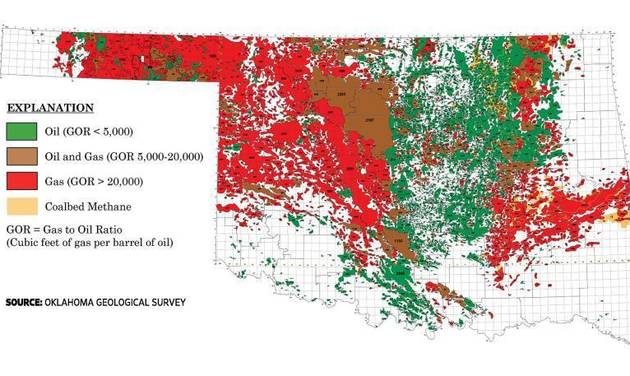

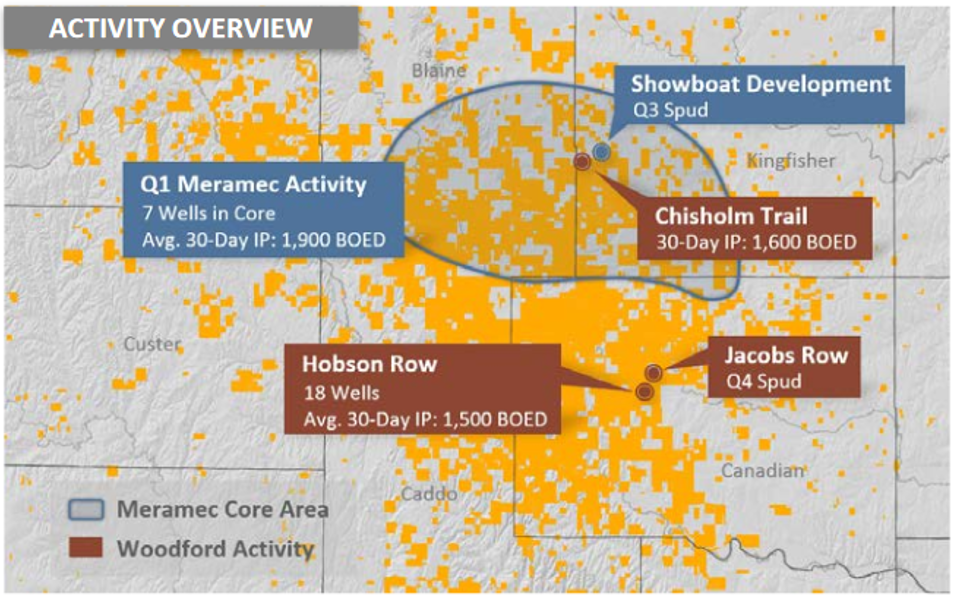

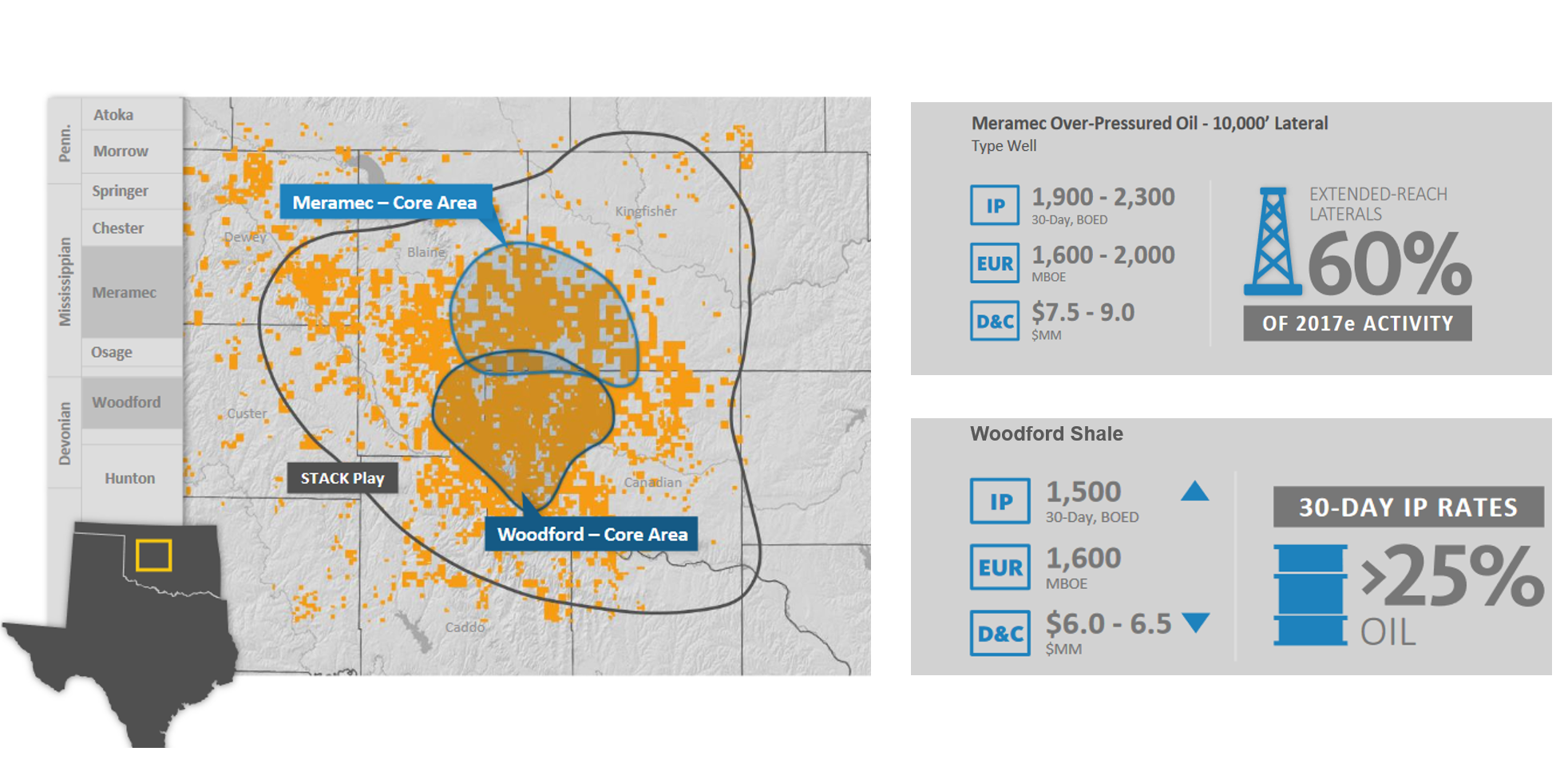

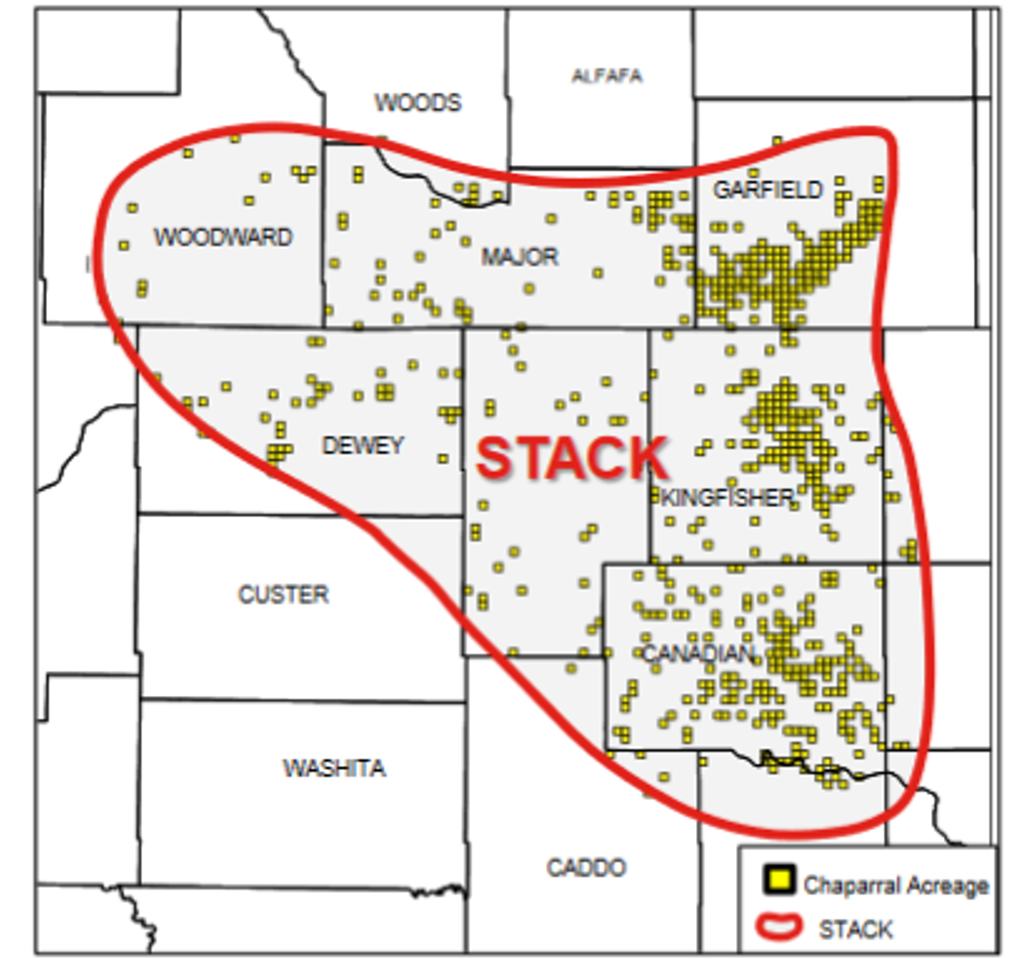

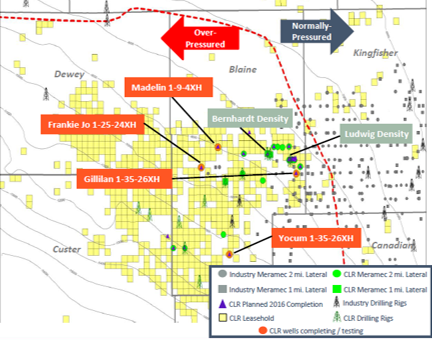

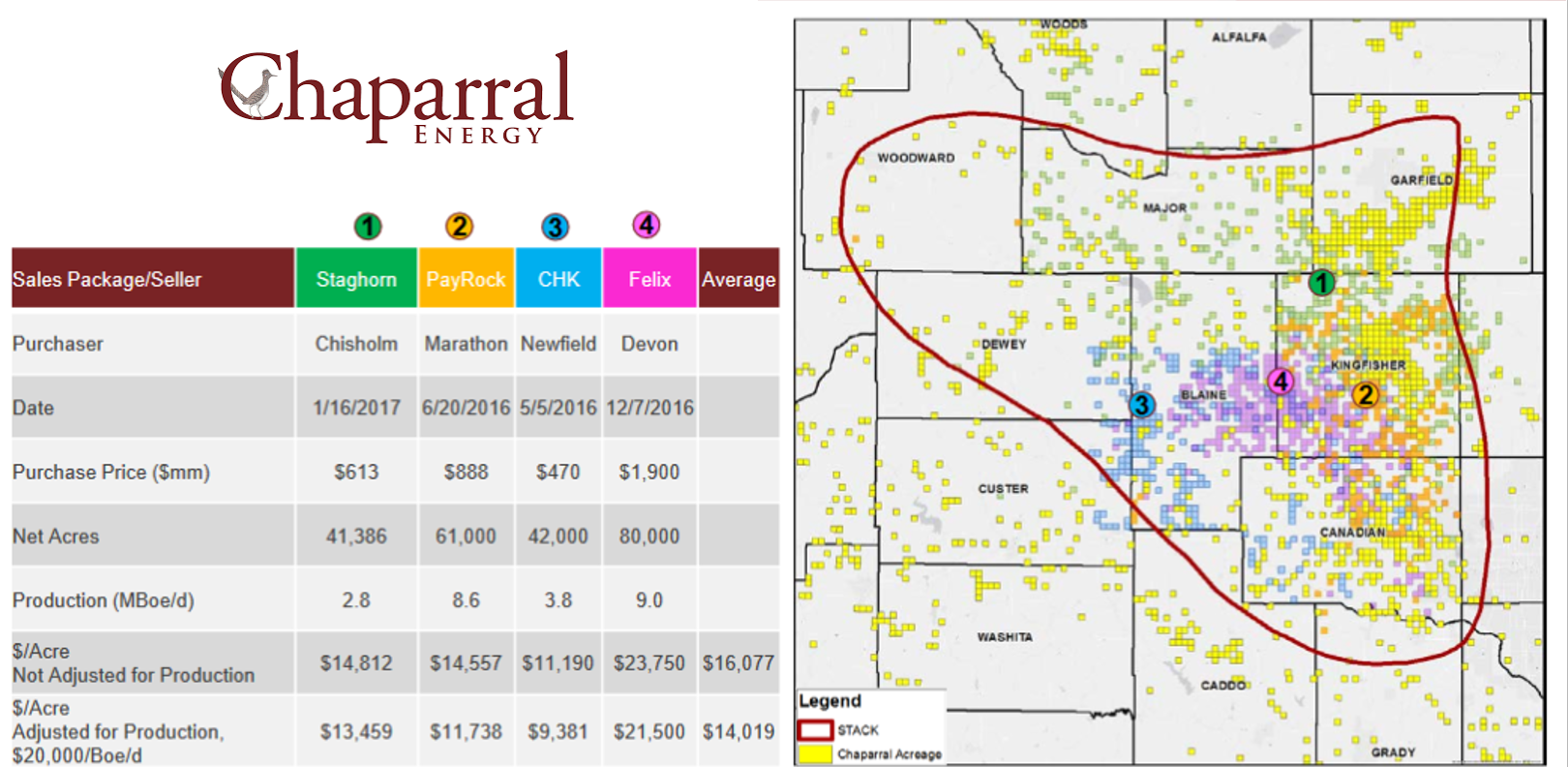

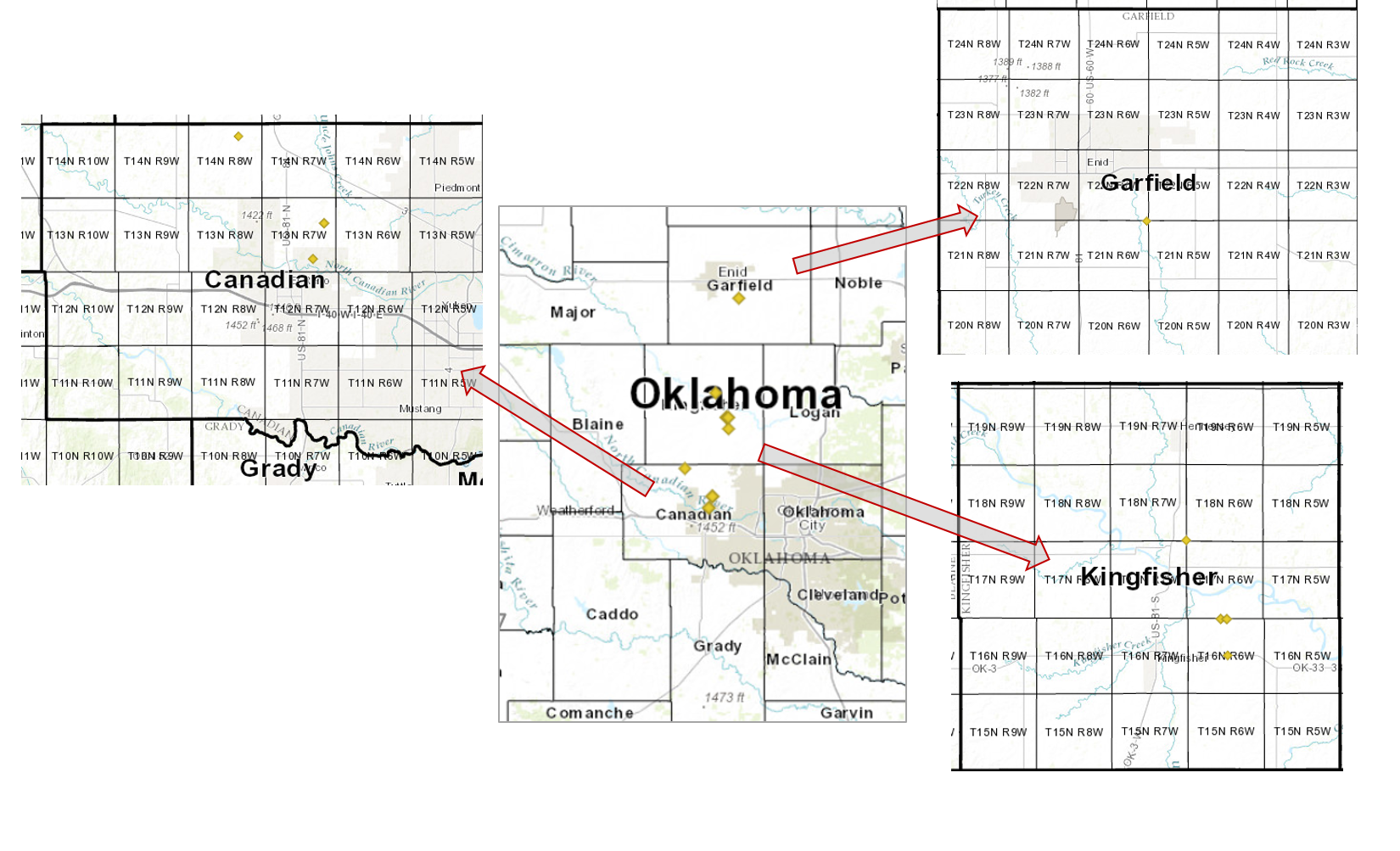

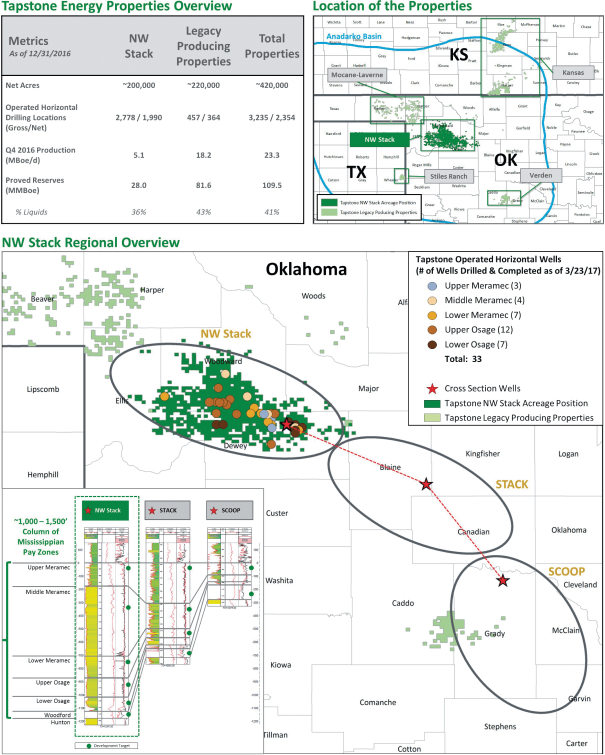

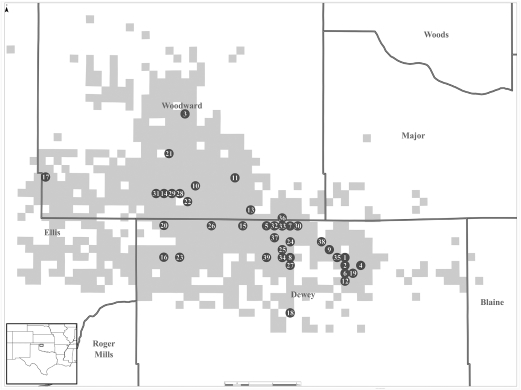

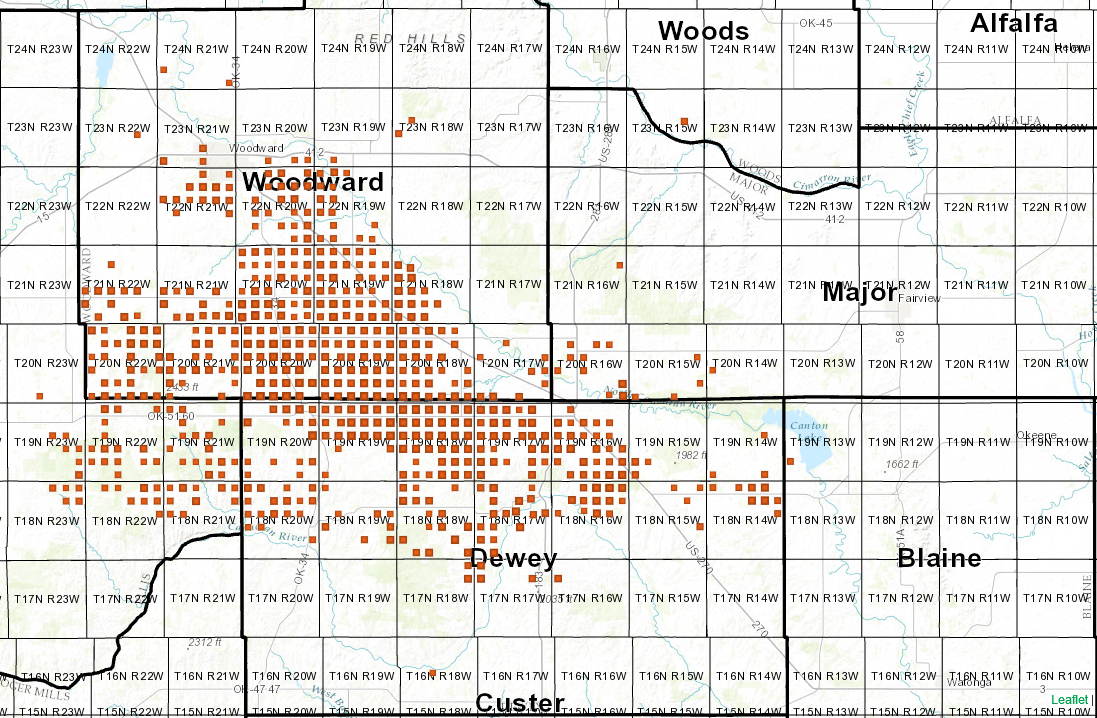

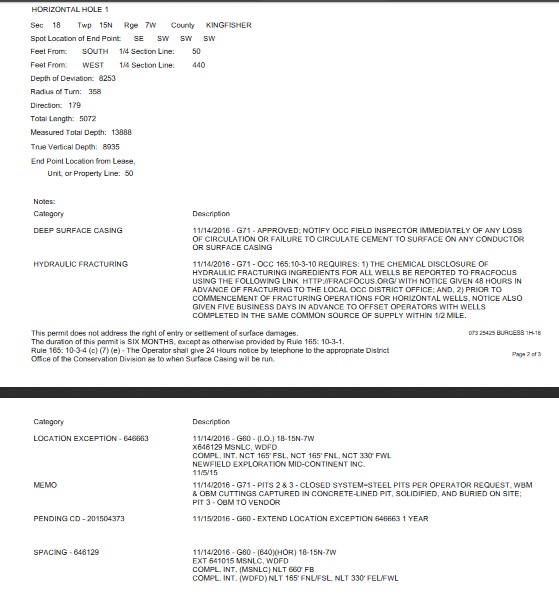

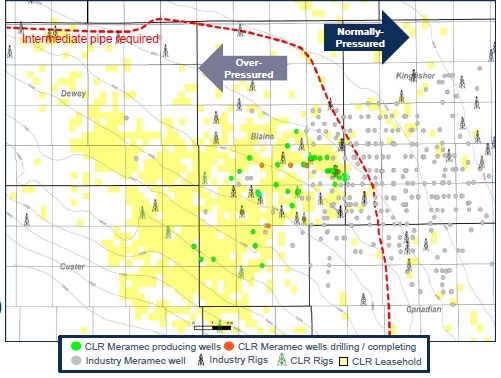

Energy publications have been focusing on the Permian Basin (TX) and STACK Play (OK) for the past year or so due to those two regions experiencing”profitability in current economic conditions.” But take one step into the courthouse lying within Tornado Alley, and you will see that something is also brewing in Grady County, OK.

Located 45 mins SW of Oklahoma City is Chickasha, OK, the county seat for Grady County. The courthouse is no stranger to activity, as it was the epicenter of the SCOOP play back in 2012. The courthouse saw a slow down in activity when the STACK became the hot ticket in the State; but recent discoveries and new entries have once again brought companies back to the region.

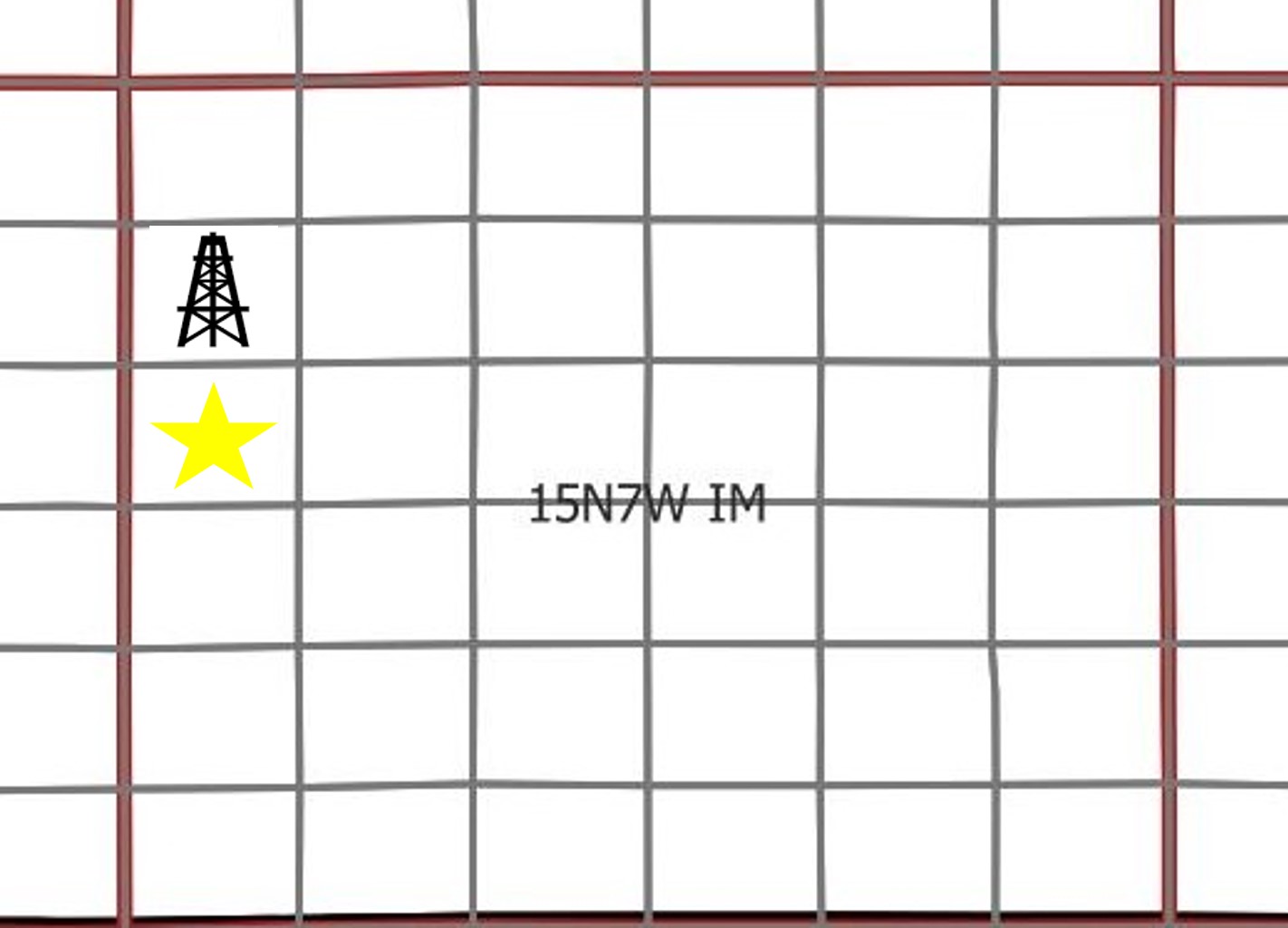

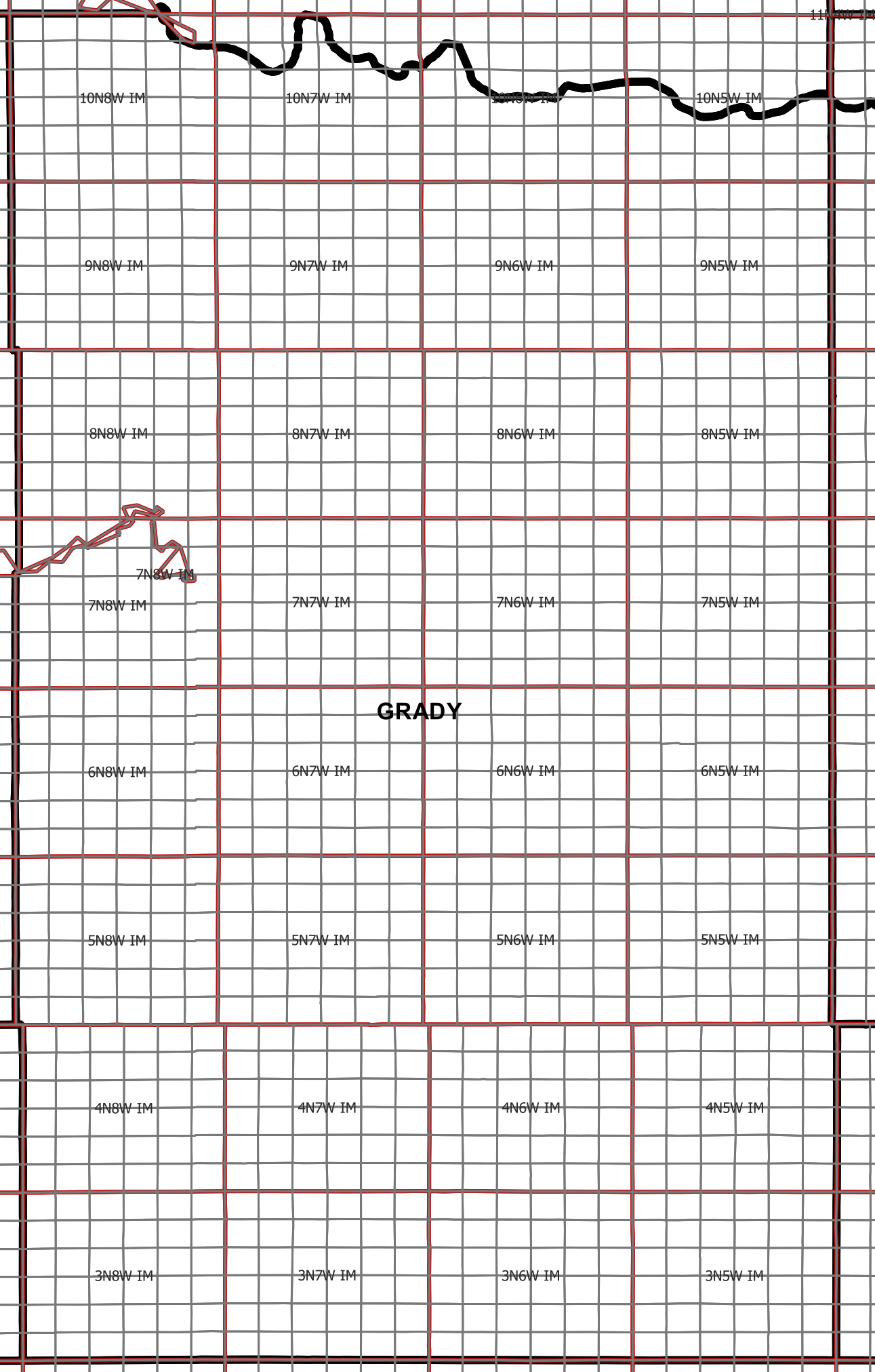

At Convey Energy we are lucky to be located a minute away from the Grady/McClain County Line. Our office is located near the southern sections of 08N-05W. Over the past few months, activity around our office has drastically increased. I am sure some of the local residents are not too thrilled, but we find it fascinating. Nothing better then seeing the industry that you love right outside your windows.

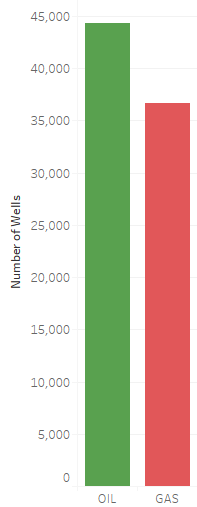

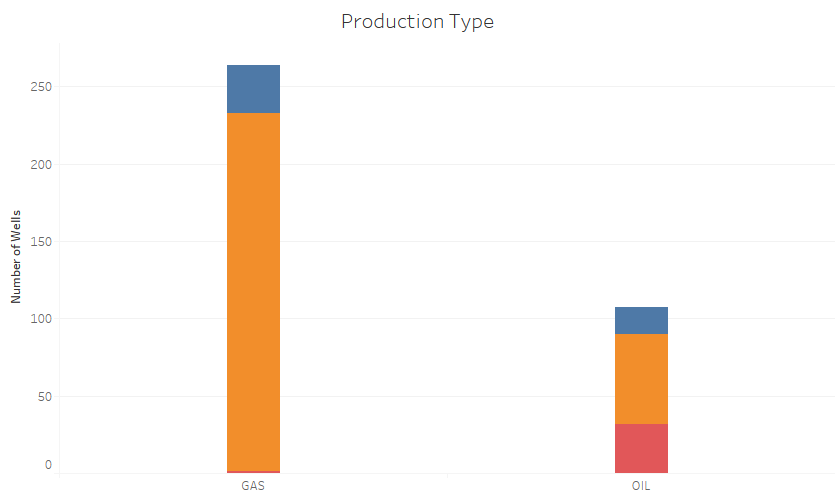

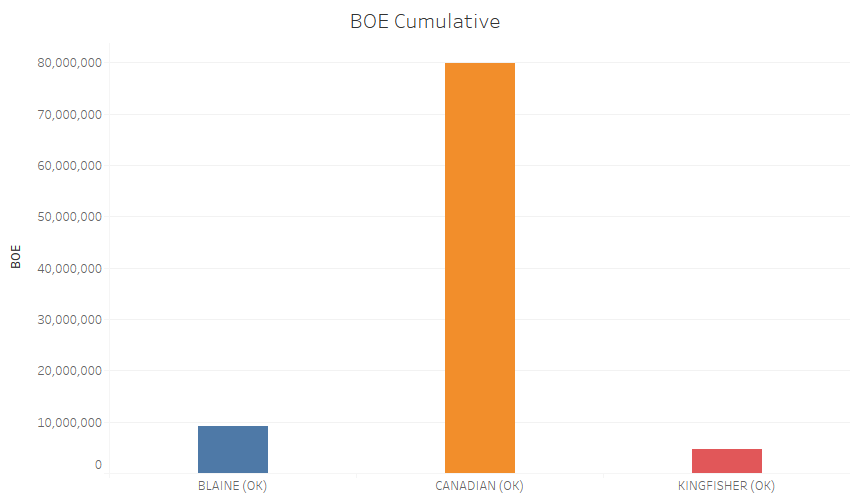

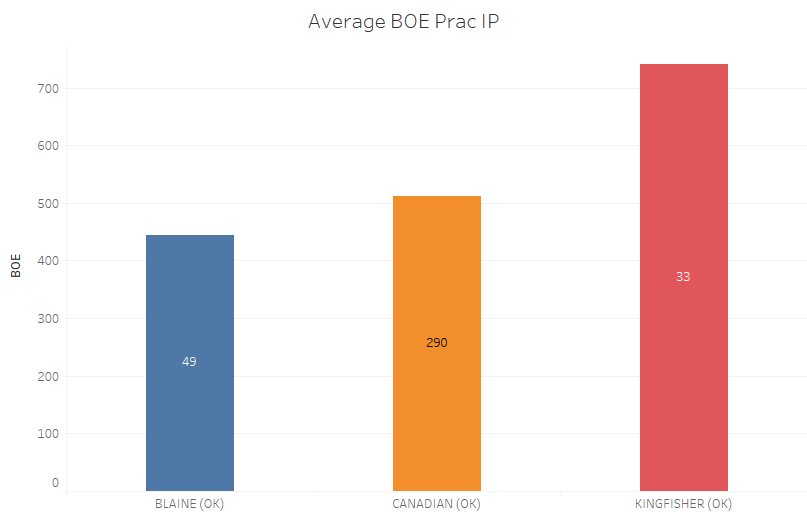

Let’s take a deeper dive into Grady and see what all the fuss is about. The tables and illustrations that follow cover 01/01/2017 – 07/31/2017:

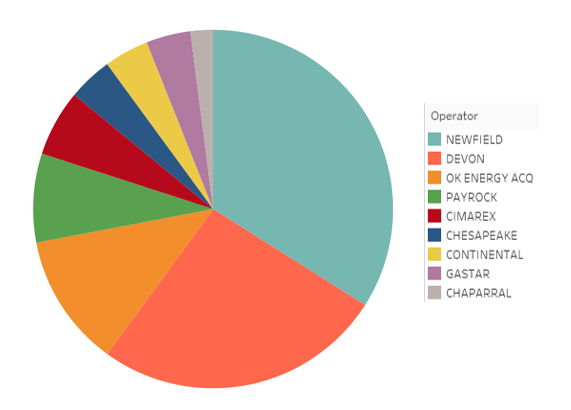

POOLING APPS

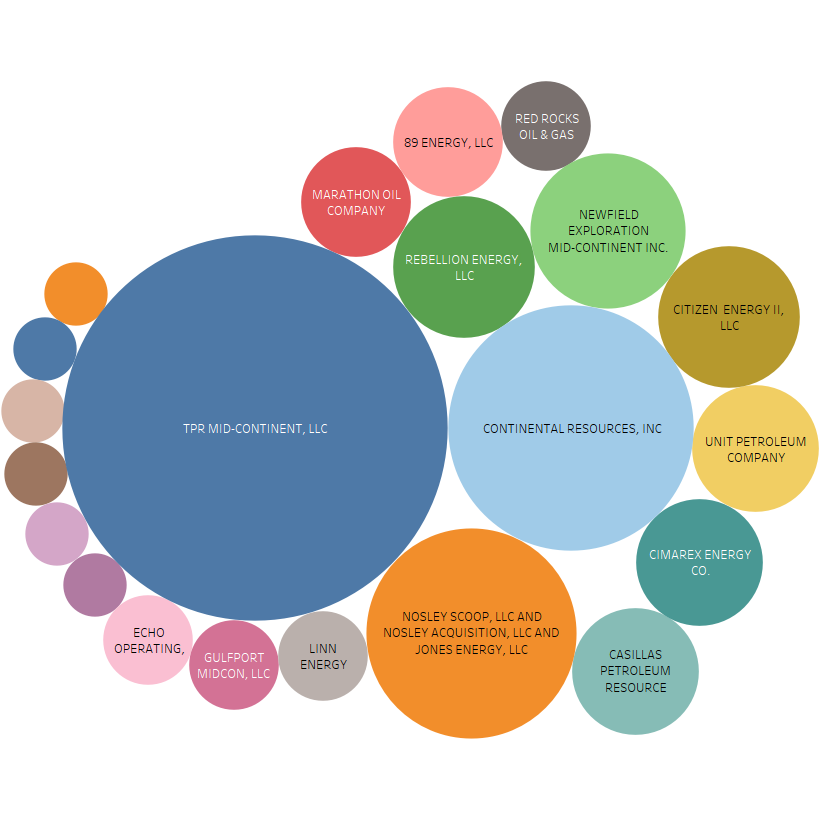

Pooling applications in 2017 have been led by TPR Mid-Continent, LLC. TPR, or Travis Peak Resources, is an EnCap Investments backed group, headquartered in Austin, TX, formed in 2013. Some other new entries to the region include Nosley (Jones Energy), who in 2016 purchased 18,000 nma from SCOOP Energy, an American Energy Partners associate, and Rebellion Energy, LLC, a Natural Gas Partners backed company formed in 2015 and located in Tulsa, OK.

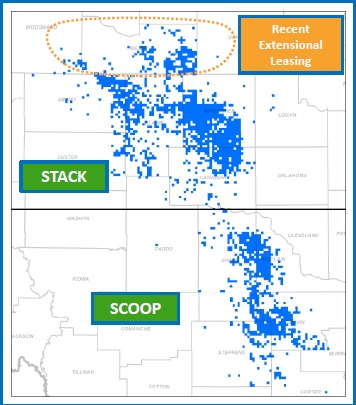

LEASING

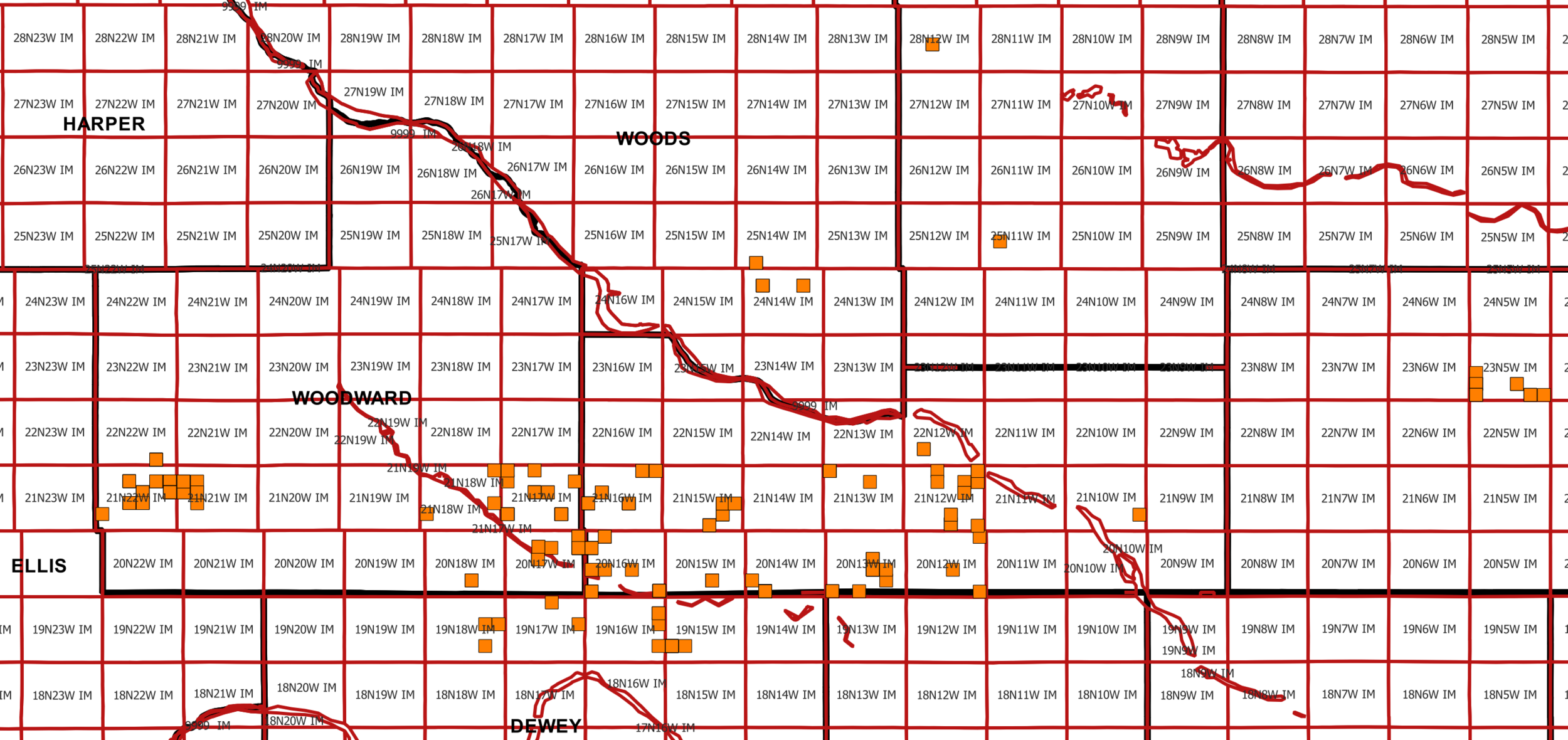

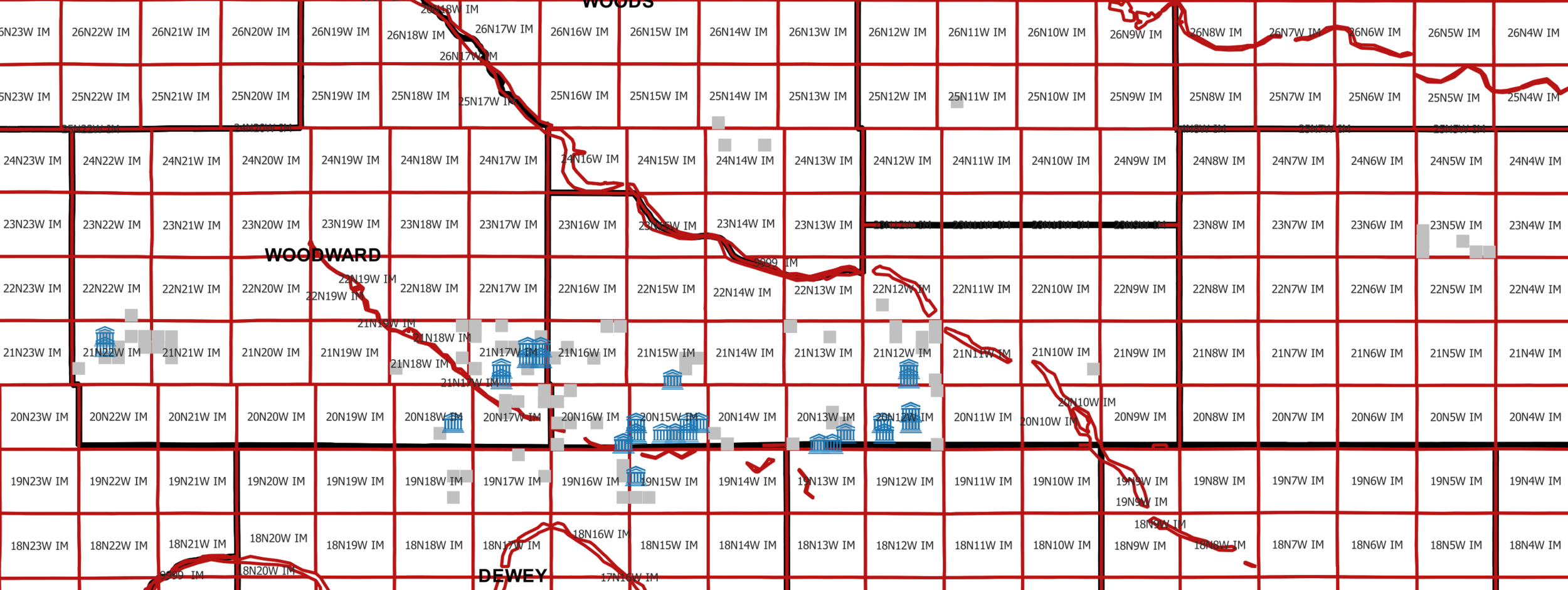

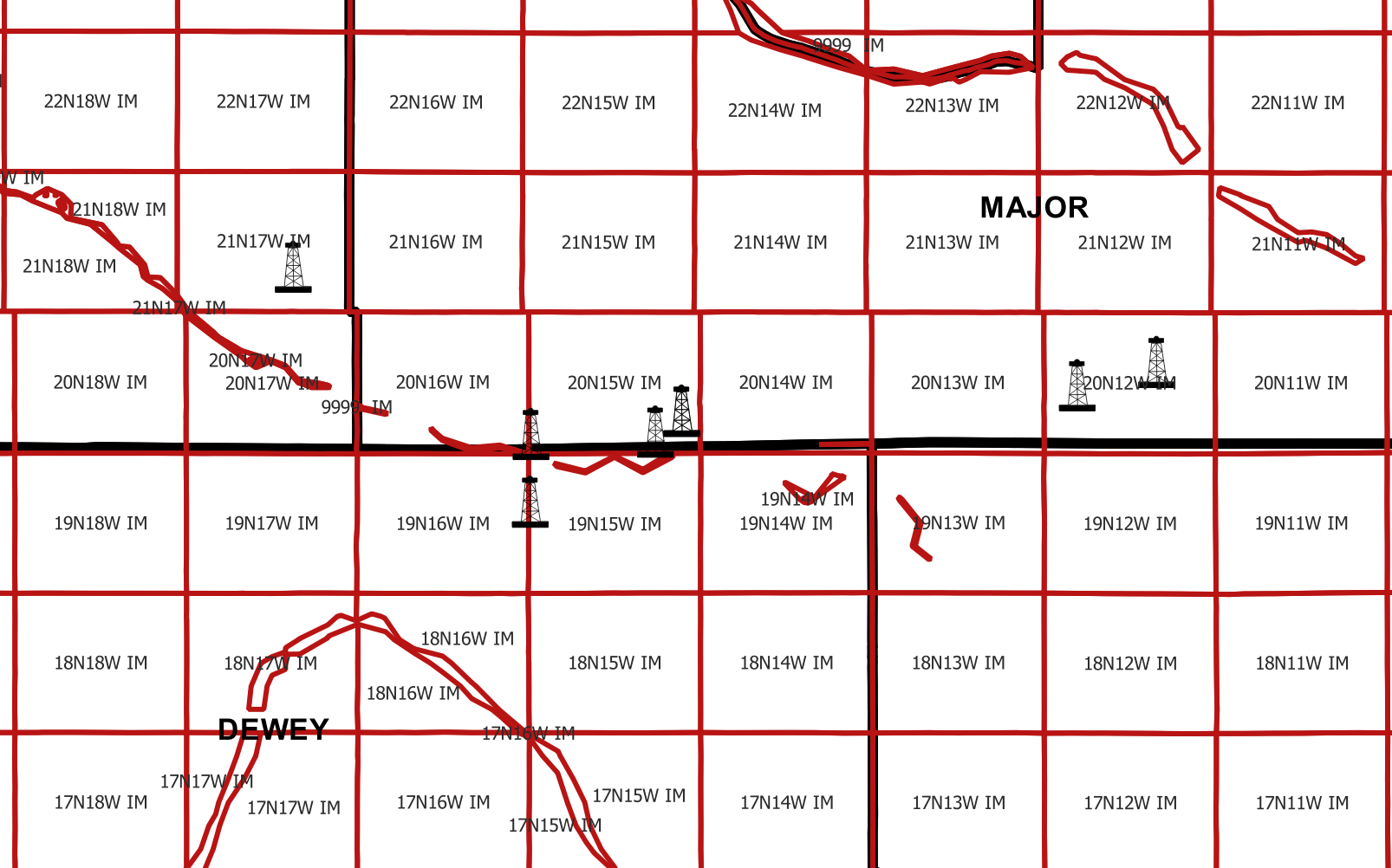

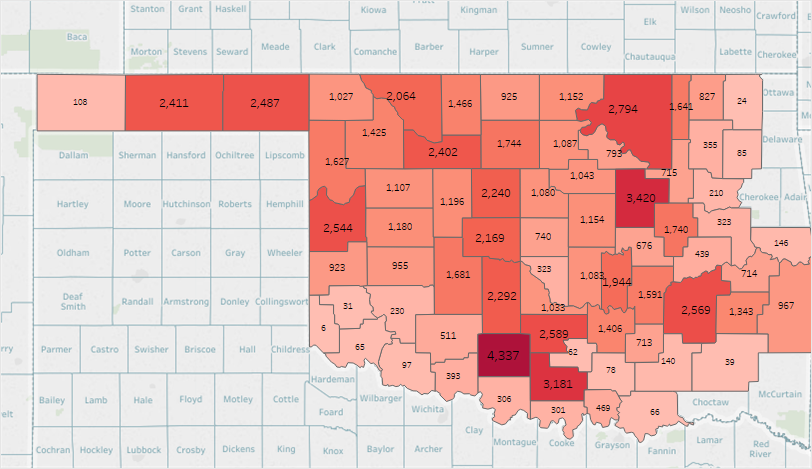

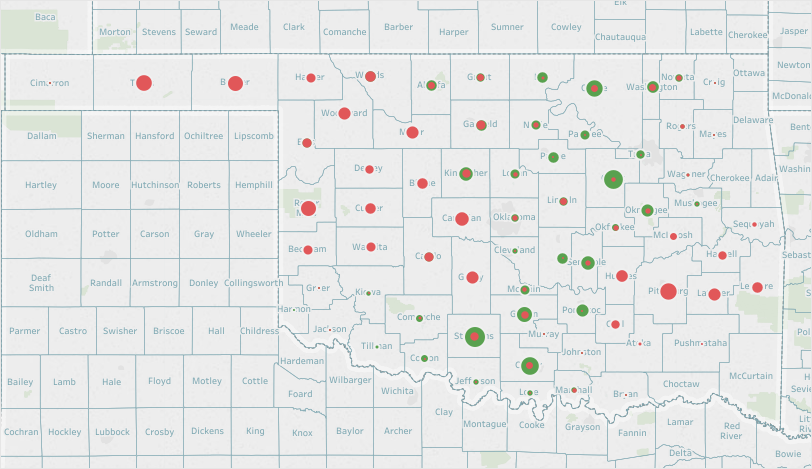

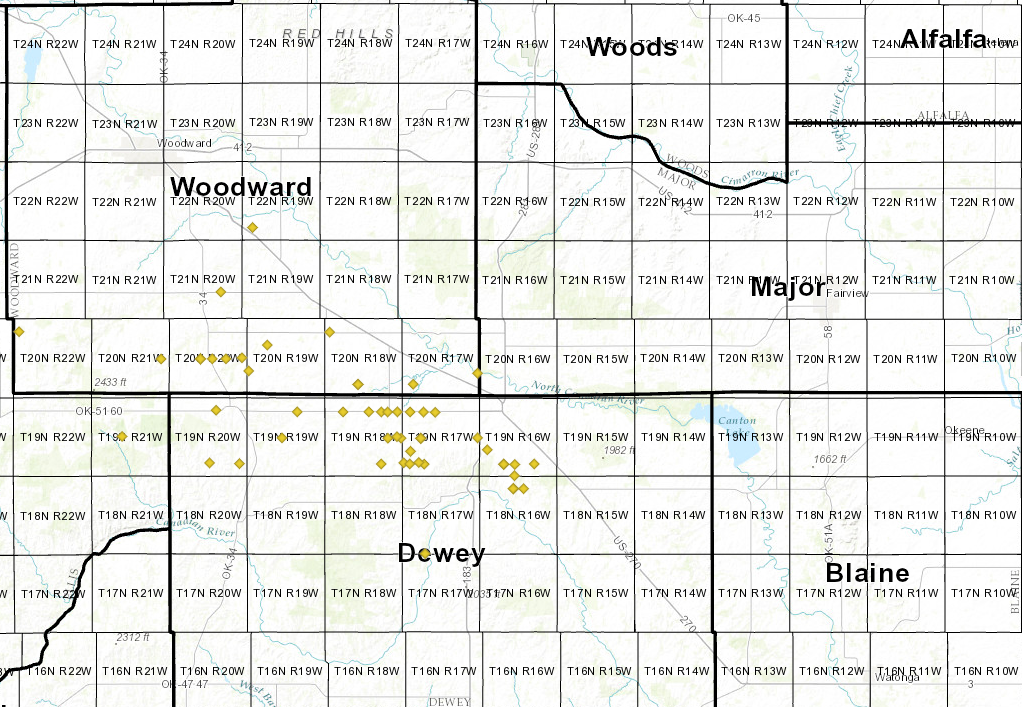

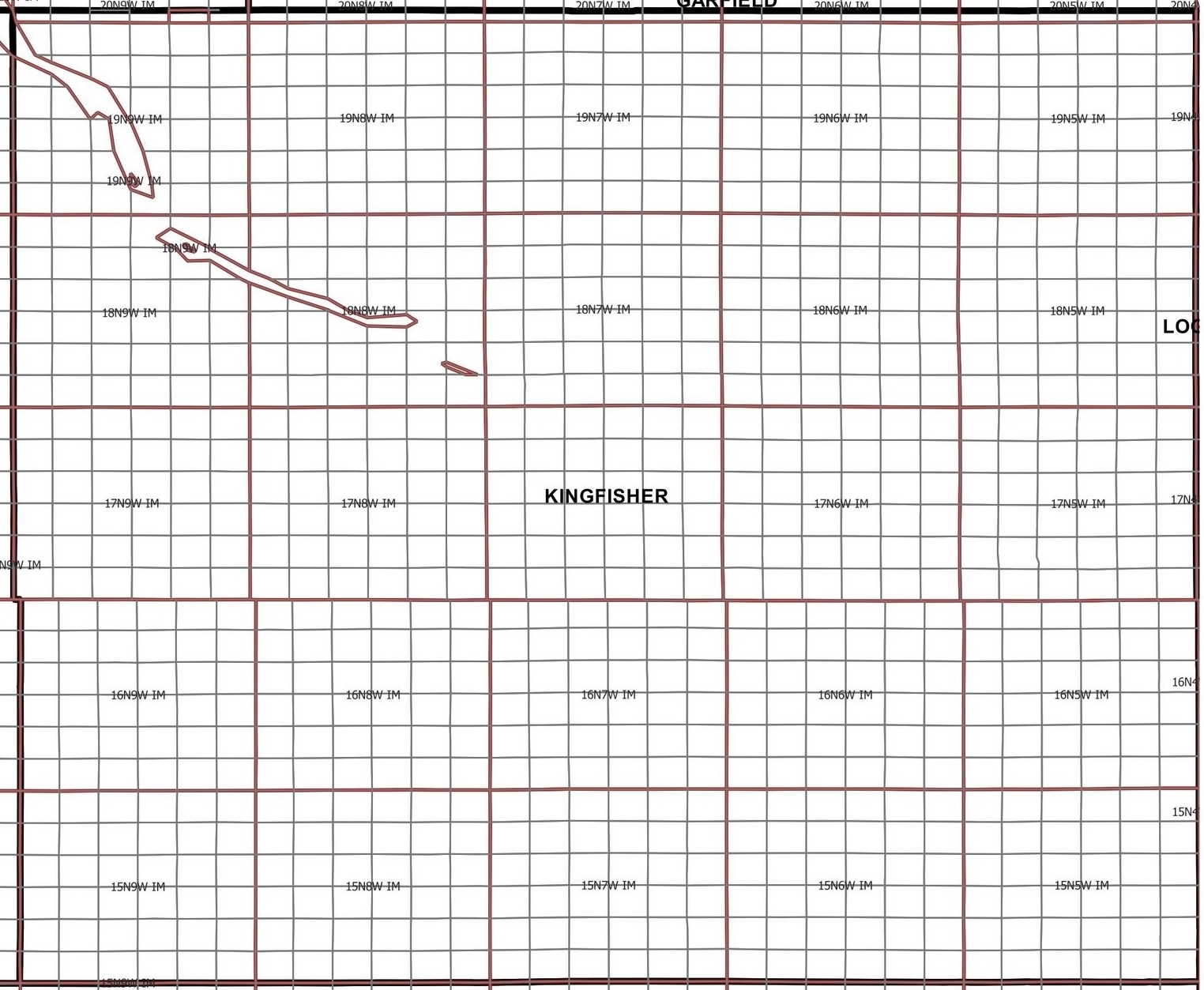

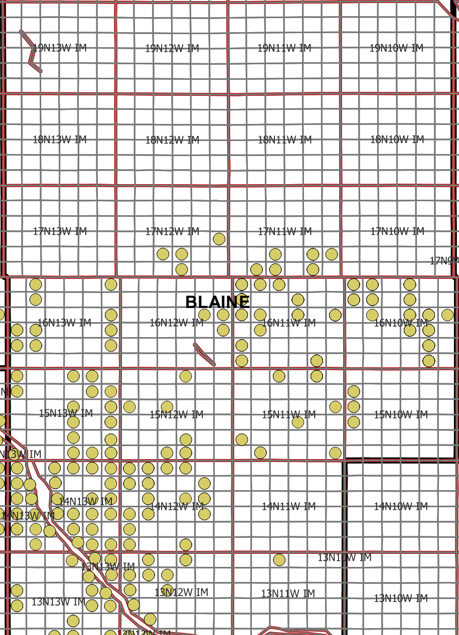

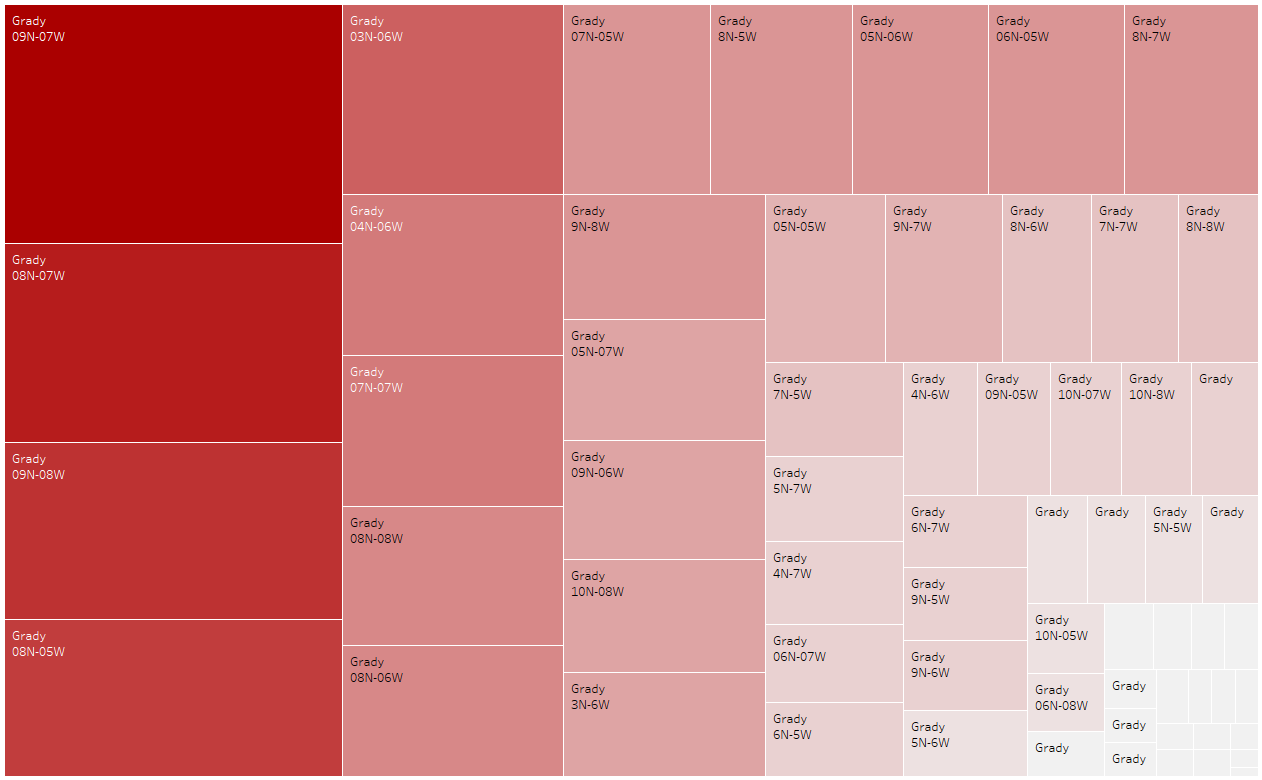

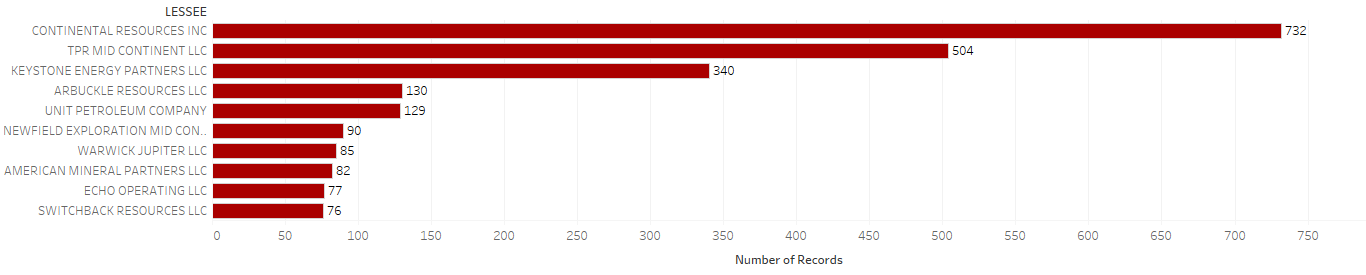

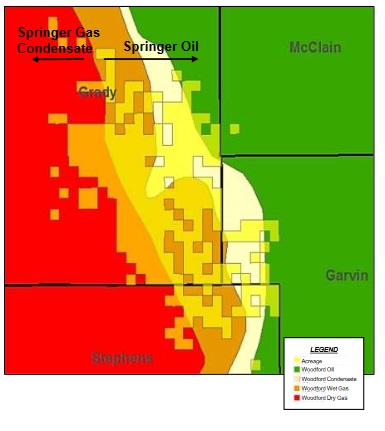

So far, approximately 3,889 leases have been filed in Grady County. The majority of new leasing activity is focused in the northern part of the County, in 08N and 09N. As mentioned, SCOOP activity started around 2012. During that time, companies were focusing their efforts in the “Core”, which covered the townships of 3N – 6N, lying between the ranges of 05W and 06W. Today, in the core, you are likely to find more mineral buyers chasing acreage than non-op buyers.

Continental continues to lead the leasing efforts in Grady County. Continental’s leasing budget is impressive, as they have substantial leasing operations going on in multiple counties thorughout the State. Travis Peak Resources is a close 2nd, followed by Keystone Energy Partners, Arbuckle Resources, and Unit Petroleum.

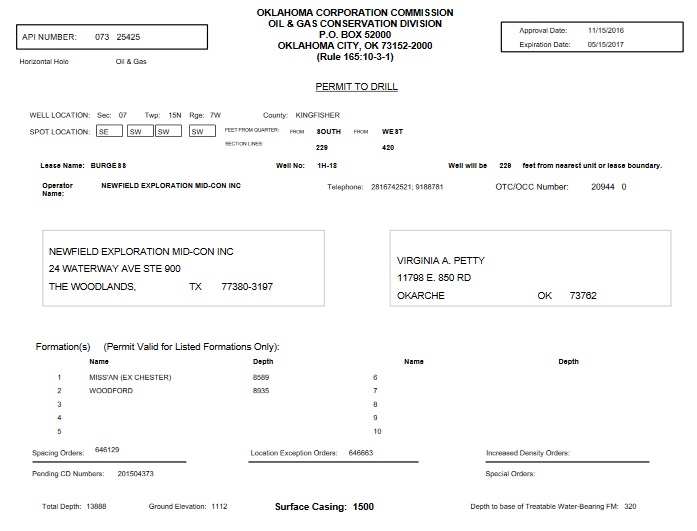

PERMITS

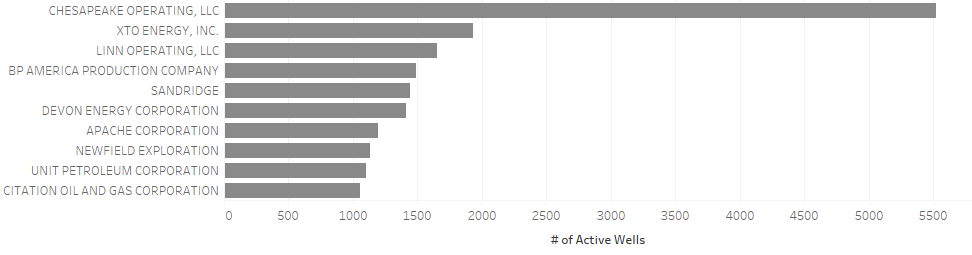

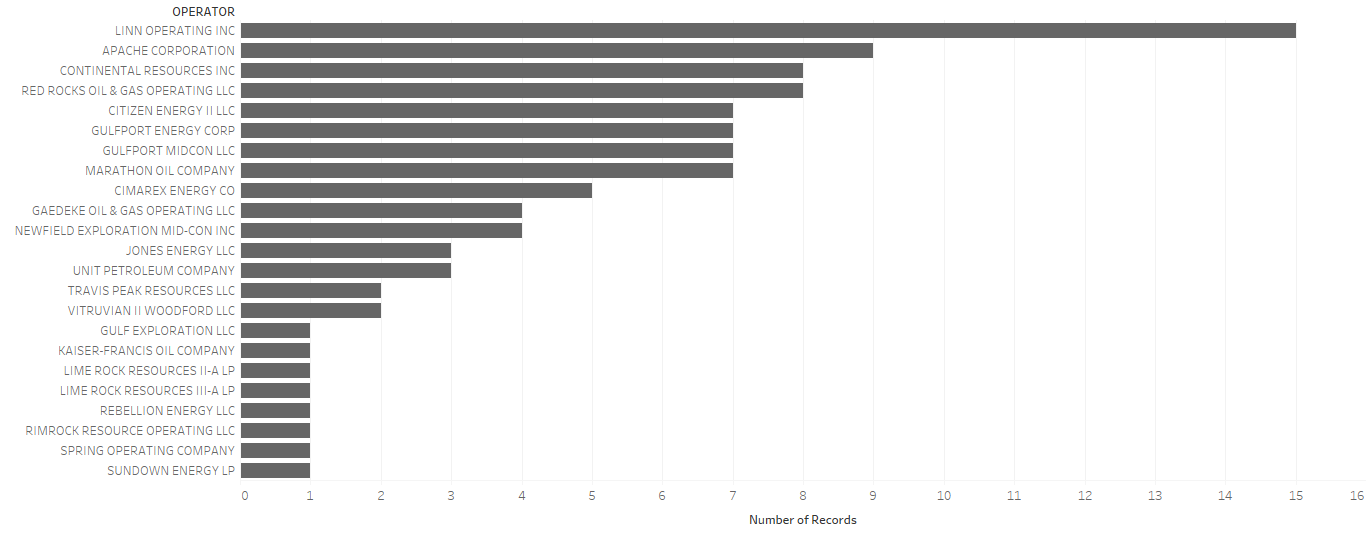

99 Permits have been approved in Grady County. Linn Operating accounts for 15, followed by Apache Corporation and Continental Resources, Inc.

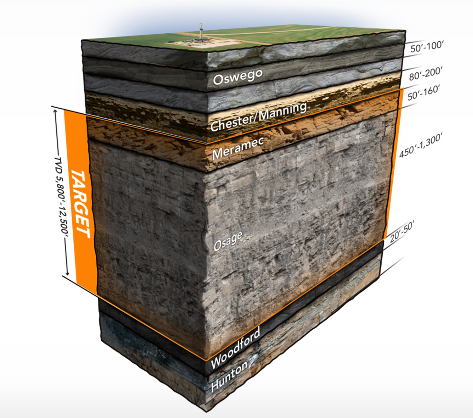

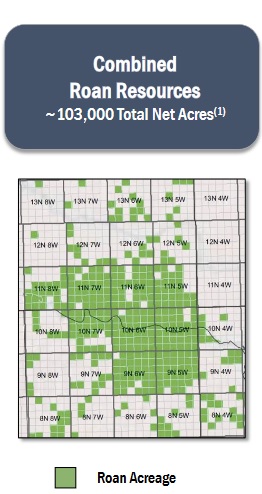

Linn and Citizen Energy recently announced the formation of Roan Resources, a pure MERGE/SCOOP/STACK play focused company. They plan to drill 58 gross wells in 2017, and will focus their drilling efforts in the Woodford and Mississippian formations.

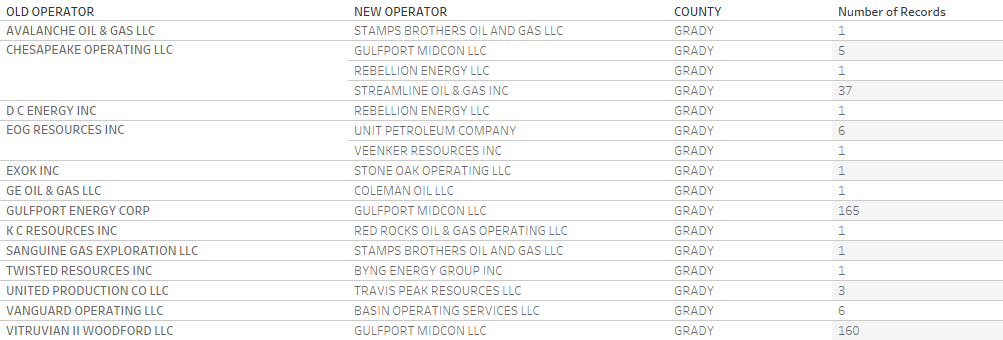

WELL TRANSFERS

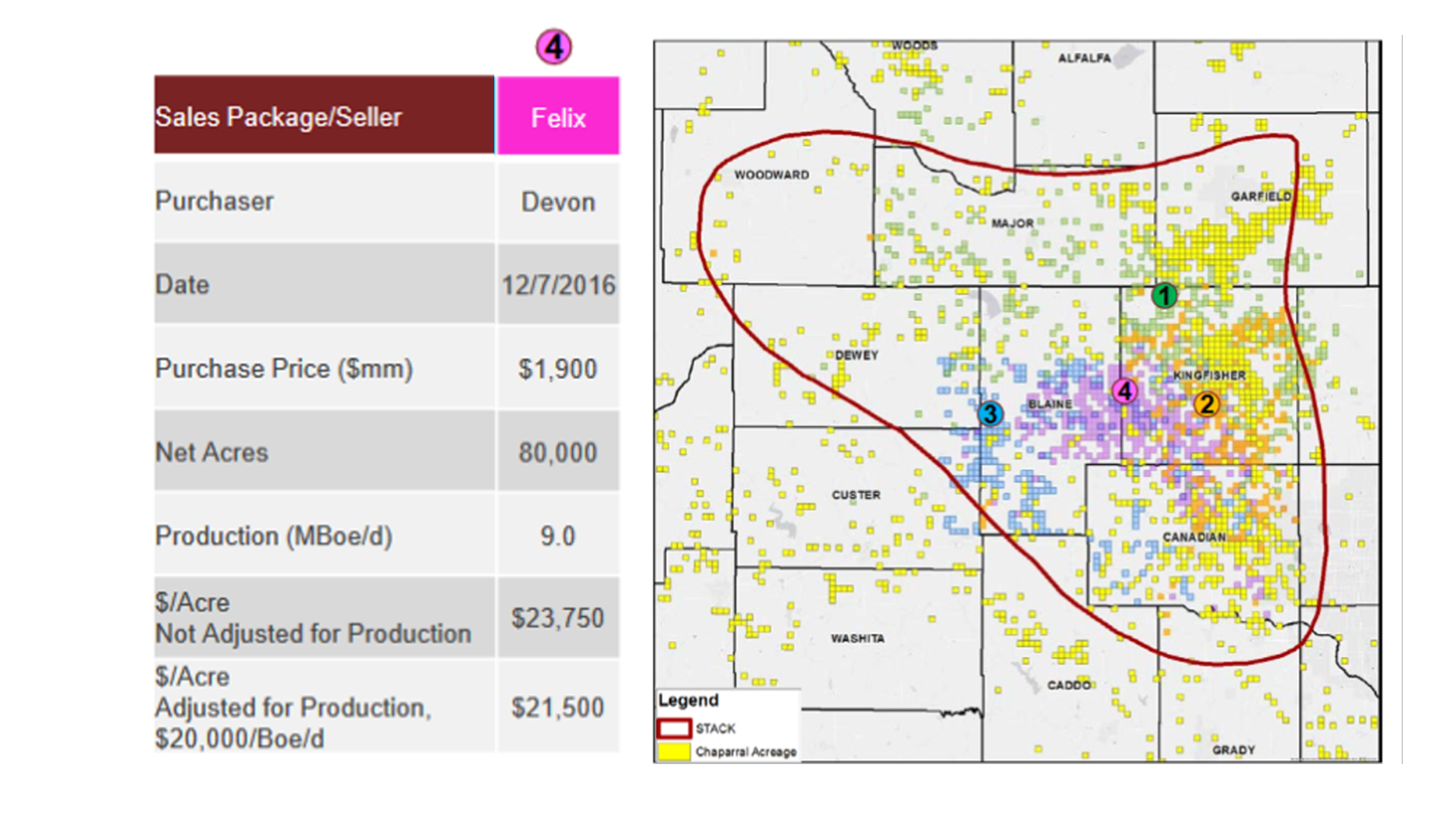

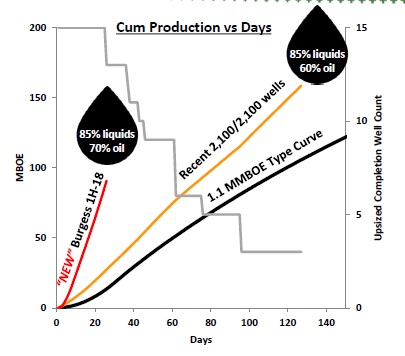

The most notable well transfer activity to date was between Vitruvian II Woodford, LLC and OKC based, Gulfport Energy. The two companies entered into an agreement in late December, wherein Vitruvian sold approximately 85,000 net effective acres, covering Grady, Stephens, and Garvin, to Gulfport Energy for $1.85 billion. Gulfport has recently been publishing some impressive well results.

As you can see, there are a lot of great things happening in Grady County. If operators continue to drill high rate of return wells in the region, then you will likely see more acquisitions/mergers and Grady County Headlines across the top of your favorite energy publications.

If your company is active, or looking to become active in this region, please contact a member of our team to learn how our client-focused services can save you time and money.

CONVEY ENERGY CONSULTANTS