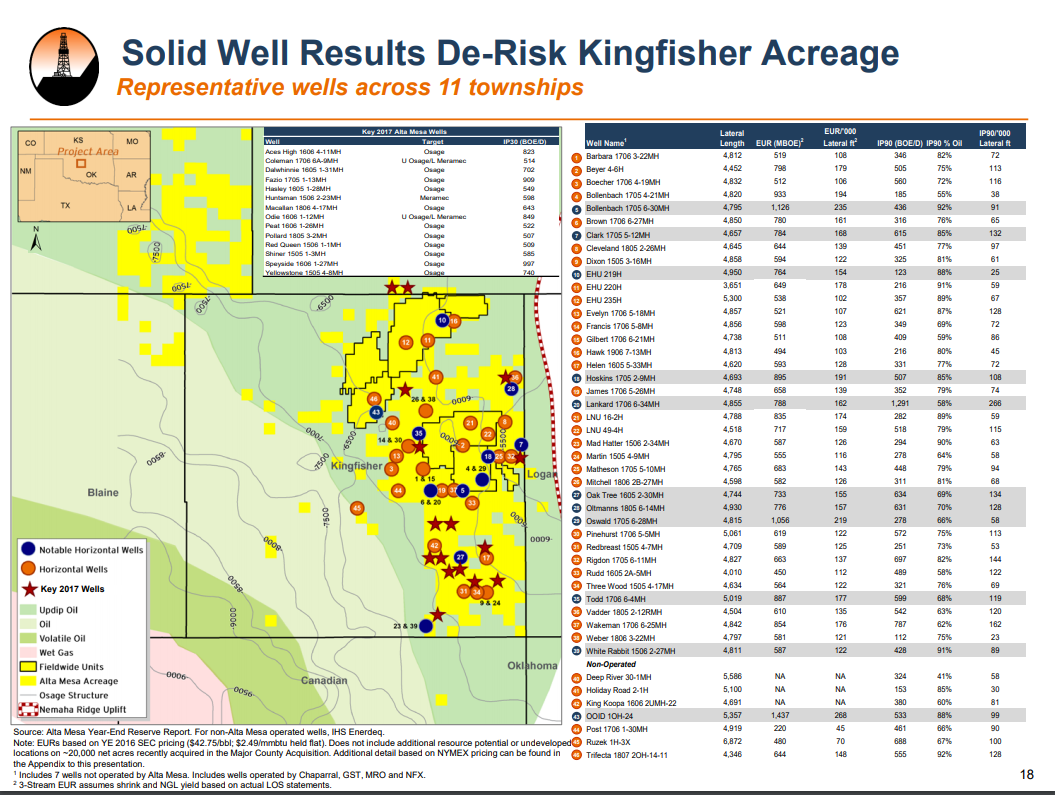

Alta Mesa likes to target the Oswego, Meramec and Osage Formations, where they lead the way in the number of STACK Wells operated by public companies, targeting these specific formations.

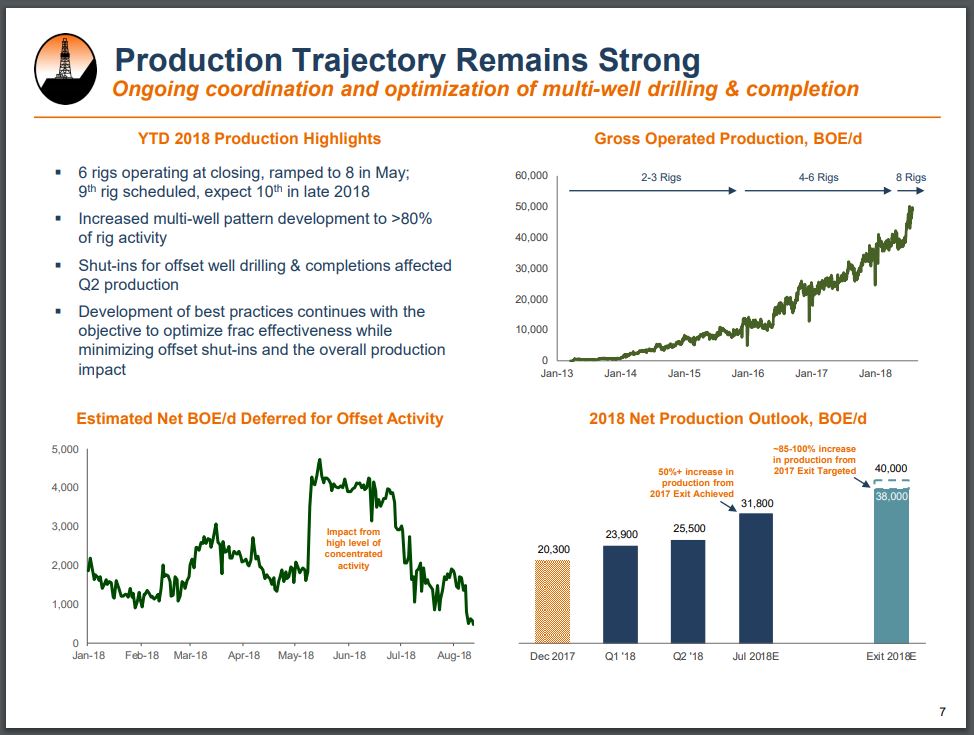

Alta Mesa’s current STACK Surface Acres covers 130,000 acres with a current production rate of 22,300 BOE/D. Alta Mesa has a $30 $/BBL WTI Breakeven price, with single-well IRR greater than 80%, positioning them as a low cost operator.

Alta Mesa Resources has an implied firm value of $3.8 Billion, at $10/share. As an earlier entrant into the STACK play (before it was named the STACK), Alta Mesa has been able to build their position over time and delineate and develop the region.

Under the leadership of Hal Chappelle, Alta Mesa Resources is positioning itself for long term success in the world class STACK play.

Convey Energy Consultants

2017 Permits